Happiness Loan Sees Sharp Rise in Subrogation Rate

Concerns Over Possible Budget Shortfall for Next Year

Calls for "Continuous Monitoring" Raised

The rate at which the government repays loans on behalf of borrowers who fail to make timely payments on "Sunshine Loan," a leading financial product for low-income individuals, has surged. As the number of vulnerable people unable to repay their debts on time increases each year, concerns are being raised that next year’s government budget for Sunshine Loan may be insufficient.

Sharp Increase in Government Repayment Rate for Sunshine Loan, a Key Financial Product for Low-Income Individuals... Delinquency Rate Also Rising

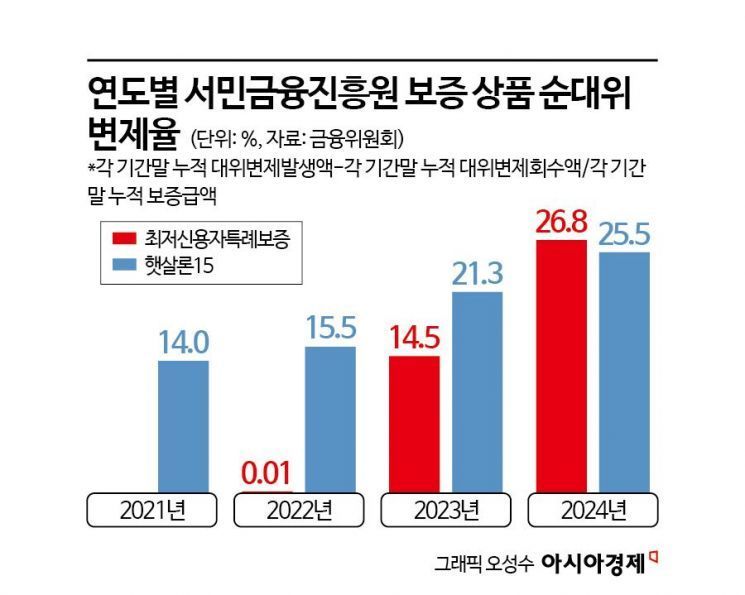

According to the Financial Services Commission and the National Assembly Budget Office on November 7, the net government repayment rate for Sunshine Loan 15, a product offered by the Korea Inclusive Finance Agency, soared from 14% in 2021 to 25.5% last year. This year, it continued to rise slightly, reaching 25.8% as of August. Sunshine Loan 15 is a financial product designed to support low-credit, low-income individuals who are unable to obtain bank loans and would otherwise have to resort to high-interest loans from private lenders or illegal financial services. As long as they meet minimum requirements, they can access bank loans through this program.

The government repayment rate refers to the proportion of loan principal that the government repays to banks on behalf of borrowers who are unable to make payments. The sharp increase in this rate indicates a significant rise in the number of people borrowing money and failing to repay it.

The net government repayment rate for another financial product for low-income individuals, the Special Guarantee for Lowest Credit Borrowers, also jumped from 0.01% in 2022 to 26.8% last year. This product is available to those with the lowest credit ratings who have been rejected even for Sunshine Loan 15 due to delinquencies.

Delinquency rates are also rising rapidly. The delinquency rate for the Illegal Private Loan Prevention Loan (formerly known as the Small Emergency Living Expense Loan), another product for low-income individuals, surged from 11.7% at the end of 2023 to 35.7% in August this year, an increase of 24 percentage points. In just about two years and six months since the program was introduced in March 2023, the default rate has surpassed the mid-30% range. The Illegal Private Loan Prevention Loan is a system that allows low-credit, low-income individuals-those in the bottom 20% of credit scores and earning less than 35 million won annually-to borrow up to 1 million won immediately, even if they have delinquencies or cannot provide proof of income.

Warning Over Sunshine Loan Budget Shortfall... Additional Fiscal Support Unavoidable if Guarantee Defaults Increase

With the risk of defaults on Sunshine Loan rising, warnings have emerged that the newly allocated budget for next year may fall short. According to an analysis by the National Assembly Budget Office, the Financial Services Commission plans to supply up to 2.33 trillion won in loans next year through Sunshine Loan 15 and the Special Guarantee for Lowest Credit Borrowers. This is an 82% increase compared to the 1.28 trillion won supplied in 2024.

To support this, a new budget of 100 billion won has been allocated. Specifically, for the target loan supply of 2.33 trillion won (with 100% guarantee) in 2026, the required funding of 403.9 billion won was calculated by applying a business loss rate of 17.3%. Of this, 303.9 billion won will be sourced from the lottery fund, and the remaining 100 billion won will be covered by the Financial Services Commission’s new budget. The estimated business loss rate of 17.3% is calculated by subtracting the guarantee fee income rate of 13.6% from the net government repayment rate of 28.3% and adding an operating cost of 2.5%.

The government expects that, after recovering subrogation claims for amounts repaid by the Korea Inclusive Finance Agency on behalf of borrowers, the final guarantee default losses will amount to about 28.3% of the total loan supply through the Sunshine Loan Special Guarantee.

However, the National Assembly Budget Office pointed out that, given the sharp increases in net government repayment rates for both the Special Guarantee for Lowest Credit Borrowers and Sunshine Loan 15, the significant expansion of next year’s guarantee supply could lead to more guarantee defaults, pushing the loss rate above the government’s projected 28.3%.

If the scale of guarantee defaults and related government repayments exceeds expectations, there could be disruptions in issuing new loan guarantees, or additional fiscal support may be needed to cover the Korea Inclusive Finance Agency’s losses. In fact, in the case of the Special Guarantee for Lowest Credit Borrowers, an increase in government repayments led to a decrease in the volume of new guarantees supplied, despite the same level of fiscal contributions. As the projected business loss rate rose, additional fiscal resources were provided through a supplementary budget this year to restore the target guarantee supply to last year’s level.

An official from the National Assembly Budget Office emphasized, "Given the nature of guarantee programs targeting vulnerable groups, expanding support will likely require increased fiscal resources to absorb the risk of guarantee defaults. Continuous monitoring of guarantee default trends is necessary to prevent a situation where new loan guarantees are suspended within the year due to a sudden surge in defaults."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)