Roborock's Premium Market Share Falls to the 50% Range

Nearly 10 Percentage Points Down Year-on-Year

Share Dispersed as Dreame and Other Chinese Brands Expand

Chinese robot vacuum cleaners are fiercely competing for dominance in the Korean market. As Roborock, which has maintained the top spot, sees its market share decline, fellow Chinese companies Dreame and Ecovacs are rapidly expanding their presence, reshaping the market landscape. In contrast, Samsung Electronics and LG Electronics, despite focusing on high-end lineups, continue to struggle to gain traction.

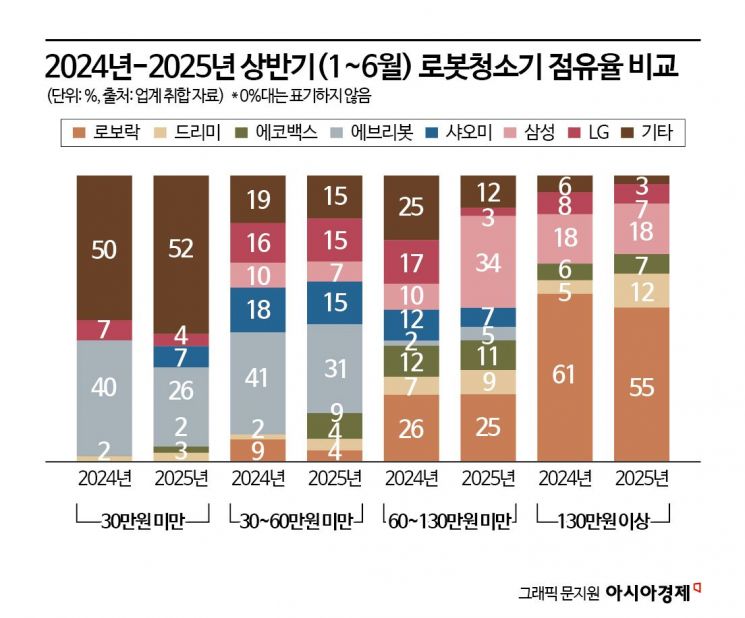

According to home appliance industry market share data obtained by Asia Economy on October 16, 2025, Roborock's market share for high-end (over 1.3 million won) robot vacuum cleaners in the Korean market during the first half of 2025 (January to June) dropped to the mid-50% range. This represents a decline of nearly 10 percentage points from the same period last year, when it exceeded 60%. Roborock also saw its market share in the mid- to low-priced (300,000 to less than 1.3 million won) segments fall by 1 to 5 percentage points each, indicating an overall downward trend.

This is interpreted as the result of Chinese competitors such as Dreame expanding their premium lineups this year, which has fragmented Roborock's market share. Dreame's growth is particularly notable. Its share of the high-end (over 1.3 million won) segment more than doubled from 5% to 12% year-on-year, and in the 1.3 million to 1.4 million won range, its share nearly tripled compared to the previous year. After holding a launch show in Korea in August to officially target the market, Dreame has rapidly expanded its presence by continuously releasing premium new products such as the X50 Ultra, X50 Master, L40S Pro Ultra, Matrix10 Ultra, and Aqua10 Ultra Roller.

Ecovacs maintained its market share in the high-end segment at last year's level, while slightly increasing sales of its mid- to low-priced products under 600,000 won. Ecovacs also released new products this year, such as the Deebot X8 Pro Omni and Deebot T80 Omni, at three-month intervals. In the mid- to low-priced segment under 600,000 won, the domestic company Everybot continues to hold the top position. Everybot accounted for the largest share, with a market share of 30% to 40%, but even this is gradually becoming more fragmented.

Meanwhile, Samsung Electronics and LG Electronics, which focus on high-end products, remain sluggish. Samsung Electronics maintained a market share in the high teens, similar to last year, while LG Electronics remained at around 7%. The combined market share of the two companies is in the mid-20% range, similar to Chinese companies such as Dreame and Ecovacs, but they still have not surpassed Roborock. Notably, Samsung Electronics increased its share in the mid-priced segment (600,000 to less than 1.3 million won) from the 10% range to the mid-30% range, while LG Electronics saw its share plummet from double digits to single digits, making its presence even less significant.

Furthermore, despite security issues with Chinese robot vacuum cleaner models coming to light this year, domestic companies have failed to secure additional market share. In September, the Korea Consumer Agency investigated six robot vacuum cleaner models available on the market and found potential privacy violations and personal information leaks in products from Narwal, Ecovacs, and Dreame.

Amid this, as the major home appliance discount season in October and November approaches, Chinese companies are accelerating preparations for new product launches. In contrast, domestic companies are losing market leadership without presenting any clear countermeasures. An industry insider commented, "To compete with Roborock, Samsung and LG need to make their presence felt with new products, but there has been almost no movement this year," adding, "If the technology race continues to center around Chinese brands, domestic companies may have fewer and fewer opportunities to catch up."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)