Deloitte Releases Results of 'APEC CEO Survey' Report

7 Out of 10 CEOs "Positive About Business Outlook"

Deloitte, the official knowledge partner for the 'CEO Summit Korea 2025' at the '2025 Asia-Pacific Economic Cooperation (APEC) Summit', released the report 'APEC CEO Survey: The Capability to Design Confidence' on October 29.

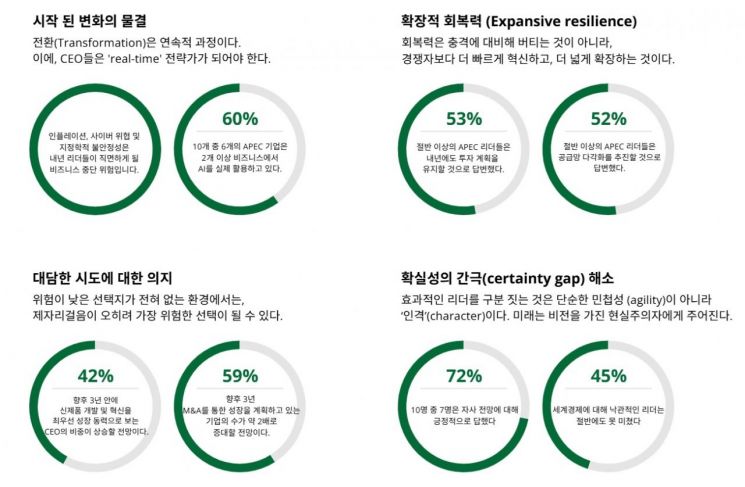

In this report, which included participation from over 1,250 leaders across 18 economies, CEOs identified 'Expansive Resilience' as a core management keyword amid uncertainty. Expansive resilience refers to leadership that not only responds to uncertainty and crises, but also transforms external shocks into new goals and growth opportunities, driving proactive change and growth.

When asked about their outlook on their own business and the global economy, 7 out of 10 respondents (70%) evaluated their own business prospects positively. In contrast, only 45% were optimistic about the global economic outlook, highlighting a gap between confidence in internal capabilities and a cautious view of the external environment.

Deloitte defined this as the 'certainty gap.' According to the report, CEOs expressed confidence in factors they can control internally, but showed caution regarding uncertainties in the external business environment, thus revealing the certainty gap.

60% of CEOs Expect Significant Improvement in Capital Raising Conditions Within Three Years

According to the survey, 42% of CEOs currently view 'technology application' with advanced digital technologies as their top growth driver. However, over the next three years, 42% of CEOs identified 'new product development and innovation' as their highest priority, indicating a shift in corporate growth strategies from technology application to innovation-centered approaches.

The proportion of CEOs prioritizing geographic expansion as a growth strategy is also expected to increase from 16% today to 30% within three years. To achieve this, CEOs are expected to actively utilize mergers and acquisitions (M&A) and strategic partnerships to scale up their businesses.

Six out of ten CEOs (60%) anticipate that capital raising conditions will improve over the next three years. As a result, companies are likely to pursue more aggressive capital management strategies, such as M&A, partnerships, and expanding market share, rather than simply taking a defensive approach to capital management.

By industry, CEOs in the consumer sector expect the most significant improvement in capital raising conditions over the next three years. CEOs in the technology, media, and telecommunications (TMT) sector also indicated a likely increase in deal activity, showing an active investment stance. In particular, CEOs in the energy, resources, and industrials (ER&I, 65%) and life sciences and healthcare (LSHC, 63%) sectors showed the highest intentions for M&A among all industries.

By company size, small and medium-sized enterprises were more optimistic about capital raising prospects than large corporations. This is attributed to the fact that large corporations are more directly exposed to global macroeconomic volatility. Regionally, Latin America (71%), Northeast Asia (64%), Southeast Asia (61%), and North America (54%) showed the highest levels of optimism in that order. The report assessed that in markets where growth potential and volatility coexist, growth strategies centered on M&A are likely to be more actively pursued.

Strengthening Operational Resilience Through Supply Chain Diversification and Technology Investment

APEC CEOs are recognizing supply chains not just as operational tools but as strategic assets. According to the report, more than half of respondents (52%) plan to expand or diversify their supply chains within the next year. They intend to strengthen operational resilience through building regional hubs, securing alternative suppliers, managing supplier performance, and enhancing logistics visibility using digital technologies. In contrast, only 17% of respondents said they would maintain their supply chains as they are.

The report analyzed that technology has become a core foundation for strengthening operational resilience. 53% of survey respondents indicated that investment in AI and automation would be their top priority this year. This trend is particularly pronounced in the technology, media, and telecommunications (TMT) sector (70%) and in North America (60%). In addition, CEOs identified cybersecurity (41%), workforce cross-skilling (29%), and inventory management (26%, rising to 40% in the consumer sector) as key priorities.

As technology investment emerges as a key means to enhance both operational efficiency and resilience, there is growing interest in expanding physical infrastructure such as data centers to meet surging computing demand. The proportion of respondents prioritizing such investments is expected to rise from 19% currently to 30% within three years.

Rob Hillard, Deloitte Consulting Asia Pacific Leader, stated, "As the pace of AI adoption, investment, and innovation accelerates, more executives in the APEC region are recognizing the potential impact of AI on business models, the economy, and society as a whole." He added, "The key challenge lies in how effectively AI can be utilized and how clearly its costs can be understood, making the capability to design confidence all the more important."

Sustainability Emerging as a Core Strategic Focus

The importance of sustainability is rising rapidly. While sustainability ranked eighth among factors likely to impact corporate strategy this year, it is expected to rise to third place within the next three years. More than half of APEC CEOs (59%) plan to increase related investments this year, more than doubling from last year (29%).

The direction of investment varied by company. Some CEOs said they would focus on energy transition, infrastructure expansion, and regulatory compliance, while others placed greater emphasis on customer-centric innovation and brand-driven growth.

By region, China is seen as leading the market across the clean technology supply chain, including critical minerals, solar, wind, and batteries. In Latin America, 76% of CEOs recognize sustainability as a core management strategy, believing it enables them to attract capital and meet customer expectations simultaneously. Companies in Southeast Asia (69%) and Northeast Asia (68%) also consider sustainability a central pillar of their capital strategies.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)