Retail Investors Go Into 'Beast Mode'

Double-Leverage Inverse ETF Tops Net Purchases

Betting on a Correction After Rapid Surge

Record-High Securities Lending and Net Short Positions Add Pressure

Despite the KOSPI index reaching an all-time high and entering uncharted territory, individual investors have flocked to inverse products that bet on a market decline. This is interpreted as Donghak Ants anticipating a correction following a short-term surge and seeking to maximize returns.

On the 11th, the KOSPI index started the session at 3336.60, up 22.07 points from the previous trading day, marking a record high for the second consecutive day. The electronic board at the Korea Exchange in Yeouido, Seoul, displays the KOSPI and KOSDAQ indices. 2025.9.11 Photo by Kang Jinhyung

On the 11th, the KOSPI index started the session at 3336.60, up 22.07 points from the previous trading day, marking a record high for the second consecutive day. The electronic board at the Korea Exchange in Yeouido, Seoul, displays the KOSPI and KOSDAQ indices. 2025.9.11 Photo by Kang Jinhyung

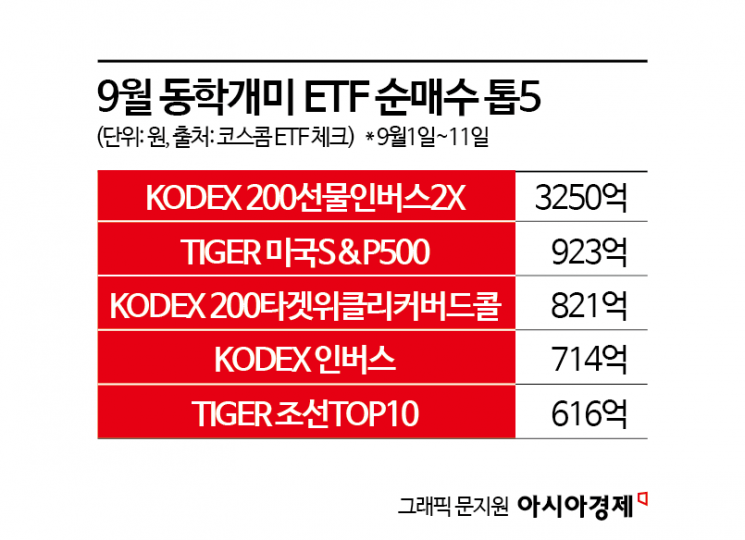

According to Koscom ETF Check on September 12, the exchange-traded fund (ETF) most heavily purchased by individual investors on September 10 and 11 was 'KODEX 200 Futures Inverse 2X' (worth 148 billion won), which tracks the daily return of the KOSPI index at -2 times leverage. Even as the KOSPI set record highs for two consecutive days, retail investors bet on a market downturn. Since the beginning of this month, they have purchased a cumulative 325 billion won, making it the top net purchased ETF. 'KODEX Inverse,' which allows investors to take a short (sell) position on the KOSPI without leverage, ranked second in net purchases at 32.1 billion won.

An official from a securities firm commented, "Korean individual investors, as the Bank of Korea previously warned, tend to have little hesitation in investing in high-leverage products," adding, "As the KOSPI continues to set new records without a clear catalyst, investor sentiment focused on maximizing returns through short-term trading appears to be expanding."

It is interpreted that more retail investors are expecting profit-taking to occur as the KOSPI, which had been moving within a range for the past two months, has risen for eight consecutive trading sessions this month. On the previous day, President Lee Jaemyung, during a press conference marking his 100th day in office-a focal point for the market-stated, "There is no need to insist on the 1 billion won threshold for the major shareholder capital gains tax," but also said, "I will leave the matter to the National Assembly," effectively shifting responsibility to the legislative body. This is also seen as a factor encouraging bets on a decline.

Lee Jaewon, a researcher at Shinhan Investment & Securities, pointed out, "What the market had hoped for was confirmation that the current major shareholder capital gains tax threshold would be maintained, but the lack of a clear statement may have disappointed some investors."

The ballooning balance of securities lending transactions is also supporting bets on a market decline. According to the Korea Financial Investment Association, on September 9, the balance of securities lending transactions surpassed 100 trillion won for the first time ever, and even after the KOSPI hit a record high the following day, it increased to 102 trillion won. The balance of securities lending refers to the outstanding amount of stocks lent by institutional investors to borrowers. While this balance does not necessarily indicate the exact amount of future short selling, an increase in the balance often leads to greater short selling pressure, which is why it is considered a 'leading indicator' for short selling.

In fact, on September 10, when the KOSPI reached its highest level ever, the value of short selling transactions increased by 142 billion won from the previous trading day, surpassing 1 trillion won (about 3.52% of the total trading value). As of September 8, the net short selling balance stood at approximately 11.1884 trillion won, the highest since short selling resumed on March 31. The net short selling balance refers to the remaining quantity after selling borrowed stocks; the higher this figure, the greater the number of investors who believe the stock or index will continue to decline.

Lee Sanghyun, a researcher at Meritz Securities, noted, "If the proportion of short selling transactions increases within the total trading volume, short selling concerns are likely to exert downward pressure on the market," adding, "If the upward trend in the short selling ratio continues, volatility is likely to increase for individual stocks. For stocks with a high proportion of short selling balances, it is necessary to be especially cautious."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)