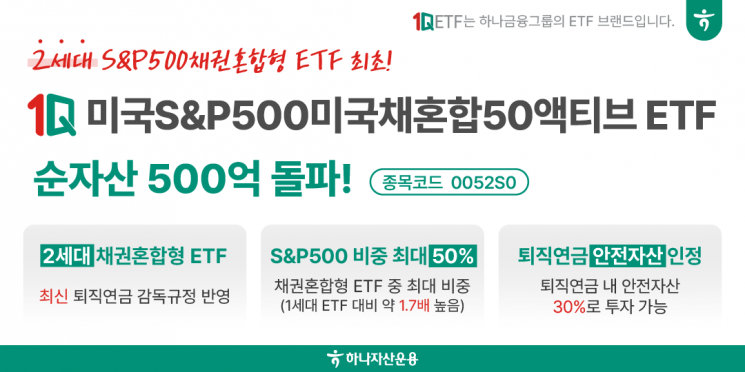

Hana Asset Management announced on the 10th that the net assets of the '1Q US S&P500 US Treasury Mixed 50 Active ETF' have surpassed 50 billion won.

This ETF invests approximately 50% each in the leading US index S&P500 and in US short-term Treasury bonds. Among bond-mixed ETFs classified as safe assets under retirement pension supervisory regulations, this represents the highest allocation.

This is a 'second-generation' S&P500 bond-mixed ETF that reflects the latest retirement pension supervisory regulations revised on November 16, 2023. Compared to first-generation S&P500 bond-mixed ETFs, it has about 1.7 times higher allocation to the S&P500.

Thanks to steady net purchases by individual investors and retirement pension investors, the ETF surpassed 50 billion won in net assets in just about three months since its listing on June 10. In comparison, it took about 1 year and 8 months (approximately 20 months) for other companies' first-generation S&P500 bond-mixed ETFs to reach 50 billion won in net assets. This is also the shortest time ever for any S&P500 bond-mixed ETF listed in Korea to achieve this milestone.

The ETF is not only eligible for 100% inclusion in retirement pension accounts, but is also considered suitable for strategies that actively increase the S&P500 allocation within such accounts. By allocating '1Q US S&P500' within the 70% risk asset portion and '1Q US S&P500 US Treasury Mixed 50 Active' within the 30% safe asset portion of a retirement pension (DC/IRP) account, investors can achieve up to 85% exposure to the S&P500 in their overall portfolio.

Since the beginning of this year, Hana Asset Management has successively listed the following ETFs: 1Q US S&P500, 1Q US Nasdaq 100, 1Q Mid-to-Short-Term Corporate Bond (A-or-higher) Active, 1Q US Medical AI, and 1Q Xiaomi Value Chain Active. The company is expanding its ETF product lineup.

The 1Q Xiaomi Value Chain Active ETF, which was listed on the 2nd, recorded net purchases of 2.2 billion won by individual investors on its first day. This ranks second in total net purchases by individuals among all Korea-listed ETFs investing in China. The 1Q Xiaomi Value Chain Active ETF has continued to see net purchases for six consecutive trading days since its listing.

Kim Taewoo, CEO of Hana Asset Management, stated, "Investor demand for ETF products suitable for the retirement pension market is growing," and added, "The 1Q US S&P500 US Treasury Mixed 50 Active ETF is being utilized as an excellent investment solution not only by securities firms and insurance companies but also by pension investors at banks."

He further commented, "1Q ETFs will continue to provide differentiated products based on real investment demand, especially centered around pension accounts, going forward."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)