Household Loans Expected to Increase by Only 3 Trillion Won This Month

Growth Slows to Half of June's Peak

Further Deceleration in Loan Expansion Anticipated

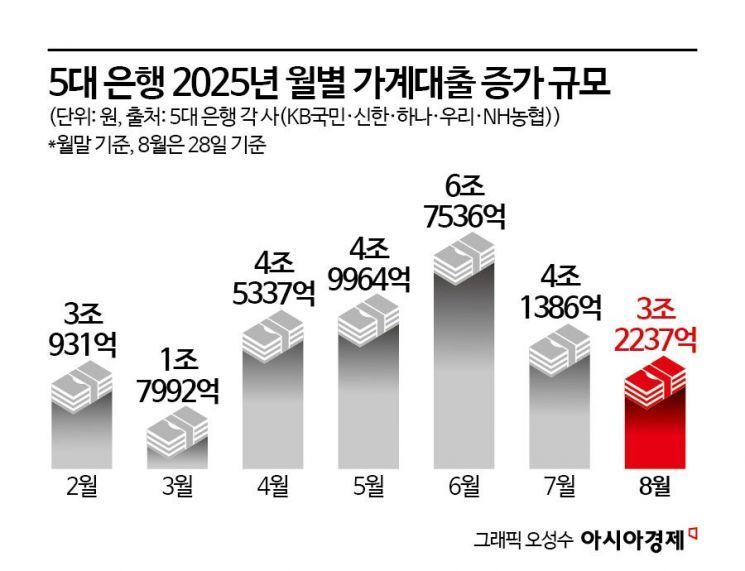

The increase in household loans for August is expected to remain in the 3 trillion won range. This is only about half the level of June, when loans saw their largest increase this year at 6.7536 trillion won. Considering the seasonal trend in August, when household loans typically rise due to summer vacations and autumn moving demand, analysts say the effects of the June 27 loan regulations are gradually becoming apparent.

According to the five major commercial banks (KB Kookmin, Shinhan, Hana, Woori, and NH Nonghyup) as of August 28, the outstanding balance of household loans stood at 762.1971 trillion won. This represents an increase of 3.2237 trillion won from the previous month (758.9734 trillion won). This is only half the increase seen in June (6.7536 trillion won), which was the largest monthly rise so far this year, and just one-third of the increase seen in August last year, which was in the 9 trillion won range.

The slowdown in growth is especially pronounced in mortgage loans. In August, mortgage loans increased by only 2.7253 trillion won. This is just half the amount of the previous month (4.5452 trillion won), and the second smallest monthly increase this year after March (2.3198 trillion won).

The growth of unsecured loans has also slowed. Although the surge in IPO investments at the beginning of the month led to an increase of over 1 trillion won in unsecured loans, the final monthly increase was just 326.4 billion won.

Typically, August is a period when household loans increase due to summer vacation and autumn moving demand, but the growth rate has clearly slowed. In August last year, the increase in household loans at the five major commercial banks was 9.6259 trillion won. A commercial bank official commented, "While banks have strengthened their internal controls over mortgage loans, it is rare to see such a sharp slowdown in growth. It appears that the effects of the June 27 loan regulations are now taking full effect."

Previously, the government announced the June 27 measures as its first real estate policy under the Lee Jaemyung administration, after housing prices and household loan growth surged in Seoul and the metropolitan area. The core of the policy is to cap the maximum mortgage loan amount in Seoul and the metropolitan area at 600 million won, and to require buyers who use mortgage loans to move into the purchased home within six months, effectively blocking "gap investments" (buying with a tenant in place).

Looking ahead, most expect the growth of household loans to slow further. Earlier this month, household loans were increasing by 200 to 300 billion won per day on average, raising the possibility of additional regulations such as tightening the loan-to-value (LTV) ratio in regulated areas, and expanding the application and review of the debt service ratio (DSR) for jeonse loans and policy finance products. However, the focus has now shifted toward adjusting the pace of loan regulations by financial authorities.

Another commercial bank official stated, "In the second half of the year, the target for household loan growth has been reduced by about half compared to before, so the pace of increase is expected to continue slowing. However, in order to maintain this trend, measures such as keeping additional interest rates high are inevitable, which means borrowers will face even higher hurdles when seeking loans."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)