Bibigo Dumpling Plant Begins Full Operation in Chiba, Japan

World's Second-Largest Frozen Dumpling Market Offers Strong Potential

Accelerating Local Market Re-entry Through Expanded Distribution Channels

CJ CheilJedang is set to begin full-scale operation of its dumpling production plant in Japan. By establishing production bases in key global markets such as the United States, China, and now Japan, the company aims to accelerate its strategy to become a top global brand, led by its Bibigo dumplings. However, concerns have been raised regarding the strong market barriers posed by dominant local players in Japan and the burden of production costs.

CJ CheilJedang Launches Full Operation of Dumpling Factory in Japan... "Accelerating Expansion"

According to the food industry on September 6, CJ CheilJedang completed and began operating its dumpling factory in Kisarazu, Chiba Prefecture, Japan, on September 2. The factory site is the size of six soccer fields, with a total floor area of approximately 8,200 square meters. The company emphasized that this is the first local production facility in Japan built by a Korean food company. CJ CheilJedang invested about 100 billion won in the factory, which will produce Bibigo dumplings for distribution throughout Japan.

CJ CheilJedang, which has been expanding its production bases in the United States and Europe, plans to use the Chiba factory as a new foothold to accelerate its entry into the Japanese market. Through the Chiba plant, the company aims to speed up its localization strategy by improving the efficiency of sourcing raw materials and product supply, ultimately scaling up its business in Japan. Kisarazu is a metropolitan city accessible from Tokyo Haneda Airport via the Aqua Line expressway.

The 'Bibigo' booth operated by CJ CheilJedang at the K-pop festival 'KCON JAPAN 2025' held last May at Makuhari Messe in Chiba Prefecture, Japan.

The 'Bibigo' booth operated by CJ CheilJedang at the K-pop festival 'KCON JAPAN 2025' held last May at Makuhari Messe in Chiba Prefecture, Japan.

Japan is the world’s second-largest frozen dumpling market, and consumption of home meal replacements (HMR) and frozen foods has continued to grow since the COVID-19 pandemic. According to Japanese market research firm Intage, sales of gyoza in Japan from April last year to March this year grew by 9.6% year-on-year, more than double the overall frozen food sales growth rate of 3.8%.

The growth of Japan’s gyoza market is driven by convenience and premiumization. As premium frozen gyoza products increase beyond simply low-cost mass-produced items, demand for frozen gyoza and dumplings is rising, especially among single-person and elderly households.

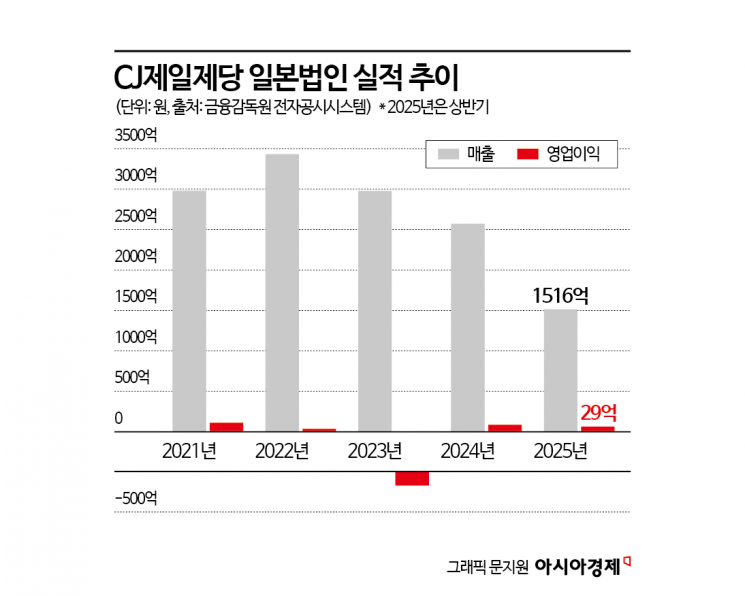

CJ CheilJedang entered the Japanese frozen dumpling market in 2020 by acquiring the local company Gyoza Keikaku, targeting the high-growth potential of the Japanese market. However, the strong oligopoly of local players and a sluggish domestic economy hindered the company’s growth. In fact, CJ CheilJedang raised the sales of its Japanese subsidiary (CJ Food Japan) to over 300 billion won within two years of entry in 2022, but has since experienced two consecutive years of declining sales and profitability.

CJ CheilJedang explained that the deepening recession in Japan’s domestic market in 2023 led to a slowdown in overall frozen food consumption, and the weakening yen had the greatest impact on its poor performance. The depreciation of the yen increased import costs, raising the cost ratio for the Japanese subsidiary. Given the conservative stance of Japanese distributors on price hikes, it was difficult to pass these costs onto consumers, resulting in reduced margins. The company also noted that converting the Japanese subsidiary’s results into Korean won further reduced its reported scale.

However, the main reason for the poor performance in Japan is seen as the inability to overcome the oligopolistic structure of local companies. Major players such as Ajinomoto have long dominated the Japanese frozen dumpling (gyoza) market, making it structurally difficult for new entrants to quickly gain a foothold. As of 2023, Ajinomoto (44.5%) and Eat & Food (30.7%) together hold more than 75% of the Japanese frozen dumpling market, maintaining overwhelming dominance.

In contrast, CJ CheilJedang has lagged behind local competitors in securing key distribution channels, resulting in a single-digit market share. Although the acquisition of Gyoza Keikaku provided a local production base, its scale was limited. As a result, clear limitations in distribution organization and investment stage made it difficult to achieve meaningful results.

Record-High Interest in K-Food... Re-engaging Local Consumers by Expanding Distribution Channels

With the completion of its new factory, CJ CheilJedang appears poised to revitalize its Japanese business. Having secured an additional state-of-the-art local production facility, the company has adopted a strategy to further expand accessibility by entering a wider variety of distribution channels. Currently, CJ CheilJedang’s products are sold through major channels such as Aeon, Costco, Amazon, and Rakuten. In July, the company began operating a dedicated Bibigo display at the discount chain Don Quijote, run by major retailer Pan Pacific International Holdings (PPIH).

In addition, CJ CheilJedang has signed an agreement with the food division of Itochu Corporation, one of Japan’s five largest general trading companies, to expand its local business. Itochu Corporation boasts a nationwide distribution network and owns several well-known brands, including Nihon Access, Japan’s largest food distributor, and the convenience store chain FamilyMart. A CJ CheilJedang representative stated, “We will continue to strengthen our collaboration with overseas distributors and lead the expansion of the global K-food territory.”

A consumer examining the Bibigo-exclusive display at the Don Quijote store located in Nakameguro, Tokyo, Japan.

A consumer examining the Bibigo-exclusive display at the Don Quijote store located in Nakameguro, Tokyo, Japan.

Above all, the growing popularity of K-content is encouraging, as interest in Korean cuisine has reached an all-time high. As global awareness of Korean food rises, acceptance of K-food in Japan is expanding beyond dumplings to include tteokbokki, ramen, and more. CJ CheilJedang expects that, by reliably supplying Bibigo dumplings locally, it can further strengthen its brand power in this environment.

A CJ CheilJedang representative explained, “With the renewed spread of the Korean Wave, we saw an opportunity in the dumpling business and made an unusually swift decision to establish the factory.” Additionally, the company sees opportunities in reducing foreign exchange risk and introducing a product portfolio tailored to the preferences of Japanese consumers.

Signs of improvement are already visible in the company’s performance. In the first half of this year, the Japanese subsidiary’s sales reached 151.6 billion won, a 26.7% increase compared to the same period last year (119.7 billion won), raising expectations of returning to the 300 billion won sales mark for the first time in three years. During the same period, sales of dumplings in Japan also grew by about 28%.

However, the dominance of major local frozen food companies such as Ajinomoto remains a challenge. While interest in Korean food has increased, the Japanese gyoza category is firmly established, so the key will be whether Korean-style dumplings can carve out a distinct position in the market.

If the development of locally tailored recipes and products is slow, or if the company fails to expand its new customer base, there could be risks of inventory buildup and lower operating rates. In addition, if existing competitors counter CJ CheilJedang’s growth with new products and promotions, the company may face increased pressure in terms of shelf priority and advertising costs within distribution channels, further adding to its cost burden.

Labor and energy costs in Japan are higher than in Korea, so local production may not immediately translate into cost competitiveness. Furthermore, if the weak yen persists, converting sales into Korean won could result in decreased revenue and increased costs, potentially weighing on the company’s global performance.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)