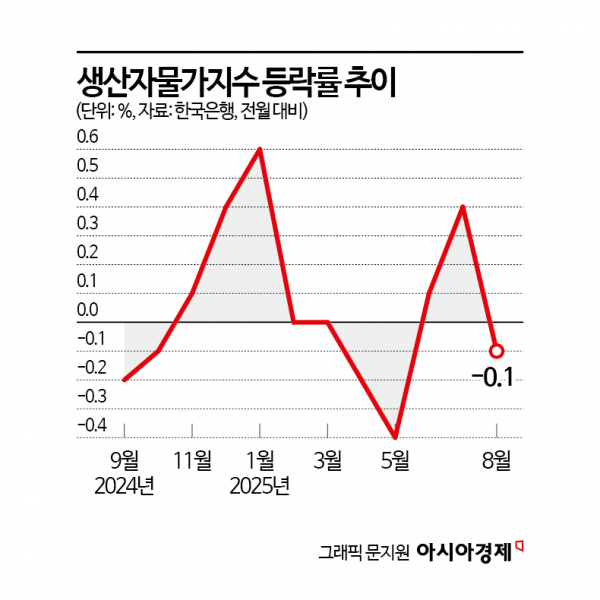

Producer Price Index at 120.12, Down 0.1% from Previous Month

Agricultural Product Prices Continue to Rise, with Napa Cabbage Up 35.5% and Spinach Up 30.7%

“Excluding Telecommunications Fee Discount, PPI Estimated to Have Risen by 0.2%”

Last month, the producer price index (PPI) declined for the first time in three months. This was largely due to SK Telecom's decision to apply a 50% discount on telecommunications fees for all subscribers following a hacking incident. This month, however, there is a high likelihood that the index will turn upward again, as raw material prices are on the rise, and residential electricity rates-after the easing of progressive rate brackets ended in July and August-along with increases in industrial city gas rates, are expected to exert upward pressure.

Producer Price Index Declines for First Time in Three Months Due to SK Telecom Fee Discount

According to the "August 2025 Producer Price Index (Provisional)" released by the Bank of Korea on the 23rd, last month's producer price index stood at 120.12 (2020=100), a 0.1% decrease from the previous month. While agricultural products rose, a decline in information and communications and broadcasting services led to a drop in the index for the first time in three months. Compared to the same period last year, the index increased by 0.6%.

By item, services were the main driver of the decline in the producer price index. Information and communications and broadcasting services (-3.4%) and business support services (-0.1%) fell, resulting in a 0.4% decrease from the previous month. Lee Moonhee, head of the Price Statistics Team at the Economic Statistics Department 1 of the Bank of Korea, stated, "In particular, within information and communications and broadcasting services, mobile telecommunications services-which included SK Telecom's August fee discount-plummeted by 26.2% from the previous month. Due to the chain-weighted calculation method used for the producer price index, it is difficult to precisely calculate the contribution of individual items, but it is estimated that the telecommunications fee discount lowered the overall producer price index by about 0.24 percentage points." Accordingly, excluding this factor, it is estimated that the producer price index for August would have risen by about 0.2% compared to the previous month.

In July, agricultural, forestry, and fishery products had surged due to extreme heat and heavy rain. In August, agricultural products (4.3%) and livestock products (2.8%) continued to rise, leading to a 3.4% increase from the previous month. Cabbage (35.5%) and spinach (30.7%) saw sharp increases, and the price of croaker jumped by 45.2%. Rice prices rose by 21.0% compared to the same period last year, which was attributed to reduced rice production last year. Lee explained, "While inventory levels may have an impact, overall, the decrease in production last year is expected to be passed on to consumer prices. Until this year's new rice is harvested and distributed, prices may continue to be affected."

Meanwhile, industrial products such as coal and petroleum products (-1.1%) declined, but food and beverages (0.3%) rose, resulting in a flat trend overall compared to the previous month. Electricity, gas, water, and waste services remained at the same level as the previous month.

By special classification, food products-including edible agricultural, forestry, and fishery products and processed foods-rose by 1.7% compared to the previous month, while fresh foods surged by 4.9%. Energy, including petroleum products, fell by 0.4%. Information technology dropped by 2.0% from the previous month. Items excluding food and energy declined by 0.2% compared to the previous month.

Raw Material Prices and Public Utility Rates in September Likely to Drive Index Upward

This month, factors contributing to a rise in the producer price index are prominent, including raw material prices, exchange rates, and public utility rates. Lee said, "So far this month, the won-dollar exchange rate has edged down by 0.1%, but the average monthly price of Dubai crude oil has increased by 1.3% compared to the previous month. Residential electricity rates, which benefited from eased progressive brackets in July and August, are now being raised again in September as that measure has ended."

Additionally, the end of the temporary mobile telecommunications fee reduction in August and the increase in industrial city gas rates are also expected to contribute to a rise in the producer price index. Lee added, "While movements may vary by item and it is difficult to make definitive predictions before price surveys are completed, the uncertainty in agricultural, forestry, and fishery product prices remains high, and so far, upward factors are clearly visible."

Last month, domestic supply prices rose by 0.2% from the previous month but fell by 0.3% compared to the same month last year. The domestic supply price index measures price changes for goods and services supplied domestically (including both domestic shipments and imports) to track the ripple effects of price changes. By stage of production, raw materials (1.2%), intermediate goods (0.1%), and final goods (0.1%) all increased.

The total output price index, which measures price changes for goods and services based on total output (including exports in addition to domestic shipments) to capture overall price fluctuations of domestic products, rose by 0.1% from the previous month. While services (-0.4%) declined, industrial products (0.2%) and others increased. Compared to the same month last year, the index rose by 0.4%.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)