IBK Economic Research Institute Report

"Close Monitoring of Loans Is Necessary"

As domestic petrochemical companies continue to post poor results, there is growing analysis that related small and medium-sized enterprises (SMEs) and small business owners are either going bankrupt or experiencing a significant contraction in their business activities.

According to the financial sector on September 19, the IBK Economic Research Institute, under Industrial Bank of Korea, stated in its recently released report, "Causes and Implications of the Crisis in Korea's Petrochemical Industry," that "close monitoring of loans extended to SMEs and small business owners located in petrochemical complexes is necessary."

The institute explained that Korea's petrochemical industry, along with the automotive and shipbuilding sectors, is a core national industry, and that its ethylene production capacity stands at 12.8 million tons, ranking fourth in the world. However, it pointed out that the naphtha cracking center (NCC) process, which uses naphtha as a feedstock, although capable of producing a wide range of products, suffers from high manufacturing costs, putting it at a disadvantage in terms of price competitiveness.

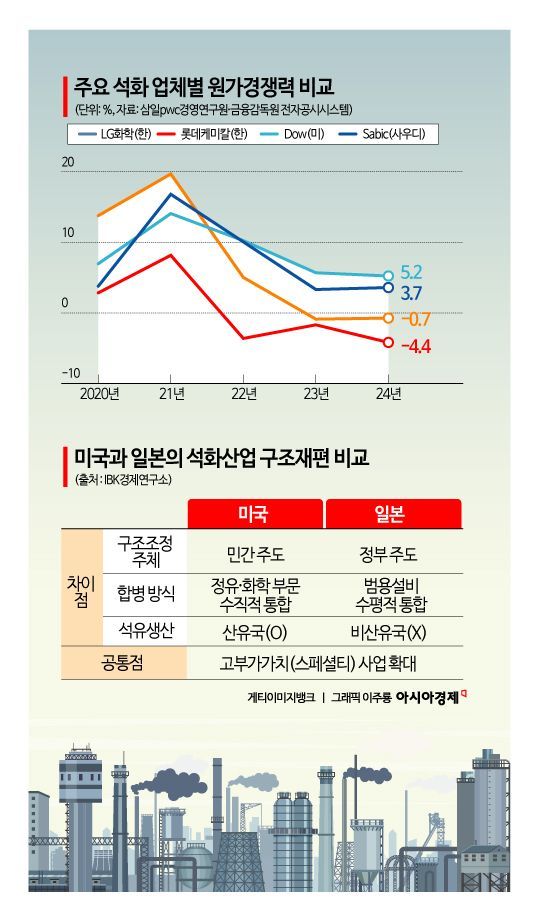

According to the report, as export sluggishness has persisted since 2022, the business performance of domestic petrochemical companies has deteriorated sharply. Based on data from the Korea Institute for Industrial Economics and Trade, petrochemical exports fell from 72.8 billion dollars (about 100.9 trillion won) in 2022 to 64.2 billion dollars in 2023, and further to 59.6 billion dollars last year. Operating results show a similar trend. The average operating profit of major petrochemical companies was about 1 trillion won in 2021, with an operating margin of 8%. However, in 2022, operating profit plummeted to around 150 billion won (operating margin in the 1% range). From 2023, they fell into the red, recording an operating margin of -3%, and last year, they posted an operating loss of about 200 billion won, with the margin dropping to the -4% range.

The institute cited as causes: ▲ intensifying oversupply, ▲ weakening cost competitiveness, and ▲ a lack of high value-added products. Although China is the largest export market, it has expanded its own production facilities, reducing its dependence on imports, and Korean companies have failed to find alternative export markets to China. In fact, exports to China amount to about 20 billion dollars, accounting for 40% of the total. Middle Eastern oil-producing countries have also made large-scale investments in the petrochemical industry and have begun to secure an advantage in cost competitiveness by adopting crude oil-to-chemicals (COTC) processes, which allow for the direct production of petrochemicals from crude oil. Korea, as a non-oil-producing country, relies on the NCC process and faces limitations in improving price competitiveness. In addition, its product portfolio is centered on general-purpose ethylene, making the transition to a structure focused on high value-added products such as high-performance resins or carbon fiber, as seen in Germany and Japan, relatively slow.

The institute predicted that while the severe oversupply and sluggish demand will not be resolved in the short term, the possibility of further deterioration is limited due to government measures. Last month, the government announced plans to strengthen the competitiveness of the petrochemical industry, promising regulatory easing and tax support on the condition that companies develop their own self-rescue plans. It also anticipated that, by requiring financial institutions to maintain existing loans until business restructuring is finalized, the short-term repayment burden would be alleviated.

However, the institute emphasized the need for financial monitoring of SMEs and small business owners located in Korea's three major petrochemical complexes (Yeosu, Seosan, and Ulsan). This is because plant operating rates within the complexes have remained at a record low of 70%, and new investment and maintenance orders have declined, putting partner companies at risk of bankruptcy. The vacancy rate for commercial buildings in downtown Yeosu surged from 12% in the second quarter of last year to 35.1% in the second quarter of this year, spreading shock throughout the regional economy. As a result, there are growing concerns that business activities of self-employed individuals in leasing and food service businesses near the complexes could contract significantly.

Meanwhile, the institute also introduced cases of industrial restructuring overseas. In the United States, private-sector-led vertical integration of the refining and chemical sectors has led to the emergence of comprehensive chemical companies, with companies focused on general-purpose products investing proceeds from asset sales into new businesses. In Japan, the government has led the consolidation of small-scale petrochemical facilities and diversification of business portfolios to transform the industrial structure.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)