GGM Repays 196 Billion Won to Seven Creditor Banks

"Banks Pressured Repayment Citing Labor-Management Conflict Concerns"

Creditors Deny, Call It "Voluntary Repayment Inquiry"

GGM Union: "Spreading False Claims, CEO Must Be Dismissed"

The Metalworkers' Union Gwangju Jeonnam Branch is holding a press conference in front of Gwangju City Hall on the morning of the 21st. Photo by Metalworkers' Union Gwangju Jeonnam Branch

The Metalworkers' Union Gwangju Jeonnam Branch is holding a press conference in front of Gwangju City Hall on the morning of the 21st. Photo by Metalworkers' Union Gwangju Jeonnam Branch

A controversy has arisen at Gwangju Global Motors (GGM), which adopted the "Gwangju-type Job" model-the nation's first labor-management win-win initiative-over the "early repayment of loans" demanded by its creditor banks.

GGM claims that the creditor banks officially requested early repayment out of concern for potential labor-management conflict, based on compliance with the labor-management win-win agreement. However, the creditor banks have denied this, leading to a dispute over the truth.

According to GGM and the Metalworkers Union Gwangju Jeonnam Branch on the 21st, GGM repaid all 196 billion won in loans borrowed from seven creditor banks in June. The seven creditor banks are Gwangju Bank, Korea Development Bank, KB Kookmin Bank, Woori Bank, Hana Bank, Suhyup Bank, and KDB Capital.

The repayment was completed using a loan from one of the creditor banks, Shinhan Bank, and prior to repayment, GGM notified the creditor banks of this plan in May in accordance with relevant regulations.

Subsequently, GGM management held the Labor-Management Win-Win Council and a management briefing on the 15th and 16th of last month, respectively, during which they claimed that the early repayment was prompted by the union's strike and an official request from the creditor banks.

It is reported that CEO Yoon Monghyun stated at the council, "The participating banks told us, 'Pay back the money quickly. We're afraid you might default on the interest,'" and added, "They said they couldn't trust us because the strike was ongoing and made a formal request for early repayment."

In response, the union protested that requesting early repayment from GGM due to the "union strike" and "labor-management conflict" amounted to union suppression. On the 18th, the union held a press conference in front of the Presidential Office in Yongsan, Seoul, condemning Korea Development Bank.

Korea Development Bank refuted GGM's claims, stating they were "groundless."

Through a press release, Korea Development Bank explained, "In February 2025, GGM inquired about the voluntary early repayment procedure and fees, and we provided the relevant information. We never requested early repayment before the loan matured, nor did we reject any requests for loan extension."

Gwangju Bank also released a statement, saying, "The early repayment of the loan was unrelated to labor-management conflict or the union strike. We did not refuse to extend the loan to GGM; on the contrary, we intended to maintain the loan."

With conflicting claims between GGM, which says it was pressured into early repayment due to labor-management conflict, and the creditor banks, the union continues to protest, claiming GGM's actions constitute union suppression.

On this day, the union held a press conference in front of Gwangju City Hall, stating, "GGM management spread false information to socially pressure and incite hatred against the union," and added, "This is clearly blackmail and intimidation. Gwangju City, as GGM's largest shareholder, must immediately dismiss CEO Yoon Monghyun."

In response, GGM argued, "The claim that Korea Development Bank never requested early repayment before the loan matured or refused a contract extension is completely inconsistent with objective facts."

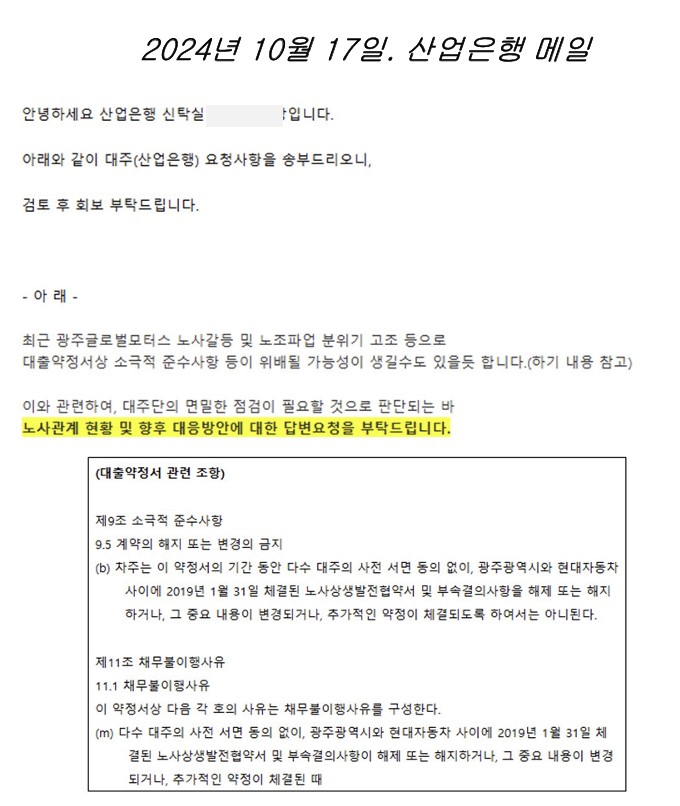

GGM explained, "In October last year, Korea Development Bank sent an email stating, 'Due to heightened labor-management conflict and a growing atmosphere of union strikes, there is a possibility of violating passive compliance clauses in the loan agreement,' and requested a response regarding the status of labor-management relations and future countermeasures. The email also attached the 'compliance requirements' and 'default conditions' from the loan agreement."

They added, "Korea Development Bank regarded GGM's labor-management situation as a potential violation of the labor-management win-win development agreement and made us aware that this could lead to loan recall in certain situations. At the time of establishment, 50% of the total investment was debt, making the company highly sensitive to demands from the banking sector."

They further stated, "The biggest challenge for GGM was to extend or refinance nearly 200 billion won in debt at the end of the year. Accordingly, in April and May, we inquired with the syndicate and commercial banks about taking over the entire remaining loan balance, but received no response."

Meanwhile, eight financial institutions lent a total of 270 billion won to GGM under repayment conditions from 2020 to December this year. Since September 2022, GGM has been repaying 7 billion won to the creditor banks every quarter.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)