Nota Surges 510% Over IPO Price in Just Five Days

Innotech Quadruples Its Offering Price on First Trading Day

Time to "Separate the Wheat from the Chaff"

Newly listed stocks on the KOSDAQ market, such as Nota and Innotech, have been soaring in succession. Trillions of won in market funds are pouring into the initial public offering (IPO) market. As concerns over overheating grow, experts in the financial investment industry have advised that it is time to carefully distinguish between high- and low-quality stocks.

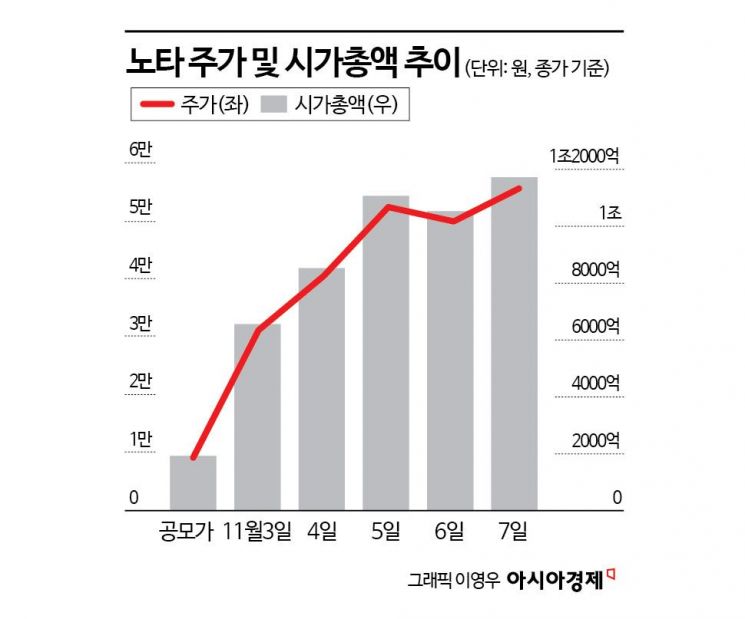

According to the financial investment industry on November 10, Nota, which was listed on November 3, surged 508.8% over its offering price in just five trading days. Its market capitalization swelled from 192.6 billion won based on the offering price to 1.17 trillion won.

Previously, Nota conducted a demand forecast for institutional investors over five trading days from October 14 to 20. All participating institutions suggested prices at or above the upper end of the offering price range, which was 9,100 won. The proportion of shares with mandatory holding commitments reached 59.7%.

Nota is a company that creates environments where artificial intelligence (AI) operates efficiently, from cloud to on-device, based on its AI model lightweighting and optimization technology. Through its proprietary platform, Netspresso, it reduces model size and computational load, thereby improving the efficiency of AI development and operation. Nota is expanding the AI ecosystem by collaborating with companies such as Nvidia, Samsung Electronics, and Qualcomm, and is leading the standardization in the lightweighting and optimization sector. Its sales increased from 3.6 billion won in 2023 to 8.4 billion won last year. The sales target for this year has been set at 14.5 billion won.

With the rapid growth of the AI industry, Nota immediately attracted investor attention upon its listing. On the first day of trading, it opened at 22,500 won, up 147.3% from the offering price of 9,100 won. After closing at 31,000 won, the price climbed to as high as 65,300 won on November 6. Subsequently, as some investors sold to realize profits, it closed at 49,750 won. On November 7, when the KOSDAQ index fell more than 2%, Nota's stock price surged again and closed at 58,000 won.

The sharp rise of newly listed Nota also had a positive effect on Innotech, which was listed on the KOSDAQ market on November 7.

Innotech, which develops reliability environmental test equipment and special testing devices, began trading on its first day at 50,300 won, a 242.2% increase from its offering price of 14,700 won. Less than an hour after trading began, the price had risen to 58,800 won. Its market capitalization reached 522 billion won, four times its offering price-based market cap of 130.5 billion won.

As Nota and Innotech, both newly listed on the KOSDAQ market this month, have soared in succession, interest in the IPO market is expected to grow even further. During the two-day subscription period for IPO shares from November 4 to 5, Curiosis and Sena Technology attracted 7.27 trillion won and 3.5 trillion won in subscription deposits, respectively.

In addition to Curiosis and Sena Technology, companies such as Aromatica, AimedBio, Theraview Holdings, Algenomics, and Acryl are also planning IPO subscriptions. The trend of market funds flocking to the IPO market is expected to continue for the time being.

A representative from the financial investment industry said, "When funds pour into the IPO market, it can affect the pricing of new shares," adding, "Given the increased volatility in the stock market, it is important to carefully distinguish between high- and low-quality newly listed companies when investing."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)