Fair Trade Commission Releases Status of Share Ownership in Publicly Disclosed Business Groups

It has been revealed that 13 major conglomerates in South Korea pledged to grant shares for performance compensation, including Restricted Stock Units (RSUs), to their owners or owner families last year. Among them, Hanwha and Eugene entered into share grant agreements with second-generation owners. Although the owner families held only a 3.7% ownership stake, the internal shareholding ratio-representing group control through affiliate shareholdings-rose to the 62% range.

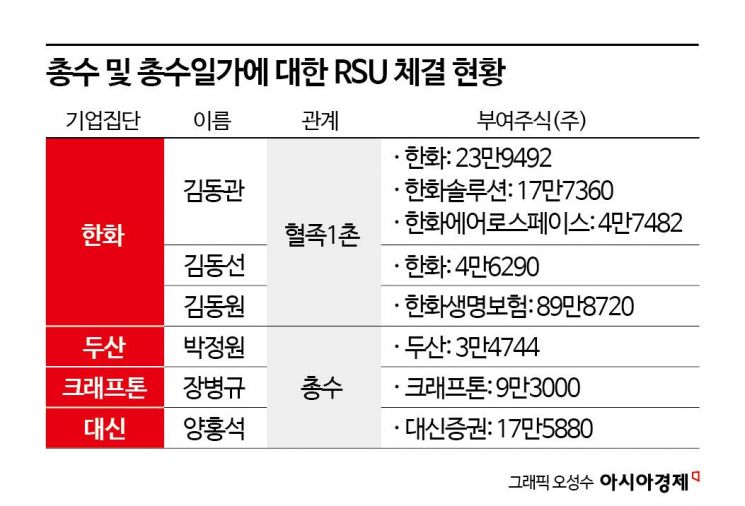

Hanwha grants RSUs to second-generation owners Kim Dongkwan, Kim Dongseon, and Kim Dongwon; Doosan, Daishin, and Krafton owners also receive shares directly

On September 10, the Fair Trade Commission announced the "2025 Disclosure-Targeted Business Groups Shareholding Status." Out of 81 conglomerates with an owner, 13 groups entered into share grant agreements last year for performance compensation purposes with owners, their relatives, or executives.

These groups include Nexon, Eugene, and HYBE, which signed new share grant agreements last year, as well as SK, Hyundai Motor, Hanwha, Shinsegae, Kakao, Doosan, Naver, Amorepacific, Krafton, and Daishin.

The total number of agreements was 353. By type, RSUs-where shares are granted if certain conditions are met-accounted for 188 cases, the largest share. Stock grants, typically used to pay short-term incentives in shares, totaled 51 cases. Performance Stock Units (PSUs), where a certain percentage of annual salary is paid in shares and the final amount is determined based on performance targets, accounted for 107 cases.

SK had the highest number of agreements at 170, followed by HYBE (43), Amorepacific (35), Doosan (27), and Hanwha (23). At SK, 170 executives (including duplicates) at 22 out of its 198 affiliates received RSUs, stock grants, or PSUs.

Hanwha, Doosan, Amorepacific, Krafton, Eugene, and Daishin signed a total of 16 share grant agreements with 12 owners or owner family members. Among them, Hanwha and Eugene entered into RSU contracts with second-generation owners.

RSUs are agreements to grant company-held treasury shares if conditions such as performance achievement or a certain period of service are met. While RSUs can motivate long-term growth by linking compensation to future share value, there are concerns they may be misused to increase controlling family ownership or as a succession tool.

Hanwha has pledged to grant 239,492 Hanwha shares, 177,360 Hanwha Solutions shares, and 23,741 Hanwha Aerospace shares to Hanwha Group Vice Chairman Kim Dongkwan. Executive Vice President Kim Dongseon and President Kim Dongwon are each to receive 46,290 Hanwha shares and 898,720 Hanwha Life Insurance shares, respectively.

There are also cases where the owner receives RSUs directly. Park Jeongwon, Chairman of Doosan Group, is set to receive 34,744 treasury shares. Yang Hongseok, Vice Chairman of Daishin Securities, and Jang Byungkyu, Chairman of Krafton, will receive 175,880 and 93,000 shares, respectively. Amorepacific Chairman Suh Kyungbae initially agreed to receive 8,468 Amorepacific Holdings shares and 5,020 Amorepacific shares, but later canceled the agreement.

Owner family control surpasses 62%... Increased share acquisition through affiliates

The trend of conglomerate owner families controlling entire groups through affiliates despite low direct ownership stakes continued. As of this year, the internal shareholding ratio of conglomerates with an owner was 62.4%, up slightly from 61.1% last year. In contrast, the owner family’s direct shareholding remained at 3.7%, similar to last year’s 3.5%.

The Fair Trade Commission analyzed that while the owner family’s shareholding has remained at 3.5-3.7% over the past five years, the shareholding ratio of affiliates has steadily increased from 51.7% in 2021 to 55.9% this year.

The number of affiliates in which the owner family holds shares totals 633, with an average owner family shareholding of 10.7%. Groups with the lowest owner family shareholding were SK (0.38%), Kakao (0.48%), HD Hyundai (0.53%), Janggeum Merchant Marine (0.58%), and Hanjin (0.63%). Groups that saw the largest year-on-year decrease in owner family shareholding were Hankook & Company Group (-20.2 percentage points), Sono International (-11.8 percentage points), and Youngone (-8.0 percentage points).

19 additional companies subject to private interest regulation... Hyundai Motor and others maintain circular and cross-shareholding structures

This year, 958 companies (31%) across 81 business groups were subject to private interest regulation, an increase of 19 companies (2.0%) from last year. The Fair Trade Act designates companies where the owner family holds 20% or more of the shares as subject to private interest regulation. There are 391 companies where the owner family holds at least 20% equity, and 567 subsidiaries where regulated affiliates hold at least a 50% stake.

Five groups maintained circular shareholding structures: Hyundai Motor (4 loops), KG (2), Taekwang (2), BS (1), and Sajo (1,426), totaling 1,435 circular shareholding loops.

The Fair Trade Commission stated, "This year, companies have shown a notable willingness to voluntarily resolve circular and cross-shareholding structures." KG reduced its circular shareholding loops from 10 to 2 and completely eliminated cross-shareholdings between KG Chemical and KG Inicis. Taekwang resolved both of its circular shareholding loops as of May, the designation date.

Hyundai Motor and BS saw no change in the number of circular shareholding loops compared to last year. Sajo, newly designated as a disclosure-targeted business group this year, reduced some of its previously held circular shareholding loops and currently holds 1,218 as of August.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)