Gold Banking Balances Surpass 1 Trillion Won This Year

Number of Accounts Exceeds 300,000

Gold Prices Up 53% in One Year

Experts Say "Gold Prices Will Rise Further"

As gold prices reach all-time highs, a surge of capital is flowing into gold investment products. This trend is not limited to physical gold investments such as gold bars, which are favored by high-net-worth individuals, but is also being driven by younger investors entering the gold banking market, which allows for smaller-scale investments. The balance of gold banking accounts has surpassed 1 trillion won this year, and the number of accounts has exceeded 300,000.

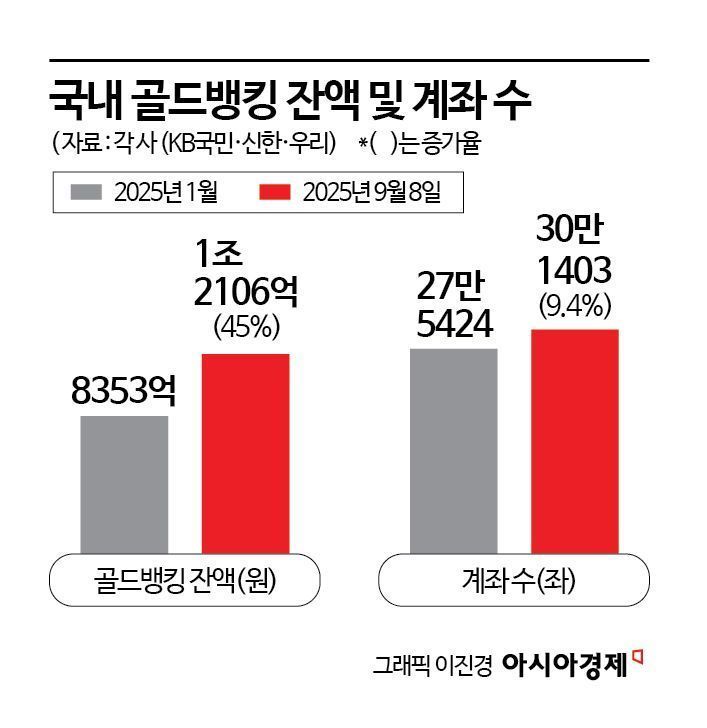

According to the financial sector on September 11, the balance of gold banking accounts at the three major commercial banks in Korea that offer this service (KB Kookmin, Shinhan, and Woori) stood at 1.2106 trillion won as of September 8. This represents an increase of 375.3 billion won in gold banking balances just this year, a sharp 45% jump. The number of gold banking accounts also reached 301,403 as of September 8, up 9.4% (25,979 accounts) since the beginning of the year.

An official at one of the commercial banks stated, "Demand has been rising significantly as gold prices have steadily increased since last year," adding, "In particular, there is a notable influx of younger customers into gold banking, which allows for small-scale investments, rather than into high-priced gold bars."

Sales of gold bars have also increased. From the beginning of this year through September 4, the five major commercial banks (Kookmin, Shinhan, Hana, Woori, and NH Nonghyup) sold a total of 336 billion won worth of gold bars, more than double last year's total sales of 165.4 billion won.

The background behind the influx of capital into physical gold and gold-related products at banks appears to be a preference for safe assets due to the weakening dollar, as well as the expansion of gold holdings by global central banks. Recently, due to weak U.S. employment data, the market has taken at least a 0.25 percentage point interest rate cut as a given, and some are even raising the possibility of a larger 0.5 percentage point "big cut." Additionally, the expansion of gold purchases by major central banks is another factor pushing gold prices higher. According to Shinhan Investment Corp., the average annual net increase in central bank gold holdings was 130 tons from 2015 to 2019, but this figure nearly doubled to 260 tons per year from 2022 through the first half of 2025.

As a result, international gold prices are on a steep upward trajectory. On September 9 (local time), the New York Mercantile Exchange closed with gold at $3,683.30 per ounce (about 31.1g), setting a new all-time high. Domestic gold prices are also rising rapidly in response. According to Korea Gold Exchange, as of 1:42 p.m. on September 10, the domestic gold price stood at 706,000 won per don (3.75g). This represents an increase of about 53% compared to 462,000 won on September 10 last year.

As gold surges, silver prices are also on the rise. According to the New York Mercantile Exchange, the international price of silver surpassed $40 per ounce for the first time since 2011 on August 29, closing at $41.34 per ounce on September 9. The total sales of silver bars at four banks in Korea (Kookmin, Shinhan, Woori, and Nonghyup) this year reached 4.514 billion won, about six times last year's total sales.

Experts predict that gold prices could rise even further. Ha Geonhyeong, a researcher at Shinhan Investment Corp., said, "As long as central banks continue buying and there is demand for hedging financial and fiscal policy risks, gold prices will continue to rise," adding, "By the end of this year, gold prices could approach $4,000."

Kim Kyunghoon, a researcher at Daol Investment & Securities, also commented, "Gold prices have an inverse relationship with monetary policy and a much stronger positive correlation with fiscal policy, so the more interest rates are lowered and debt is issued to stimulate the economy, the higher gold prices will go." He analyzed, "If we assume that U.S. national debt will approach $55 trillion over the next five years, the fair value of gold in five years could reach $9,850."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)