Robotics, Future Vehicles, and Displays: Next-Generation Industries

Korea Called for 'Fast Follower' Strategy, but Lacks a Domestic Supply Chain

Industry Warns of "Weakened Competitiveness"... Urgent Need for Support in Materials, Parts, and Equipme

It has been five years since the government enacted the Special Act on Materials, Parts, and Equipment (commonly referred to as the "Sobu-jang Special Act") and emphasized localization, yet Korea's advanced strategic industries remain heavily dependent on foreign sources. There is growing analysis that, in next-generation sectors such as robotics, future vehicles, and displays, the entrenched reliance on Japan and China for core technologies and key components is making it increasingly difficult for Korea to take the lead in these industries. Concerns are mounting that supply chain risks could directly translate into risks to industrial competitiveness.

Increase in Manufacturing Robots, but Parts Still Sourced from Japan and China

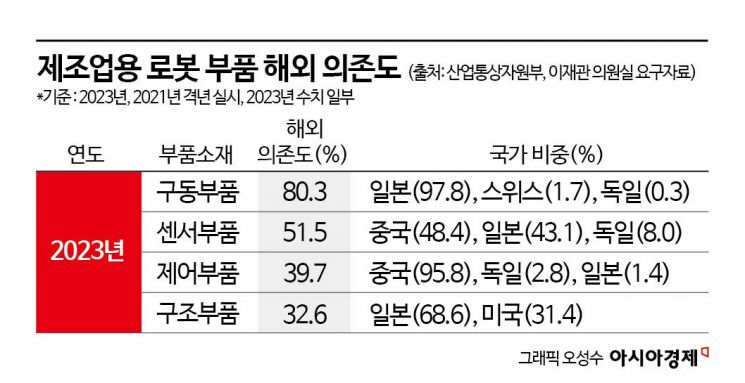

According to data requested by Assemblyman Lee Jaegwan of the Democratic Party of Korea from the Ministry of Trade, Industry and Energy, as of 2023, the overseas dependency rate for drive components used in domestic manufacturing robots reached 80.3%. This figure is higher than the 77.7% reported in 2021. Among these, the vast majority of imported drive components-97.8%-were sourced from Japan. Drive components, which include motors, reducers, and drives, are the most critical parts that move the joints of robots.

For other components, the dependency has recently shifted from Japanese to Chinese products. Sensor components-such as camera modules, torque sensors, and encoders, which serve as the "eyes and ears" of robots-had an import share of 51.5% from China and Japan. Compared to 2021, reliance on Japanese products decreased from 74.3% to 43.1%, while dependence on Chinese products more than doubled from 23.2% to 48.4%. For control components, Japanese products accounted for the highest share in 2021 (57.3%), but from 2023, Chinese products dominated with a 95.8% share.

Industrial robots are already being utilized across various domestic industrial sites. According to the Ministry of Trade, Industry and Energy, the total sales of the domestic robotics industry in 2023 reached 5.9805 trillion won, a 1.5% increase from the previous year. About half of this figure comes from manufacturing robots. While demand for robots is rising rapidly, most of the detailed components are still procured from overseas.

As a result, not only are foreign component manufacturers benefiting, but domestic robot manufacturers are also facing increased burdens. The small scale of the supply chain makes it difficult to procure components in bulk, preventing price reductions. Heo Jeongwoo, Chief Technology Officer (CTO) of Rainbow Robotics, pointed out, "Since gears, motors, and sensors inside robots have not been localized, we have no choice but to produce them at higher costs compared to products from other countries. For domestic companies to manufacture these components, materials and equipment are ultimately required. However, there are no companies in Korea that produce such materials and equipment, nor is there any investment in this area."

'Next-Generation Growth Engine' MicroLED Components Also 90% Imported

Even in the display industry, where Korea maintains the world's top market share, the rate of localization is weak. In the case of LCDs (liquid crystal displays), where China has rapidly increased its market share, most components are already imported. According to data requested by Assemblyman Lee Jaegwan from the Korea Display Industry Association, from 2022 to 2024, key LCD components such as liquid crystal (LC) material, polarizers, color filters, glass substrates, backlight units (BLUs), and exposure equipment were all 100% dependent on overseas sources. Only driver ICs and etching equipment were identified as domestically produced.

As of 2023, the localization rate for OLED materials and components stood at about 60%. The Ministry of Trade, Industry and Energy explained that for items such as light-emitting materials, rare earth-based raw materials, and precision components, Korea still relies on countries holding original technologies, such as Japan and the United States. Although the localization rate for equipment has been increased to 71%, some essential equipment for production processes, such as exposure and deposition machines, are still almost entirely imported. According to the Korea Display Industry Association, the fine metal mask (FMM)-a key component that determines the resolution and yield of OLEDs-has a foreign dependency rate of over 95%. Transparent adhesive layers (OCA) and manufacturing equipment for OLED deposition are also more than 90% and 80% imported, respectively. The foreign dependency rate for light-emitting organic materials is around 67%.

The microLED sector, which has recently attracted industry attention, also faces high dependency on Taiwan and China for major components such as LED chips (light-emitting sources) and backplanes (circuit boards), further increasing supply chain risks. In particular, more than 90% of LED chips, transfer process equipment, and inspection/calibration equipment are imported. For encapsulation and optical components, which determine luminous efficiency, the foreign dependency rate exceeds 95%. About 80% of backplanes are also imported.

Industry experts predict that within the next three years, China will catch up with Korea's market share in OLEDs following LCDs, and emphasize the need to secure a technological lead in microLEDs, which are expected to become mainstream after 2030. However, without achieving localization of components, competitiveness will decline and securing technology itself will become increasingly difficult.

An industry official stated, "Nearly all LED chips are sourced from the Taiwanese chip design and manufacturing company PlayNitride, and backplanes are sourced from the Taiwanese component manufacturer AOI. If these companies stop supplying, domestic firms will be unable to produce microLEDs. Although Korea secured a budget of 500 to 600 billion won last year by passing the preliminary feasibility study law, the market assessment is that it is already too late to take the lead."

Future Vehicles and Battery Components Also Imported from China

For future vehicles such as electric vehicles, hydrogen vehicles, autonomous vehicles, and connected cars, the dependence on China for secondary batteries (batteries) is overwhelming. Backed by strong government support, China is leading the future vehicle industry. The supply chain for vehicle-related components is also rapidly expanding and extending across all industrial sectors.

According to the Ministry of Trade, Industry and Energy's compilation of Korea's trade statistics over the past five years, imports of nickel hydroxide-essential for manufacturing batteries and cathode materials for future vehicles-were concentrated in China, accounting for about 96.4% last year. For lithium hydroxide, a key material determining battery performance, the share of imports from China was 82.7% last year and has remained in the 70-80% range over the past five years.

Natural graphite also had a dependency rate of over 97% on China last year, up from the 95% range in 2020. Other key secondary battery materials, such as artificial graphite, cobalt oxide, and manganese dioxide, have also seen China's market share remain in the 70-90% range over the past five years, effectively establishing a single-source supply structure.

For cathode precursors and ternary cathode active materials, 80-90% of imports are concentrated in China, and separators, which are critical for battery safety, are also more than 70% dependent on China. In certain years, the share from countries such as Finland, Switzerland, and Japan has increased slightly, but overall, the concentration on China remains pronounced. Despite the government's emphasis on localization and its policies to promote domestic production of materials, parts, and equipment, the supply chain for key materials in future vehicles and batteries remains exposed to China risk.

Assemblyman Lee Jaegwan stated, "When the dependency on specific countries for key materials is high, the entire domestic industry can be shaken by sudden changes in international affairs. Since localization of materials, parts, and equipment is directly linked to economic security, urgent policy support is needed to raise the localization rate and secure the global competitiveness of advanced strategic industries."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)