Stock Price Up 160% This Year

PharmaResearch Surpasses Amorepacific in Beauty Sector Market Cap

Operating Profit Expected to Surge Again in Q3

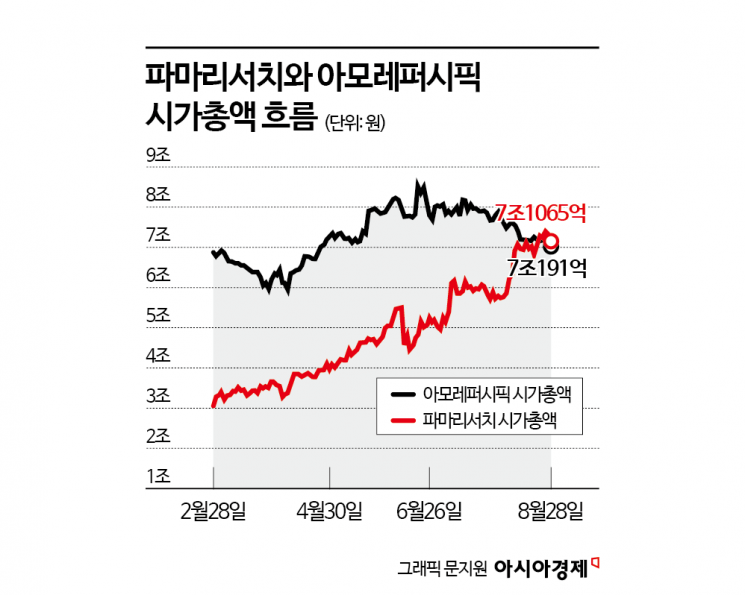

As the corporate value of PharmaResearch has continued to rise, it has surpassed the market capitalization of Amorepacific. Within the beauty sector, it has now become the second-largest company by market capitalization, following APR. Financial market experts in Yeouido expect PharmaResearch to maintain its growth momentum in the second half of this year as well.

According to the financial investment industry on August 29, PharmaResearch's stock price has risen by 160.6% since the beginning of this year. Its market capitalization has grown to 7.1 trillion won, exceeding Amorepacific's 7.02 trillion won based on the previous day's closing price. At the end of last year, Amorepacific's market capitalization was 3.37 trillion won higher than that of PharmaResearch. However, as Amorepacific's stock price has only increased by 14.5% this year, a reversal in market capitalization has occurred.

PharmaResearch has developed regenerative medicine pharmaceuticals such as Rejubenex injection and Rian eye drops, medical devices for skin improvement such as Rejuran, and Conjuran, an intra-articular injection. Rejuran is a skin booster made from polynucleotide (PN) and polydeoxyribonucleotide (PDRN) extracted from salmon.

PDRN and PN are regenerative medicine ingredients that have proven safety and efficacy. After extracting DNA from salmon germ cells, they are separated into specific fragments with medicinal effects and used as raw materials for pharmaceuticals and medical devices.

In the second quarter of this year, PharmaResearch recorded sales of 140.6 billion won and operating profit of 55.9 billion won. Compared to the same period last year, these figures increased by 69.2% and 81.7%, respectively. The operating margin was 39.7%, which was 6.2 percentage points higher than market expectations. The gross profit margin (GPM) reached 76.2%, marking an all-time high since the company's establishment. Shin Minsoo, a researcher at Kiwoom Securities, explained, "The leverage effect is occurring as the proportion of sales from Rejuran, which has the highest profitability, is increasing."

Kim Chunghyun, a researcher at Mirae Asset Securities, analyzed, "The growth rate of Rejuran in the domestic market has exceeded expectations," and added, "In the second half of this year, the number of medical tourists is expected to increase due to visa-free entry for Chinese nationals and the expiration of the value-added tax refund system for cosmetic procedures." He further stated, "This year, Rejuran sales are expected to reach 295.8 billion won, an upward revision from the previous estimate of 231 billion won."

Kyobo Securities estimated that PharmaResearch will achieve sales of 148.9 billion won and operating profit of 64.7 billion won in the third quarter of this year. Compared to the same period last year, these figures are expected to increase by 66.9% and 85.3%, respectively. Jung Heeryeong, a researcher at Kyobo Securities, analyzed, "As the proportion of the medical device business increases, the gross profit margin (GPM) in the second half of this year should remain at the same level as the second quarter," and added, "With a decrease in selling and administrative expenses, including TV advertising costs, the operating margin is expected to reach 43.5%."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)