The Third Amendment to the Commercial Act, Mandating Treasury Share Buybacks and Cancellations, Acts as a Positive Catalyst

Financial Holding Companies Gain Momentum in Pursuing 'Value-Up' Initiatives

Despite the unfavorable environment surrounding the banking sector in the second half of the year, the stock prices of the four major financial holding companies-KB, Shinhan, Hana, and Woori-have climbed to just below their previous highs. This is attributed to the government's decision to maintain the 5 billion won threshold for the major shareholder standard in capital gains tax on stocks, which has improved overall investor sentiment, and the third amendment to the Commercial Act, which mandates the immediate cancellation of treasury shares after buybacks. This amendment has been a positive factor for financial holding companies pursuing 'value-up' policies.

According to the financial industry on September 19, the stock prices of the four major financial holding companies have risen by an average of 7.6% this month, surpassing the KOSPI's increase of 7.14% over the same period. Looking at the year-to-date performance in 2025, bank stocks have risen by 48%, outpacing the KOSPI's 42% gain. As a result, the stock prices of the major financial holding companies have approached their previous peaks. As of the previous day's closing, KB Financial Group ended at 117,300 won (previous high: 127,000 won), Shinhan Financial Group at 69,100 won (previous high: 73,500 won), Hana Financial Group at 90,500 won (previous high: 97,300 won), and Woori Financial Group at 26,250 won (previous high: 27,150 won).

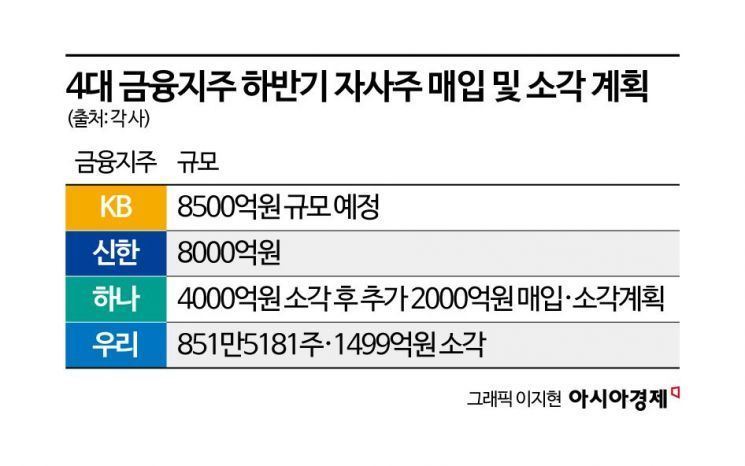

The key factor driving the stock price increase has been identified as the third amendment to the Commercial Act. The core provision of this amendment, which requires treasury shares to be canceled within six months to one year, has lifted the stock prices of financial holding companies. Major domestic financial holding companies have already been steadily pursuing treasury share buybacks and cancellations as part of their 'value-up' initiatives. The four major financial holding companies alone have planned to cancel treasury shares worth 3.5 trillion won this year.

Looking in detail, KB Financial Group bought back and canceled treasury shares worth 820 billion won in the first half of the year and plans to execute an additional 850 billion won in the second half. Shinhan Financial Group has conducted four rounds of treasury share buybacks since February and canceled 500 billion won worth early in June. It also plans to buy back and cancel approximately 800 billion won worth in the second half. Hana Financial Group canceled treasury shares worth 400 billion won on September 9, the largest amount since the holding company was established in December 2015. Although the initial plan was to cancel 400 billion won, this target was achieved early, and the company plans to buy back and cancel an additional 200 billion won by September 24. Woori Financial Group is also canceling 8,515,181 treasury shares (worth 149.9 billion won) on this day. If these plans are executed as intended, KB Financial Group's total shareholder return rate for this year is expected to exceed 50%, while Shinhan and Hana Financial Groups are also projected to reach the 40% range.

The mandatory buyback and cancellation of treasury shares is considered a representative shareholder-friendly policy. As the number of shares in circulation decreases, earnings per share (EPS) and return on equity (ROE) improve, and if market capitalization and total dividends are maintained, not only can stock prices rise, but dividend payouts can also be expected to increase.

Jung Taejoon, a researcher at Mirae Asset Securities, analyzed, "After the announcement of the tax reform plan, bank stocks underperformed for about a month due to various issues such as fines related to equity-linked securities (ELS), fines for collusion on loan-to-value (LTV) ratios, and increases in education and corporate tax rates. However, during the correction, their price attractiveness became more apparent," adding, "The fact that a full-fledged improvement in fundamentals is imminent will also serve as a catalyst for further gains."

The government's decision to maintain the 5 billion won threshold for the major shareholder standard in capital gains tax has also contributed to improved investor sentiment. Kim Jaewoo, a researcher at Samsung Securities, said, "While maintaining the major shareholder standard does not directly impact the banking sector, it is positive in that it reaffirms the government's commitment to enhancing the value of the domestic stock market. If bank earnings continue to improve and their undervaluation becomes more evident, this could lead to a gradual rise in stock prices going forward."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)