Long-Term Incentives (LTI): The Key Motivator for U.S. Companies

Driving Growth and Shaping Corporate Culture

Excessive Compensation Can Lead to Shareholder Discord

The Tesla board of directors has proposed a compensation package for Chief Executive Officer (CEO) Elon Musk worth up to 1 trillion dollars (approximately 1,380 trillion won), bringing the generous long-term incentive (LTI) systems of American companies into the spotlight. U.S. firms carefully design LTIs to maximize the potential of their leaders and drive optimal performance.

Musk to Receive 1 Trillion Dollars if He Grows Tesla Eightfold

The LTI promised to Musk by Tesla consists of approximately 420 million shares, which equates to 12% of the company’s total outstanding shares. If all targets are met, Musk’s stake in Tesla could increase to as much as 25%.

However, in order for Musk to receive the full allotment of shares, he must accomplish a series of missions set by the board: achieving a market capitalization of 8.5 trillion dollars for Tesla (about eight times the current value), delivering 20 million vehicles, reaching 10 million subscribers to its Full Self-Driving (FSD) software, and deploying 1 million autonomous taxis. The board plans to evaluate Musk’s performance annually from next year through 2035, granting the compensation in stages each year.

Robyn Denholm, Chair of Tesla’s board, explained that the compensation package is intended “to keep Musk at the company and to motivate him.” The board plans to put the LTI plan to a vote in November.

LTI Emerges as a Core Driver of U.S. Corporate Competitiveness

LTI is a type of executive bonus paid when corporate executives achieve medium- to long-term goals. It is typically awarded in the form of stock options or performance share units (PSUs). While companies around the world grant LTIs to CEOs, the United States is the country that utilizes LTI strategies most aggressively.

According to the U.S. Institute for Policy Studies, total executive compensation at the top 100 publicly listed companies in the United States increased by 34.7% from 2019 to 2024, more than double the 16.3% increase in average worker pay. This was largely due to a significant rise in LTI awards for executives.

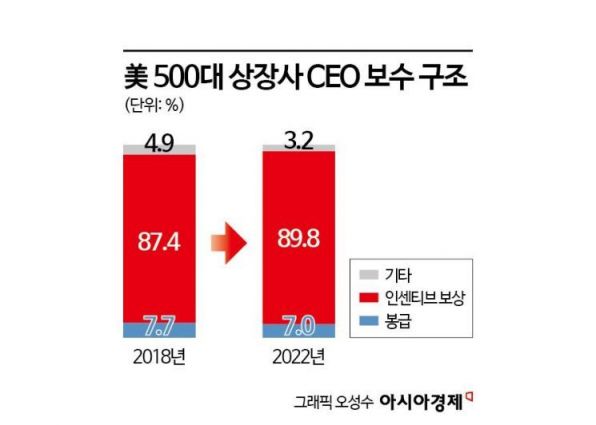

The compensation structure of CEOs at U.S. publicly traded companies, where incentive-based rewards constitute an overwhelming proportion. Source: Harvard Law School Corporate Governance Forum.

The compensation structure of CEOs at U.S. publicly traded companies, where incentive-based rewards constitute an overwhelming proportion. Source: Harvard Law School Corporate Governance Forum.

LTIs go beyond bonuses and are closely linked to corporate growth strategies. They motivate executives to drive company growth and help retain talented leaders. Additionally, boards can use LTIs to cultivate organizational cultures that align with their business models. For this reason, business schools and consulting firms across the United States study compensation strategies for numerous companies, striving to identify the optimal LTI structure.

As a result, the nature of LTIs varies by company. For example, e-commerce giant Amazon is known for adopting a purely performance-based LTI system, eschewing miscellaneous incentives such as meeting attendance fees and bonuses. This is reportedly a strategy to prevent executives from clinging to specific tasks for too long.

Microsoft overhauled its LTI program after Satya Nadella became CEO in 2014, and since 2021, has included factors such as corporate reputation and ethical behavior in executive performance evaluations. Given the company’s frequent clashes with regulators, reputation management is considered crucial. Google has crafted its LTI strategy to align with corporate profitability, focusing on metrics such as market-to-book ratio (MBR), return on assets (ROA), and operating margin. This supports Google’s growth strategy of aggressively increasing research and development (R&D) investment through high profitability.

Excessive LTIs Spark Shareholder Backlash... Concerns Over Widening Inequality

LTIs can be a double-edged sword for companies, as excessive executive compensation may provoke shareholder backlash. While U.S. shareholders have the right to vote for or against executive compensation under the Dodd-Frank Act, these votes are advisory and not legally binding, which limits their impact.

There have been cases where large LTI awards have strained relations between companies and their shareholders. In 2018, minority shareholders of Tesla objected to Musk’s LTI package, filing a lawsuit in Delaware court claiming that the compensation was excessive and the board was not sufficiently independent. After seven years of litigation, the Delaware court invalidated Musk’s compensation package earlier this year. In August, the Tesla board replaced the package with 960,000 restricted stock units under separate conditions.

There are also growing concerns that executive LTIs exacerbate income inequality. In August, The Guardian cited data from a U.S. think tank, reporting that the pay gap between CEOs and average workers has reached a record high of 632 to 1. On September 14 (local time), Pope Leo XIV remarked in an interview with Catholic media outlet Crux, “Sixty years ago, CEOs earned four to six times more than workers, but now it is said to be 600 times. There are even forecasts that Elon Musk could become the world’s first trillionaire,” adding, “This may be related to the gradual loss of the noble meaning of human life.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)