“Current Commercial Act Limits Shareholder Proposals”

National Assembly Pursues Parallel Amendments

Enhancing the effectiveness of the Stewardship Code (guidelines for institutional investors' exercise of voting rights) has emerged as the next key task for improving corporate governance among domestic companies. In political circles, measures such as introducing an 'advisory proposal' system are being considered to encourage institutional investors to exercise their shareholder rights more substantively. With recent amendments to the Commercial Act and the spread of shareholder activism, there are expectations that efforts to improve governance could accelerate.

According to the investment banking industry on October 15, the Korea Capital Market Institute recently released a report titled "Characteristics and Implications of Advisory Proposals in Major Countries," which suggested institutional reforms to enhance the effectiveness of the Stewardship Code.

An advisory proposal refers to a resolution voted on at a shareholders' meeting that is not legally binding. Advisory proposals recommend that the board of directors and management establish specific policies, disclosures, or plans, but even if such proposals are approved, neither the company nor its directors are obligated to comply. Nevertheless, they are regarded as a useful tool for shareholders to express their opinions on corporate issues and for companies to gather shareholder input.

"Advisory Proposals: The Key to Strengthening Substantive Communication"

Jung Jisoo, a senior researcher at the Korea Capital Market Institute, stated, "In major countries such as the United States, where advisory proposals are permitted, it is generally impossible for shareholder proposals to infringe upon the authority of the board of directors. However, non-binding advisory proposals, special resolutions, and advisory votes are allowed. Most systems are structured to expand communication with shareholders without restricting the authority of the board."

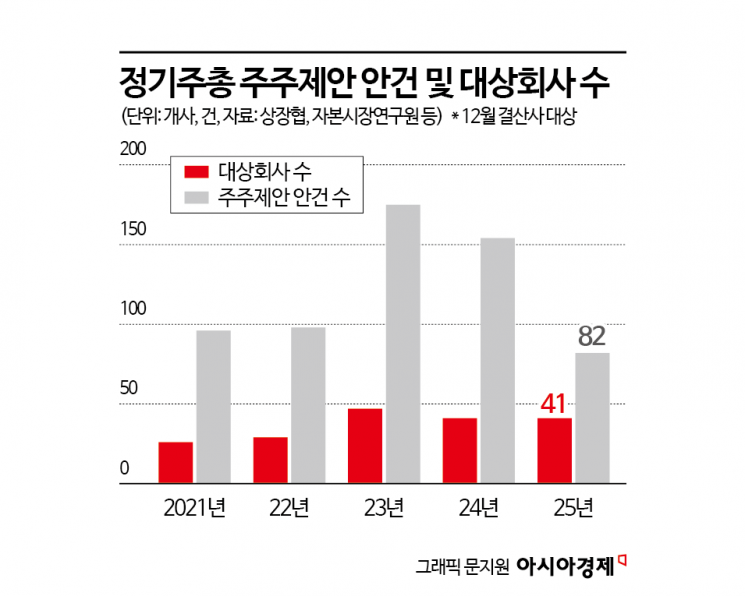

In contrast, in Korea, shareholder proposals are generally limited in scope and are mostly confined to matters requiring approval at shareholders' meetings. According to the Korea Capital Market Institute, only 41 companies (16 listed on KOSPI and 25 on KOSDAQ) submitted shareholder proposals at this year's regular shareholders' meetings. Compared to all listed companies, this represents approximately 2% of KOSPI firms and about 1.5% of KOSDAQ firms.

A total of 82 proposals were submitted, with the appointment and dismissal of executives accounting for the largest share at 34.2% (28 proposals). Shareholder returns and amendments to articles of incorporation each accounted for 24.4% (20 proposals), while executive compensation made up 3.7% (3 proposals). Only 10 companies saw their proposals approved, resulting in an approval rate of 24.4%, which is a 12.2 percentage point decrease from last year.

Regarding this, researcher Jung explained, "Under the current Commercial Act, advisory proposals are difficult to recognize from an interpretive standpoint. Even if shareholders wish to express opinions on various matters, the board of directors can reject them on the grounds that they are not items for shareholder resolution. This year, minority shareholders have also shown increased interest in advisory proposals as a means of shareholder activism."

Commercial Act Amendments and Value-Up Policies Drive 'Governance Reform'

As a result, discussions on institutional reform are gaining momentum in the National Assembly, particularly among the ruling party. In July, Lee Soyoung, a lawmaker from the Democratic Party of Korea, sponsored an amendment to the Commercial Act to introduce the 'advisory proposal right,' allowing minority shareholders to express opinions on corporate management, and to strengthen the effectiveness of general shareholder proposal rights.

At the time, Assemblywoman Lee stated, "This is a new channel for minority shareholders to voice their opinions on corporate management and a mechanism to institutionally support trust and communication between shareholders and companies. Ensuring that shareholder participation in sustainability-related issues is discussed within the institutional framework will contribute to greater corporate transparency and long-term value enhancement."

Such discussions are expected to have a direct impact on the capital market, in line with the trend of amending the Commercial Act. Kim Byungyeon, a researcher at NH Investment & Securities, said, "Improvements to the Stewardship Code will create synergy with amendments to the Commercial Act, such as expanding directors' fiduciary duties, separate election of audit committee members, and mandatory cumulative voting. Additionally, there are ongoing discussions about introducing advisory proposals, easing the 5% rule (disclosure requirements for holdings and changes above 5%), and implementing expulsion measures for non-compliance with the Stewardship Code."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)