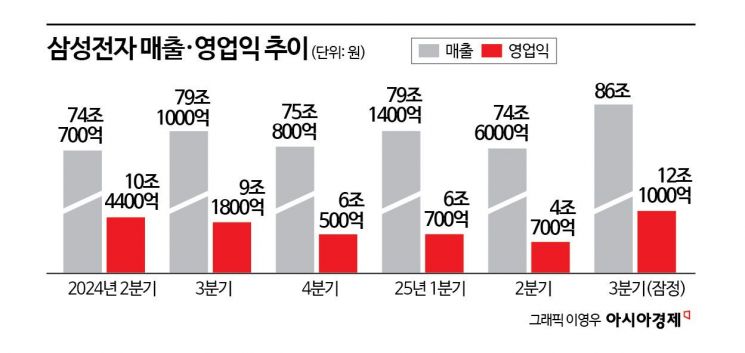

Operating Profit Reaches 12.1 Trillion Won, Revenue Hits 86 Trillion Won

Operating Profit Up 31.8% Year-on-Year

Samsung: "Improved Memory Market Conditions"

Samsung Electronics has announced a surprise operating profit of over 12 trillion won for the third quarter. This marks the company’s highest performance in three years since posting an operating profit of 14.1 trillion won in the second quarter of 2022. Quarterly revenue also reached an all-time high. The semiconductor division saw significant improvement as demand for both DRAM and high-bandwidth memory (HBM) increased, and sales of new foldable smartphones were strong. With rising demand for artificial intelligence (AI) semiconductors, some analysts interpret this as the official beginning of a "semiconductor supercycle."

On October 14, Samsung Electronics announced that its consolidated operating profit for the third quarter of this year reached 12.1 trillion won, up 31.8% from the same period last year. Revenue rose by 8.7% to 86 trillion won.

Both revenue and profit exceeded market expectations. The market had forecasted revenue of around 84 trillion won and operating profit of about 10 trillion won. These figures are preliminary, and detailed results by business segment have not been released.

The core driver of this third-quarter surprise performance was the memory business. As demand for general-purpose semiconductors rapidly increased and sales of HBM3E ramped up, profitability improved noticeably. Analysts say this is not merely a recovery in market conditions, but the beginning of a "supercycle" triggered by a shift in demand toward high-performance memory driven by the spread of AI. An industry insider stated, "The memory market has improved, which appears to have significantly boosted overall results," adding, "The main factors seem to be increased demand for DRAM and server solid-state drives (SSD), as well as higher HBM3E sales."

The non-memory segment also showed signs of recovery, further boosting the upward trend. Foundry (semiconductor contract manufacturing) utilization rates improved, narrowing losses, while increased orders for legacy (mature) process technologies and the stabilization of mass production for the company’s own application processor, Exynos 2600, were cited as positive factors. Losses in the system semiconductor division, which had reached around 2 trillion won, are estimated to have been reduced to about 1 trillion won. With both memory and non-memory segments recovering in tandem, industry observers cautiously note that Samsung Electronics is regaining its strength as the semiconductor market rebounds.

The mobile division was driven by strong sales of foldable phones. The Galaxy Z Fold 7 and Z Flip 7 series, launched in July, set a new record for the foldable lineup with 1.04 million units sold during domestic pre-orders, and also achieved the highest sales for the series in the United States. As a result, the operating profit of the MX (Mobile eXperience) division is estimated to reach the 3 trillion won range.

However, the outlook for the fourth quarter and beyond remains cautious. While demand for high-performance memory driven by the expansion of AI servers is expected to continue into next year, global variables such as tariff risks remain significant. Kyunghee Kwon, a research fellow at the Korea Institute for Industrial Economics & Trade, said, "As the focus of data center demand shifts amid the AI supremacy race, the memory supercycle is heading toward a peak in 2026."

However, there are also views that it is difficult to be optimistic about future performance due to uncertainties surrounding tariffs, intensifying US-China tensions, and significant exchange rate volatility.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.