Samsung Electronics Plunges for Just Over 10 Minutes in Pre-Market on the 6th

One Investor's Automated Buy Order Successfully Executes

On February 6, while Samsung Electronics shares showed extreme volatility in the pre-market session, a case of an individual investor who happened to execute a buy order at the lower limit price became a hot topic online.

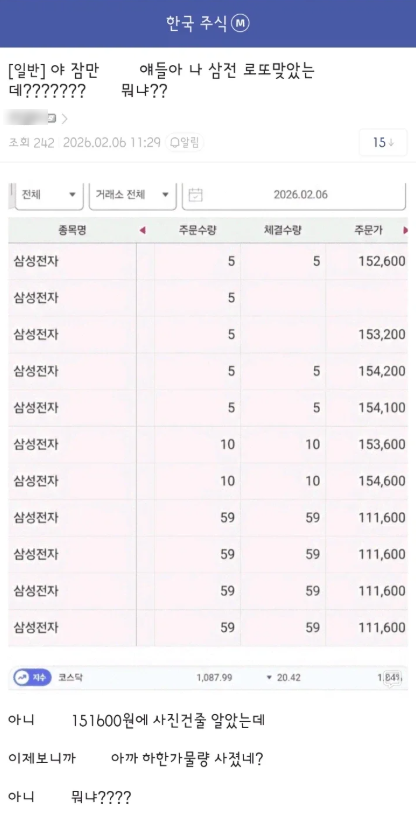

On this day, a post was uploaded to an online community claiming success in buying Samsung Electronics shares at the lower limit price. Investor A, who wrote the post, said, "I thought I bought Samsung Electronics at 151,600 won, but when I checked the transaction history, I saw that I had bought shares at the lower limit price," adding, "What on earth happened?"

According to the transaction history disclosed by A, immediately after the pre-market opened that day, Samsung Electronics plunged 29.94% from the previous day and fell to the lower limit price of 116,000 won, during which a large volume of trades was executed. Due to the rapid price movement, the Volatility Interruption (VI) mechanism was also triggered. VI is a system that switches a stock to single-price auction trading for 2 minutes when its execution price fluctuates beyond a certain threshold compared to the previous price, in order to prevent excessive price swings.

After the VI was triggered, Samsung Electronics quickly recouped its losses and returned to its normal price level in just over 10 minutes. The closing price of Samsung Electronics on this day was 158,600 won, meaning that based on the lower-limit purchase price, A recorded an unrealized return of about 36%.

Netizens who saw the post reacted with envy, leaving comments such as "It's like winning the lottery with an automated trading system," "I didn't know this was even possible," and "Some people are destined to be lucky no matter what."

Meanwhile, Samsung Electronics ended the day 0.44% lower than the previous session. SK Hynix also closed 0.3% lower at 839,000 won.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.