Comprehensive Partnership with OpenAI

Participation in the "Stargate Project"

Sales Growth Expected for Samsung and SK Hynix

Potential Restructuring of the AI Semiconductor Order

Establishment of AI Data Centers Seen as a Positive Factor

Government Considers Easing Separation of Industrial and Financial Capital

Expanded Capacity for Large-Scale Funding

With the visit of Sam Altman, CEO of OpenAI, to South Korea and the signing of comprehensive partnerships with Samsung Electronics and SK Hynix, industry experts are evaluating that the Korean semiconductor sector is experiencing a convergence of multiple favorable factors. The demand structure, which had been concentrated on Nvidia, is now likely to diversify. In addition, the government has expressed its intention to ease regulations on the separation of industrial and financial capital targeting the semiconductor and AI industries, opening new avenues for funding.

According to industry sources on October 2, Altman's visit has been seen as a strategic opportunity for South Korea to secure a leading position in the midst of the global AI race. If these deals materialize, Samsung Electronics and SK Hynix could see a sharp increase in sales.

This is especially significant as it presents domestic semiconductor companies with a new opportunity to reduce their reliance on Nvidia, often referred to as the "semiconductor king." Until now, the global AI market has been driven by demand for GPUs supplied by Nvidia and the supporting demand for high-bandwidth memory (HBM), with domestic memory companies facing the limitation of an overly concentrated sales structure focused on a single customer. However, with Samsung and SK participating as strategic partners in OpenAI's "Stargate Project," the situation has changed. As Korean companies become deeply involved in the next-generation large-scale data centers that have been highlighted as a key issue in the AI era, this is seen as a turning point that directly demonstrates the potential for a restructuring of the global AI semiconductor order, which has been centered on Nvidia.

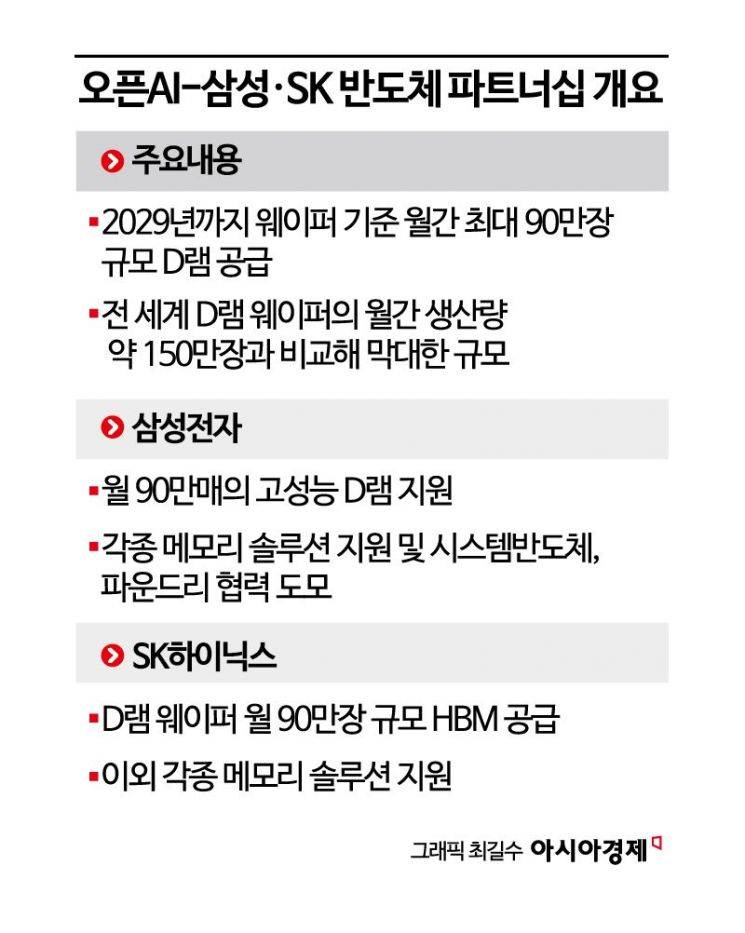

In particular, there is speculation that OpenAI's AI data centers will require such vast amounts of memory that HBM sales to OpenAI could surpass those previously supplied to Nvidia, potentially making OpenAI the largest customer for domestic companies. According to Samsung and SK, OpenAI is reported to require 900,000 DRAM wafers per month for the Stargate Project. DRAM, known for its large capacity and high speed, is a core component of AI data centers, and its price has recently surged due to increased general-purpose demand.

Both companies stated that they will actively utilize their existing infrastructure to ensure stable memory supply. The cooperation could also expand into non-memory sectors such as system semiconductors and foundry services. If OpenAI pursues the development of its own AI accelerators in the long term, demand could increase even further. According to foreign media, OpenAI currently procures GPUs from Nvidia, but CEO Altman has expressed his intention to begin in-house production. After completing his visit to Korea, he is scheduled to meet with TSMC in Taiwan. If production volumes increase, Samsung Foundry may also have an opportunity to secure orders.

The government has also made it clear, following the meeting with CEO Altman, that it will accelerate regulatory reforms to foster the AI industry. Kim Yongbeom, Chief Presidential Policy Secretary, stated, "The President believes that easing the separation of industrial and financial capital is an option that can be considered." As collaboration with OpenAI gains momentum and domestic companies such as Samsung and SK face the need to expand semiconductor plants and attract investment, the government intends to ease financial regulations to broaden funding capacity. The separation of industrial and financial capital is a system that prevents industrial capital from holding more than a certain percentage of shares in financial institutions, designed to prevent the privatization of financial resources and unfair transactions. The business community has consistently argued that this regulation has hindered large-scale corporate investments, and if the latest remarks are realized, there is growing anticipation that the investment environment for the semiconductor and AI industries could change significantly.

An official from a business association commented, "With inter-company cooperation being established and the necessary government support also being considered, everything is working in sync like well-meshed gears," adding, "Government support must move beyond the review stage and be implemented, and companies should also strive to maintain this cooperation going forward."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)