Estimated Third-Quarter Net Profit for Eight Listed Insurers: 2.2633 Trillion Won

Expected to Fall 4% Year-on-Year

Life Insurers Down 9.4%, Non-Life Insurers Up 0.3%

Domestic Market Saturated Due to Low Birth Rates and Aging Population

Insurance companies are expected to see their performance decline in the third quarter, following a downturn in the second quarter. The saturated domestic market, driven by low birth rates and an aging population, is being further impacted by fierce competition in health insurance, reduced investment returns due to low interest rates, and a rising loss ratio in auto insurance, all of which are expected to negatively affect earnings.

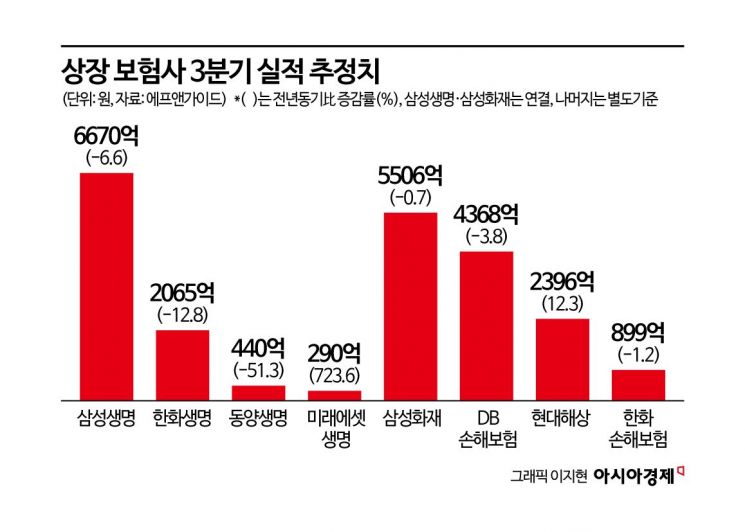

According to financial information provider FnGuide on September 29, the consensus (market average estimate) for third-quarter net profit among eight listed domestic insurers-Samsung Life Insurance, Hanwha Life Insurance, Tongyang Life Insurance, Mirae Asset Life Insurance, Samsung Fire & Marine Insurance, Hyundai Marine & Fire Insurance, DB Insurance, and Hanwha General Insurance-stands at 2.2633 trillion won. This represents a projected 4% decrease compared to the third quarter of last year, when net profit was 2.3574 trillion won. By sector, life insurers are expected to see net profit decline by 9.4%, while non-life insurers are projected to see a 0.3% increase. The estimates for Samsung Life Insurance and Samsung Fire & Marine Insurance are on a consolidated basis, while the others are on a standalone basis.

Samsung Life Insurance’s third-quarter net profit is expected to be 667 billion won, a 6.6% decrease compared to the same period last year. Samsung Life Insurance is currently shifting its portfolio from whole life insurance, which has low profitability and high interest rate sensitivity, to health insurance, which offers higher long-term returns. The related increase in expenses is expected to reduce insurance profit. However, investment profit is projected to rise, as the proceeds from the sale of Ferrum Tower in Jung-gu, Seoul, to Dongkuk Steel-amounting to 230 billion won-will be reflected.

Hanwha Life Insurance’s third-quarter net profit is estimated at 206.5 billion won, a 12.8% decrease compared to the same period last year. Hanwha Life Insurance’s performance is expected to deteriorate due to intense competition to secure health insurance customers, a sector where non-life insurers hold a 70% market share. In the first half of this year, Hanwha Life Insurance’s net profit was only 179.7 billion won, down 48.3% from the previous year. Loss-making contracts in some aggressively marketed health insurance products, coupled with poor investment returns, were cited as reasons.

Tongyang Life Insurance’s third-quarter net profit is expected to plunge 51.3% year-on-year to 44 billion won. This is believed to reflect costs related to strengthening capital adequacy and its incorporation into Woori Financial Group.

Mirae Asset Life Insurance’s third-quarter net profit is forecast to soar by 723.6% year-on-year to 29 billion won. This surge is attributed to robust sales of variable insurance products, the company’s main offering, amid rising domestic and international stock markets this year.

Samsung Fire & Marine Insurance’s third-quarter net profit is estimated at 550.6 billion won, a 0.7% decline from the same period last year. The company’s leading market share in auto insurance is expected to be a drag. In the second quarter, Samsung Fire & Marine Insurance managed to earn only 800 million won in auto insurance. Kiwoom Securities recently reported that Samsung Fire & Marine Insurance is expected to post a 33 billion won loss in auto insurance in the third quarter, with the deficit projected to widen to 112 billion won in the fourth quarter.

The recent sharp rise in auto insurance loss ratios is negatively affecting the performance of major non-life insurers selling auto insurance. The cumulative loss ratio from January to August this year was 84.4%, up 4 percentage points from the same period last year. The main causes are four consecutive years of premium reductions, excessive medical treatments, and increased repair costs. Some experts predict that the annual auto insurance deficit will exceed 600 billion won this year, marking the highest level since 2019.

DB Insurance, which holds the second-largest share of the auto insurance market, is also expected to report a third-quarter net profit of 436.8 billion won, down 3.8% year-on-year. Feeling limited in the domestic auto insurance market, DB Insurance acquired U.S. auto insurer Fortegra for 2.3 trillion won on September 26. This is the largest overseas M&A deal ever by a Korean insurer.

Hyundai Marine & Fire Insurance’s third-quarter net profit is projected at 239.6 billion won, a 12.3% increase compared to the same period last year. The company is expected to offset losses from weak auto insurance performance by securing insurance contract service margins (CSM) from protection-type insurance. Hong Yeran, a researcher at Korea Investment & Securities, stated, “Unlike other companies that raised premiums following last month’s reduction in the assumed interest rate, Hyundai Marine & Fire Insurance announced it has no plans for additional premium adjustments this year. Considering price competitiveness, new contract volumes are expected to gradually increase from the third quarter onward.”

Hanwha General Insurance’s third-quarter net profit is projected to decrease by 1.2% year-on-year to 89.9 billion won. Hanwha General Insurance plans to merge with Carrot General Insurance, a digital insurer specializing in pay-per-mile auto insurance, on October 1. In the first half of this year, Hanwha General Insurance and Carrot General Insurance recorded auto insurance losses of 13 billion won and 19.3 billion won, respectively. By absorbing Carrot General Insurance, Hanwha General Insurance aims to reorganize its auto insurance division and improve its loss ratio.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)