FSS Releases Status of Delinquency Rates on Korean Won Loans at Domestic Banks

Rising Number of Companies and Households Borrowing and Failing to Repay on Time Amid Economic Downturn

As the economic downturn continues, there has been an increase in the number of companies and households borrowing money from banks and failing to repay on time.

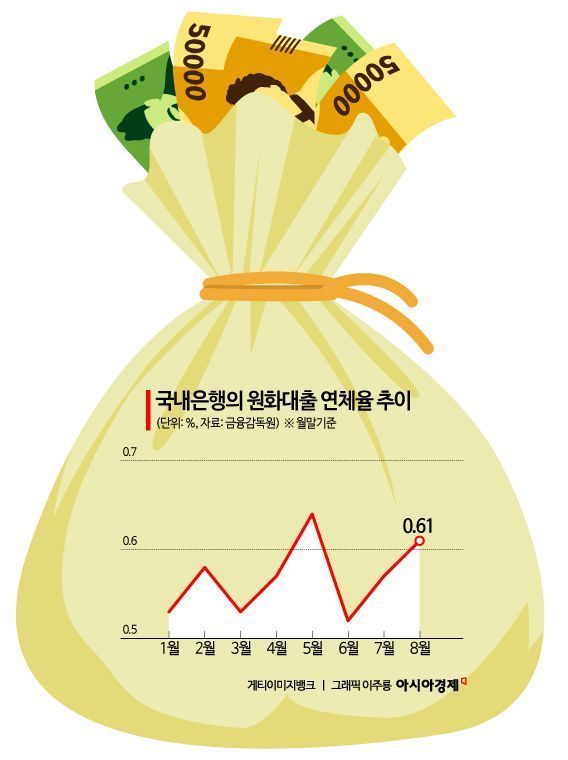

According to the "Status of Delinquency Rates on Korean Won Loans at Domestic Banks (Provisional)" report released by the Financial Supervisory Service on October 24, the delinquency rate for Korean won loans at domestic banks-measured by loans overdue by more than one month-stood at 0.61% as of the end of August. This marks an increase of 0.04 percentage points from 0.57% at the end of the previous month, and a rise of 0.08 percentage points from 0.53% in the same month last year.

The banks' loan delinquency rate reached a yearly high of 0.64% in May, dropped to 0.52% in June, rose again to 0.57% in July, and has now increased for two consecutive months through August.

Looking at annual trends, the delinquency rate fell to as low as 0.24% at one point in 2022, climbed into the 0.4% range in 2023, remained in the 0.5% range last year, and has now reached the 0.6% range this year, marking a third consecutive year of increases. Analysts attribute this trend to the continued economic stagnation, which has led to more companies and households borrowing from banks and being unable to repay on time.

In August, newly delinquent loans amounted to 2.9 trillion won, an increase of about 100 billion won from the previous month. During the same month, the amount of delinquent loans resolved was 1.8 trillion won, up by about 200 billion won from the previous month. The Financial Supervisory Service explained that although the amount of resolved delinquent loans increased in August, the amount of new delinquencies exceeded the amount resolved, resulting in a higher delinquency rate compared to the end of the previous month.

By sector, the delinquency rate for corporate loans in August was 0.73%, up 0.06 percentage points from the previous month. The delinquency rate for large corporate loans was 0.15%, an increase of 0.01 percentage points from the previous month, while the delinquency rate for small and medium-sized enterprises rose by 0.07 percentage points to 0.89%.

In August, the delinquency rate for household loans was 0.45%, up 0.02 percentage points from the previous month. The delinquency rate for mortgage loans was 0.30%, an increase of 0.01 percentage points from the previous month, while the delinquency rate for household loans excluding mortgages (such as unsecured loans) jumped by 0.06 percentage points to 0.92%.

An official from the Financial Supervisory Service stated, "We will guide banks to maintain sufficient loss-absorbing capacity in preparation for the possibility of increased delinquencies and insolvencies due to continued sluggish domestic demand and ongoing internal and external uncertainties." The official added, "We plan to strengthen asset soundness management, especially at banks where the amount of resolved delinquencies is small compared to new delinquencies and where the proportion of loans to vulnerable sectors is high, by encouraging the sale of non-performing loans and the expansion of loan-loss provisions."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)