Aramid, the "Fiber of Dreams," Used in Optical Cables and More

Yantai of China Rapidly Closing In with 7% Market Share

Entering a "Chicken Game" Amid Fierce Price Competition from Low-Cost Rivals

Kolon Industries has effectively entered a 'chicken game' in the advanced fiber aramid market. It has been reported that the company’s management recently issued a directive to "lower the sales price." As Chinese-made products are flooding into the specialty (high value-added) aramid market, Kolon Industries is now adopting a strategy of defending volume and market share through fierce price competition, similar to what is seen with commodity products.

According to the chemical industry on September 26, Kolon Industries’ management has instructed the aramid business division since the beginning of this year that "production must be increased, even if it means lowering the sales price."

Aramid is called the "fiber of dreams" as it is used as a key material in advanced fields such as bulletproof vests, optical cables, and electric vehicle tires. It is produced from terephthalic acid and chlorine, and has been considered a product that contributes to the added value of the petrochemical sector. In February last year, Kolon Industries invested 298.9 billion won to more than double its production capacity from 7,500 tons per year to 15,310 tons per year. This expansion was largely driven by projections that the global aramid market would grow from 4.5 billion dollars (approximately 6.3405 trillion won) in 2023 to 7 billion dollars by 2030, as demand increases in areas like 5G cables and ultra-high-performance tires.

However, with the emergence of latecomer Chinese companies, aramid can no longer be classified as a specialty product. As sales competition has intensified, product prices have started to decline. Kolon Industries’ global market share in aramid is estimated at 11%, making it the third largest in the world after DuPont of the United States and Teijin of Japan. In South Korea, Taekwang Industrial and HS Hyosung have much smaller scales, producing 1,500 tons and 3,700 tons per year, respectively.

In contrast, Yantai in China has significantly increased its production capacity to 16,000 tons per year, raising its market share to 7%. An industry insider commented, "With the chemical industry in a slump and Chinese companies launching aggressive low-cost strategies, the global aramid market is now experiencing a price war."

Additionally, investment in optical cable infrastructure has been delayed due to the economic downturn and uncertainty surrounding U.S. tariff policies. Regarding the decision to lower sales prices, a company representative explained, "We are carrying out an operational efficiency project across all business areas." The core of this operational efficiency is to reduce costs by increasing yield, meaning the company intends to lower expenses by boosting production. Previously, a Kolon Industries representative stated at an earnings briefing, "It is true that there is currently an oversupply of aramid. We need to secure a certain operating rate to cover fixed costs, and for this reason, we are adjusting sales prices."

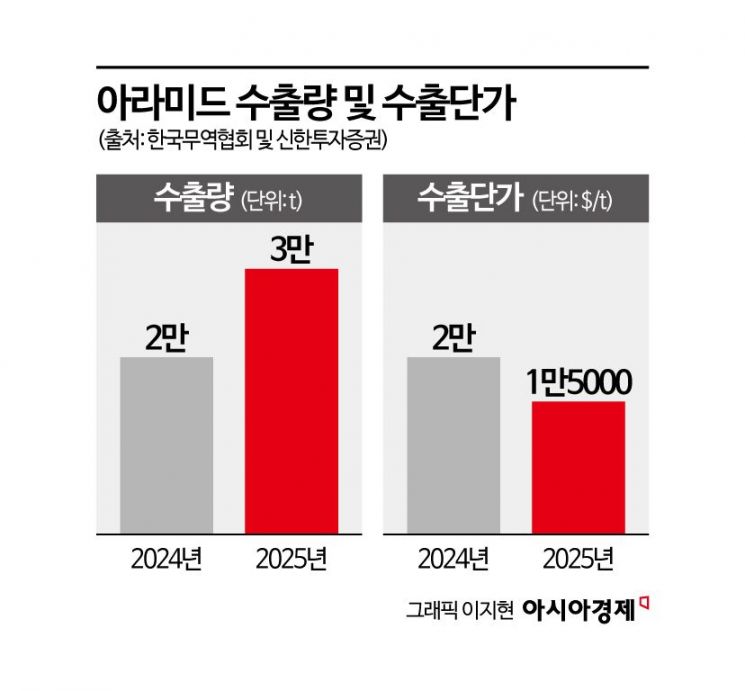

Recently, Kolon Industries’ operating margin has been on the decline, from 4.2% in 2023 to 3.3% in 2024, and an estimated 3% in 2025. According to the Korea International Trade Association and Shinhan Investment Corp., aramid export volume increased from 20,000 tons to 30,000 tons compared to last year, but the export price per ton fell from 20,000 dollars to around 15,000 dollars.

Industry sources estimate that Kolon Industries’ aramid operating rate has risen from about 50% in the second half of last year to 60% in the first quarter of this year, and to the mid-70% range in the second quarter.

This phenomenon is not unique to aramid. There have been previous cases where products once considered specialty items, such as polarizing film and polysilicon, collapsed under the mass production offensive of Chinese companies. An industry insider said, "China is threatening domestic companies by mass developing and producing even specialty products. For us, there are limits to relying solely on price competition."

Kolon Industries is simultaneously working to lower product manufacturing costs by increasing yield and strengthening research and development in product areas that China cannot easily replicate. Recently, the company has also invested in the mPPO business, a next-generation low-dielectric material for copper-clad laminates.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)