Industry Raises Concerns Over Launch Delays Due to Organizational Restructuring

Financial Authorities Draw a Line: "No Problem With Year-End Launch"

Transition to Managed Benefits by Health Authorities Stalls

Experts Warn: "The Longer the Delay, the Greater the Consumer Harm"

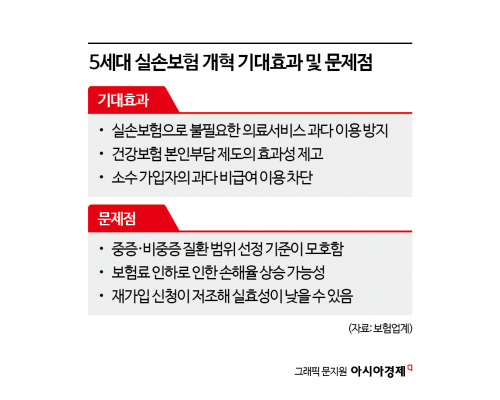

Despite concerns that the launch of the fifth-generation indemnity health insurance (indemnity insurance) by the end of the year may be uncertain due to organizational restructuring and executive vacancies at the financial authorities, the authorities have drawn a clear line, stating that "the plan will proceed as scheduled." They intend to announce changes to supervisory regulations within this month, finalize detailed policy terms, and launch the product by the end of the year as planned. However, industry experts point out that if the health authorities delay the transition to managed benefits, the effectiveness of the product will be compromised and confusion in the field will be inevitable.

Due to loopholes in the indemnity health insurance system, a vicious cycle is occurring involving excessive claims for non-reimbursable items, deterioration of insurance companies' profitability, and premium increases.

Due to loopholes in the indemnity health insurance system, a vicious cycle is occurring involving excessive claims for non-reimbursable items, deterioration of insurance companies' profitability, and premium increases.

Due to the loopholes in the indemnity health insurance system, a vicious cycle has continued involving excessive claims for non-reimbursable items, deteriorating profitability for insurance companies, and premium increases. In response, the Financial Services Commission and the Financial Supervisory Service are in the final stages of discussions, aiming to announce changes to the supervisory regulations for the fifth-generation indemnity insurance within this month, according to confirmations on September 8. Based on the reform plan announced in April, they are currently making adjustments to the wording and handling detailed administrative tasks, with the Financial Supervisory Service leading the revision of the policy terms.

The Financial Services Commission and the Financial Supervisory Service dismissed industry concerns that the launch would be delayed due to organizational restructuring and executive vacancies. An official from the Financial Services Commission stated, "We plan to reflect the plan announced in April in the supervisory regulations and announce it within this month, so there will be no setbacks to the launch within the year." A Financial Supervisory Service official also emphasized, "Only detailed administrative tasks such as policy adjustments remain, so there will be no problem with the year-end launch."

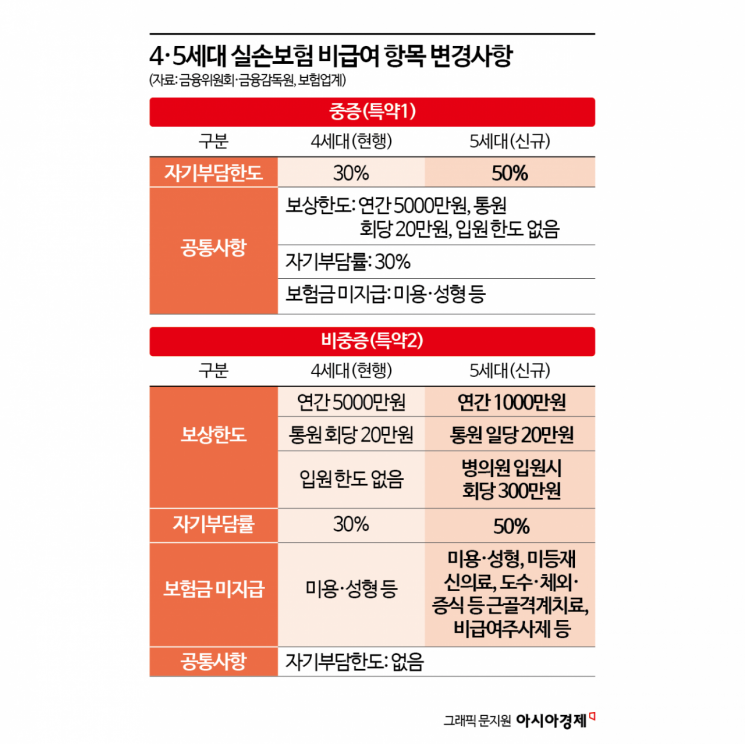

However, the industry has a different perspective. Even if the financial authorities push for a launch within the year, the effectiveness of the system will be diminished if the health authorities delay the introduction of managed benefits. The fifth-generation indemnity insurance aims to strengthen the distinction between severe and non-severe patients and to curb excessive claims for non-reimbursable items. However, the criteria for severe and non-severe conditions remain ambiguous, and there are concerns about a possible increase in loss ratios due to premium reductions.

In particular, the industry complains about difficulties in responding because the scope of items subject to managed benefits and the range of standard fees are not clearly defined. There are widespread speculations that "manual therapy will definitely be included," and that "musculoskeletal treatments, non-reimbursable injections, and new medical technologies may also be included," but no precise information has been confirmed.

The expert committee under the Special Committee on Medical Reform, which is responsible for discussing managed benefit items for the fifth-generation indemnity insurance, has not even disclosed its member composition or meeting schedule. Since the meeting in May, its activities have effectively been suspended due to the presidential election and the confirmation hearing for the Minister of Health and Welfare. It is also unclear whether committee members will be replaced, and there are ongoing criticisms that the insurance industry has been excluded, making practical coordination difficult.

An official from the National Health Insurance Service labor union pointed out, "Since the Special Committee on Medical Reform was established under the previous administration, there are questions about the momentum and effectiveness of the fifth-generation indemnity insurance reform."

The industry believes that the health authorities must first finalize the managed benefit items and standard fees to minimize confusion. A senior official from an insurance company said, "If the health authorities set the standards first and then the financial authorities proceed with rate calculations and policy revisions, risks and confusion can be reduced. While both authorities share the policy goal of preventing excessive claims for non-reimbursable insurance benefits and premium increases, it is regrettable that they seem to be working separately."

Experts also urge prompt action from the health authorities. Lee Juyeol, a professor in the Department of Health Administration at Namseoul University, emphasized, "If the transition to managed benefits is delayed, there will continue to be cases where the same non-reimbursable item is billed at different rates by different hospitals and clinics, leading to high insurance claims. The health authorities must take proactive measures to reduce consumer harm."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)