Haidi Lao's Sales Near 100 Billion Won This Year

Bawangchaji Set to Open Stores in Korea This Year

Targeting Millennials & Gen Z with Experiential and Premium Strategies

Intensifying Competition Among Domestic Franchises Inevitable

Chinese dining brands are making an aggressive push into the Korean market. Previously dismissed as "low-cost, low-quality," Chinese food and beverage (F&B) brands are now targeting Korean consumers with experiential services and premium strategies. As the recovery of the Chinese economy remains sluggish, these brands are turning their attention to Korea. However, with the domestic franchise market already saturated, concerns are rising that a direct clash with local brands is inevitable.

According to industry sources on September 22, the annual sales of Haidi Lao, a Chinese hot pot franchise, are expected to approach 100 billion won this year. This represents a 28% increase compared to last year’s 78 billion won, and follows a 34% growth rate in 2022 (58.3 billion won), marking two consecutive years of rapid expansion.

Haidi Lao, which entered the Korean market in 2014, operates stores in major cities such as Gangnam, Myeongdong, Busan, and Jeju, and is considered a successful case of market entry. Rather than simply serving hot pot, the brand has attracted significant attention by offering free snacks and nail services in waiting areas and performing dough shows at tables, emphasizing the service experience. Analysts note that this strong focus on "experience" rather than just taste has resonated with Millennials & Gen Z, serving as a powerful differentiator.

19 Stores Opened in Two Years... ‘Starbucks of the East’ Set to Enter Korea

The Chinese food craze that began with malatang and tanghulu has recently expanded to milk tea. Starting with "Mixue Bingcheng" (operating as "Mixue" in Korea) in 2022, Chinese milk tea brands such as "Chabaidao" (operating as "Chabaekdo" in Korea) and "Xicha" (operating as "Heytea" in Korea) entered the Korean market last year. Mixue currently operates 12 stores mainly around university areas in Seoul, while Chabaekdo is about to open its 19th store. Heytea also operates six stores, primarily in Gangnam, Myeongdong, and Hongdae.

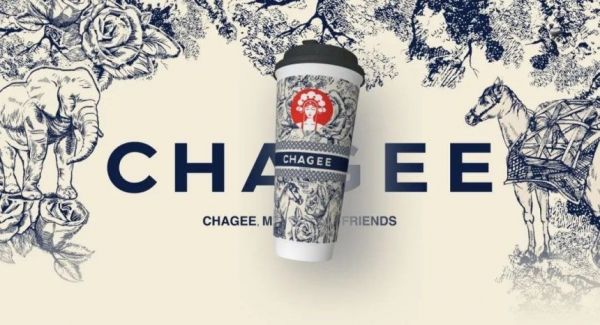

This year, "Bawang Chaji" (operating as "Paewangchahee" in Korea), one of China’s top three milk tea franchises and known as the "Starbucks of the East," is preparing to open its first Korean store. In July, Bawang Chaji established a Korean subsidiary under the name "Chaji Korea LLC" and is currently in negotiations to form a joint venture with major Korean coffee franchise and distribution companies, with the final partner selection expected soon.

Chinese Dining Industry Faces Domestic Crisis, Turns to Korea as Breakthrough

The expansion of Chinese F&B franchises into Korea is rooted in sluggish domestic demand in China. According to Hongchanwang, a Chinese dining industry media outlet, 3 million restaurants, cafes, and bakeries closed in China last year, the highest number ever recorded. Hongchanwang reported, "Last year, the keywords in the Chinese dining industry were 'downsizing' and 'store closures.' There was a series of negative news, including withdrawals, delistings, and founders fleeing."

Korea has become a land of opportunity. Korean consumers are generally receptive to Chinese dishes such as fried chicken, malatang, and guobaorou, and there is already significant demand for Chinese cuisine in everyday life. With the rise of K-food and the Korean Wave, entering Korea is now seen not just as opening an overseas store, but as a stepping stone toward becoming a global brand.

Unlike in the past, Chinese franchises are no longer relying on "low-price strategies." Instead, they have shifted to persuading consumers with "premium experiences." Haidi Lao charges up to 30,000 to 40,000 won per person, or 100,000 won for two people, yet still attracts crowds. Heytea has priced its signature "Cloud Crisp Grape" at 7,400 won, which is higher than the 5,000 to 6,000 won price range of Gongcha Korea, a Taiwanese bubble tea brand already established in Korea. This is nearly double Heytea’s local price in China, which is 18 to 21 yuan (about 3,440 to 4,013 won).

Chinese Brands Expected to Expand Even Faster... Survival Strategies for Korean Brands Put to the Test

Industry experts predict that the influence of Chinese franchise brands in the Korean market will likely grow even further in the coming years. In particular, with visa-free travel now permitted between Korea and China, the recovery of tourism demand could rapidly boost brand recognition in Korea.

An industry insider said, "Korea is geographically close and consumer trends change quickly, so the pace of market entry will accelerate. We are likely to see more cases where brands rapidly increase store numbers to target tourist demand."

Concerns are also mounting that the expansion of Chinese franchises will intensify competition in the domestic market. As of last year, there were 8,802 franchise headquarters, 12,377 brands, and 365,014 franchise stores in Korea.

Another industry official explained, "While the influence of Chinese franchises is not yet significant, if the pace of entry increases, the market position of domestic brands could be weakened in the medium to long term. Especially in overlapping segments like cafes and beverages, direct competition is inevitable, so some brands may be eliminated and the market may undergo restructuring."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)