First Media Briefing Since Establishment of Shinsegae-Alibaba Joint Venture

Presentation of Future Business Strategies and Vision

Investment Plans for Seller Support, Enhanced Customer Benefits, and AI

Declaration to Lead Open Market Sector

Gmarket, which is making a fresh start as a joint venture between Shinsegae Group and China's Alibaba Group, has declared 2026 as the first year of its renewed growth and announced a new investment of 700 billion won to strengthen its e-commerce competitiveness. Through this, the company has set a goal to more than double its annual gross merchandise volume (GMV) within five years.

James Jang (Seunghwan Jang), CEO of Gmarket, is speaking at the Media Day held at COEX in Gangnam-gu, Seoul on the 21st. Photo by Jaehyun Park

James Jang (Seunghwan Jang), CEO of Gmarket, is speaking at the Media Day held at COEX in Gangnam-gu, Seoul on the 21st. Photo by Jaehyun Park

On the 21st, Gmarket held a Media Day at COEX in Gangnam-gu, Seoul to present its future business strategies and vision. Previously, on September 18, Gmarket became a subsidiary of a joint venture established with a 50:50 investment from Shinsegae Group and Alibaba International, following approval from the Fair Trade Commission for their business combination review.

James Jang (Korean name Seunghwan Jang), who was appointed as the new head of Gmarket in Shinsegae Group's regular executive reshuffle for 2026 at the end of last month, declared, "To reclaim Gmarket's position as the No. 1 open market in Korea, we will actively pursue two pillars of our mid- to long-term strategy: strengthening domestic competitiveness and global expansion." He also expressed the company's commitment to building a platform that connects domestic and overseas markets with the catchphrase "G-Market = Global-Local Market."

Of the 700 billion won Gmarket is investing as initial capital, 500 billion won will be allocated solely to strengthening seller competitiveness. First, 350 billion won will be used for direct support programs to help existing sellers with promotions and sales growth. Specifically, for large-scale promotions like Big Smile Day, Gmarket will cover all customer discount costs, allowing all sellers to participate. The company will also abolish a separate annual fee of 50 billion won that was previously charged for discount coupons. In addition, more than 20 billion won per year-an increase of 50% over previous years-will be invested in policies to foster new and small-scale sellers, and over 100 specialists will be hired to provide onboarding support and personalized consulting. A zero-commission policy will also be introduced, waiving fees for new sellers for a certain period.

For Gmarket users, 100 billion won will be invested annually to enhance promotional benefits. The scale of customer support for the upcoming Big Smile Day event will be expanded by more than 50% compared to last year. In addition, the company plans to cultivate four major events-Hangawi Big Sale, Seol Big Sale, and G-Rock Festival-into Gmarket's flagship discount promotions.

To diversify its product lineup, Gmarket plans to attract around 1,000 brands this year alone, including popular brands that have previously been hesitant about online sales. Leveraging Alibaba's global distribution network and direct sourcing system, the company also aims to secure approximately 1 million global brand products (SKUs). In collaboration with Emart, Gmarket will operate a dawn delivery service for fresh foods and other items.

The remaining 100 billion won of the new investment will be used to leverage Alibaba's accumulated AI expertise. Specifically, deep learning technology will be applied to product recommendations, and starting next year, the company will strengthen its "multimodal search" capabilities. Multimodal search refers to a method of identifying customer intent and providing diverse search results by incorporating unstructured data such as impressions and sensations, in addition to simple text.

Gmarket also plans to differentiate itself from domestic e-commerce competitors by targeting overseas markets. The company is already selling 20 million products in five countries-Singapore, Malaysia, Thailand, the Philippines, and Vietnam-through Lazada, Alibaba's Southeast Asian platform. Going forward, Gmarket aims to expand its reach to South Asia, Southern Europe (including Spain and Portugal), North America, Central and South America, and the Middle East. The company has set a goal to achieve more than 1 trillion won in annual GMV from cross-border e-commerce alone within five years.

CEO Jang stated, "By the end of this year, we will complete the recovery of our platform's fundamentals and basic structural improvements, finishing preparations for renewed growth. We will secure new growth engines on the global stage, strengthen win-win partnerships with sellers, and become an innovative company that delivers the highest customer satisfaction."

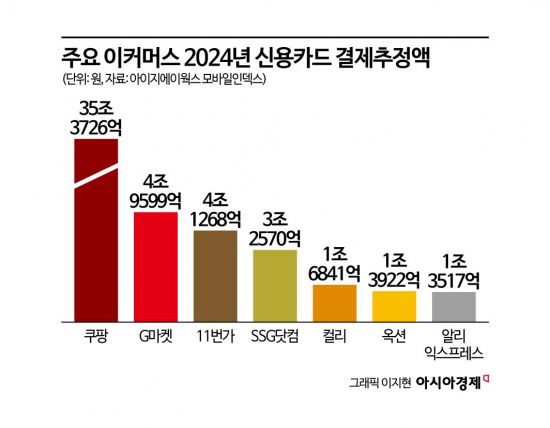

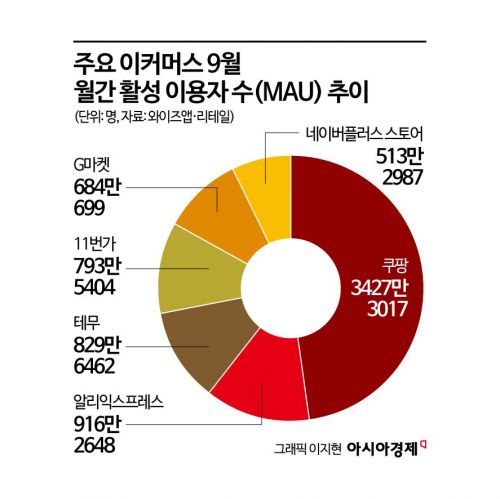

Meanwhile, according to annual credit card payment estimates by e-commerce platform compiled by IGAWorks Mobile Index, Gmarket's estimated payment amount last year was 4.9599 trillion won, ranking second after Coupang (35.3726 trillion won). Combined with Aliexpress (1.3517 trillion won), the total reaches approximately 6.3116 trillion won. According to WiseApp Retail, Coupang ranked first in monthly active users (MAU) last month with 34,273,017 users, while Aliexpress (9,162,648) and Gmarket (6,840,699) combined for about 16 million users.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)