Innotech and Nota Attract 17 Trillion Won in Subscription Deposits

Number of IPOs Expected to Rise in the Fourth Quarter Compared to the Third

With the KOSPI surpassing the 4,000 mark, the initial public offering (IPO) market is also experiencing a renewed upturn. Funds are flowing back into the IPO market, which had slowed in the third quarter of this year.

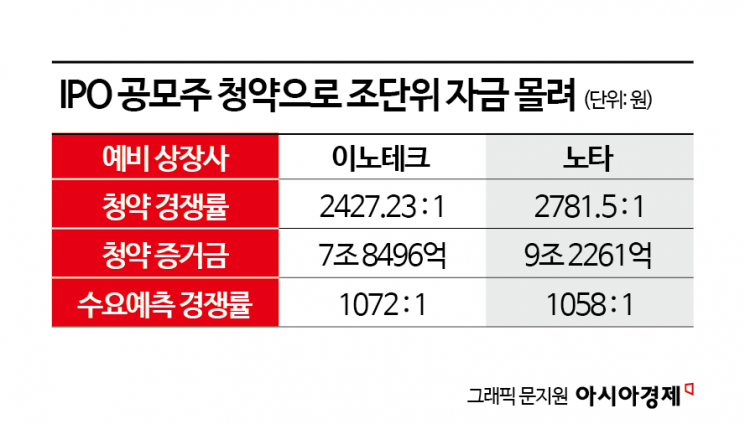

According to the financial investment industry on October 30, Innotech, which is scheduled to be listed on the KOSDAQ market on November 7, attracted 7.85 trillion won in deposits for its public offering subscription from retail investors. From October 27 to 28, the company accepted subscriptions for 440,000 shares allocated to retail investors, recording a competition ratio of 2,427 to 1.

Previously, Nota, a KOSDAQ preliminary listing company, held its public offering subscription from October 23 to 24. The deposit for the subscription reached 9.23 trillion won, with a competition ratio of 2,781 to 1. This set a new record high in the IPO subscription market since April 2022.

Innotech is a developer of comprehensive reliability environmental testing equipment. Leveraging its technological capabilities, the company is expanding its business areas to displays, semiconductors, and secondary batteries. The funds raised through the IPO will be used for developing equipment for semiconductors and secondary batteries, strengthening global customer response infrastructure, and investing in research and development (R&D).

Nota implements environments where artificial intelligence (AI) models operate efficiently, based on technologies for AI model compression and optimization. By reducing model size and computational requirements and optimizing for hardware, the company enhances the efficiency of AI development and operation. Nota is expanding the AI ecosystem by collaborating with global companies such as Nvidia, Samsung Electronics, Qualcomm, and Arm. The funds raised will be used to expand high-performance server and hardware infrastructure, as well as to repay borrowings.

As the domestic stock market continues its upward trend and newly listed companies see their stock prices surge far above their IPO prices, large sums of money are pouring into IPO subscriptions.

Myungin Pharmaceutical was listed on the Korea Exchange on October 1 with an IPO price of 58,000 won. On the first day of listing, the price surpassed 120,000 won, and on the following day, it rose to 134,500 won. Investors who received shares through the subscription achieved a return of around 100%. Samik Pharmaceutical, which entered the KOSDAQ market through a SPAC merger on October 27, hit the upper price limit for three consecutive trading days.

The continued upward momentum in the stock market and the surge in idle funds have also influenced the IPO subscription market. As of the end of September, investor deposits stood at approximately 76.45 trillion won, up 15.3% from a month earlier. The balance of comprehensive asset management accounts (CMA) at securities firms reached 93.51 trillion won, an increase of 8.5% compared to the same period last year.

Park Sera, a researcher at Daishin Securities, stated, "Investor deposits and CMA balances have reached all-time highs since the COVID-19 pandemic," and predicted, "The number of IPOs in the fourth quarter will increase compared to the third quarter." She added, "The public offering market is expected to be centered on small and mid-cap stocks."

The IPO market was sluggish in the third quarter. A total of 25 companies were listed, with the offering amount reaching 1.1857 trillion won. Compared to the same period last year, these figures decreased by 7.4% and 5.0%, respectively. The average competition ratio for demand forecasts in the third quarter was 787 to 1, down from 1,077 to 1 in the second quarter.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)