Luxury Beauty Brands Launch Exclusive Products on E-Commerce Platforms

High Loyalty Among Target Customers

Platforms Serve as a Channel to Gauge New Product Reactions

Growth of Traditional Channels Like Department Stores Stagnates

Onli

Both domestic and international beauty brands are increasingly turning to "platforms" instead of traditional channels like department stores to launch new and exclusive products. As platforms that previously focused on food or fashion have expanded into the beauty category, the stage for debuting beauty products is shifting to capture the demand of highly loyal customers.

According to the retail industry on August 30, all 36 brands participating in the "Musinsa Beauty Festa Pop-up Store," held in Seongsu-dong, Seoul for three days starting July 29, showcased exclusive products designed specifically for Musinsa Beauty. As Musinsa has established itself as a beauty platform favored by the Gen Z generation, beyond just fashion, it has recently expanded its lineup of so-called "Only Musinsa Beauty" products through exclusive planning and early launches.

The results have been notable. Maeil Dairies launched its Sellex Strawberry Chocolate flavor exclusively on Musinsa and operated an inner beauty bar at the Beauty Festa pop-up store. During the event, transaction volume increased more than 4.8 times compared to the same period last year. Additionally, beauty brand Fivevibe collaborated with designer fashion brand Kakipoint to launch the "Extra Slim Curl Mascara" exclusively on Musinsa Beauty, resulting in a transaction volume last month that was over four times higher than the previous month.

Previously, L'Or?al Group brand Kiehl's pre-launched the "Ultra Facial Barrier Cleanser" (150ml) on Curly on July 18. The limited edition "Ultra Facial Cream" (125ml) was also introduced first on Curly, with the external packaging featuring a design exclusive to Curly.

L'Or?al Group brand Kiehl's presents the Ultra Facial Cream 2025 Purple Edition Set (125ml) as a Curly Only product. Provided by Curly

L'Or?al Group brand Kiehl's presents the Ultra Facial Cream 2025 Purple Edition Set (125ml) as a Curly Only product. Provided by Curly

French luxury group LVMH's beauty brand Make Up For Ever also joined Beauty Curly this month, launching the exclusive "HD SKIN Pressed Powder Special 3-Piece Set." On September 1, L'Or?al Group's premium antioxidant brand SkinCeuticals will officially enter Beauty Curly, with four products to be sold exclusively on Curly.

The decision by luxury beauty brands to debut new products on Curly is based on its customer base. Curly's main customers are women in their 30s and 40s with strong purchasing power, who prioritize product quality. Luxury beauty brands are using these platforms to introduce new products first and gauge customer reactions.

A Curly representative stated, "Our strengths are a premium image that recreates the first floor of a department store online, next-day delivery, and a highly loyal customer base. Since Beauty Curly attracts discerning customers who carefully select products, we can closely monitor the reactions of customers sensitive to ingredients and functionality. This is why luxury brands see it as the ideal stage to launch new products."

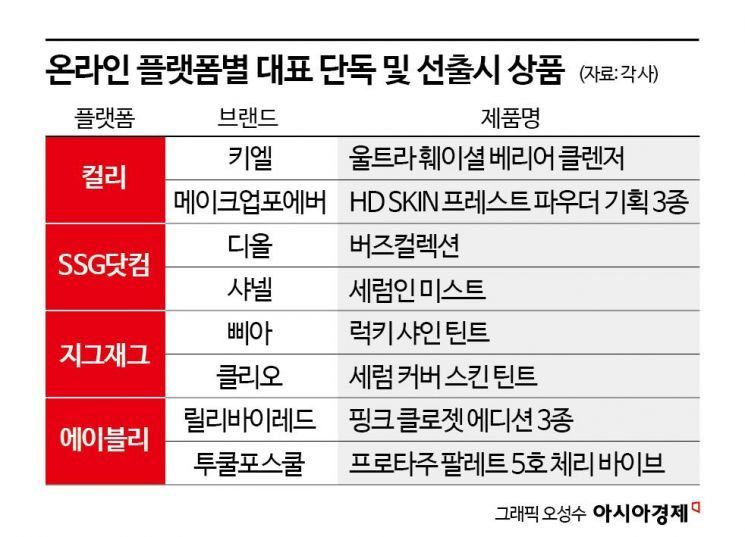

Platforms are also welcoming collaborations with luxury beauty brands, as it helps strengthen customer loyalty and boost platform credibility. In fact, thanks to such collaborative products, Beauty Curly's transaction volume grew 23% year-on-year last year. The luxury beauty category grew by approximately 40% over the same period. In response, competitor SSG.com signed a strategic partnership agreement with Christian Dior Beauty Korea in May to accelerate its "premium beauty enhancement" strategy. As part of this effort, SSG.com has consistently introduced early-launch luxury beauty products such as SK-II Pitera Mist, Dior Buzz Collection, Chanel Serum-in-Mist, and Valentino Beauty Spike Lip Balm.

Platforms popular among teens and people in their twenties are also emerging as stages for new product debuts. Zigzag, a fashion platform operated by Kakao Style, jointly developed and relaunched the previously discontinued "Lucky Shine Tint" with beauty brand Bbia last month. The relaunch drew attention as famous makeup artist Hyerimsaem participated in the development process. This month, Zigzag exclusively introduced Clio's new "Serum Cover Skin Tint."

Ably, a fashion platform run by Ably Corporation, is also focusing on exclusive early launches of small-sized cosmetics that are popular with its core customer base, the Z+alpha generation. For example, Lilybyred's "Pink Closet Edition 3-Piece Set," first introduced through a live broadcast, sold out in just two minutes during a first-come, first-served giveaway event. Too Cool for School also launched the "Protage Palette No. 5 Cherry Vibe" through a live broadcast, resulting in a 142% year-on-year increase in transaction volume on the day of the broadcast.

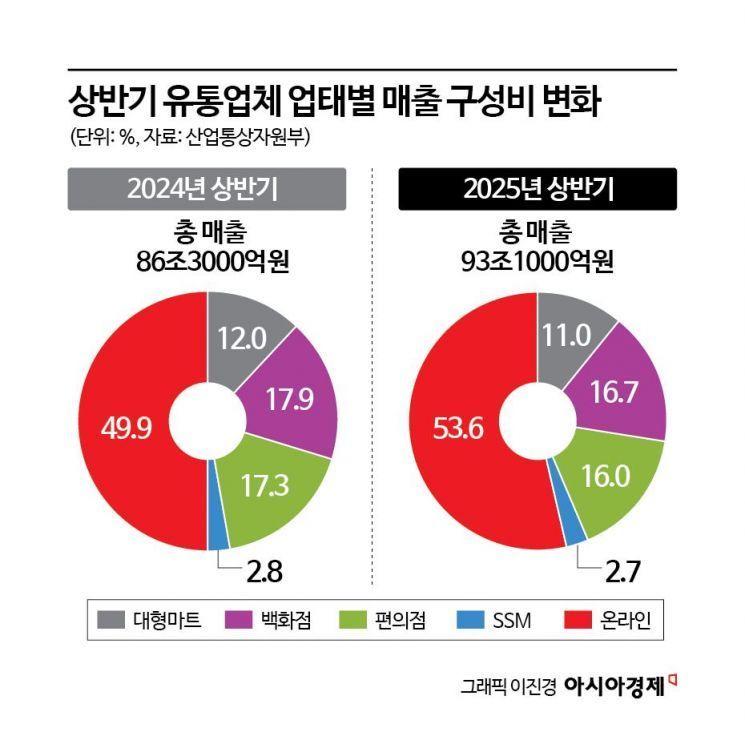

This trend is closely linked to the stagnation of traditional new product launch channels such as department stores. According to the Ministry of Trade, Industry and Energy, offline sales in the first half of this year decreased by 0.1% compared to the same period last year, while online sales grew by 15.8%, widening the gap. By business type, department stores' sales share dropped by 1.2 percentage points, while online increased by 3.7 percentage points. By product category, the offline sales share of fashion and accessories (including fashion apparel and cosmetics) fell by 5.3% year-on-year, while the online share of cosmetics sales rose by 8.6%, demonstrating the strength of the online sector.

An industry insider commented, "In the past, luxury beauty brands would launch new products mainly through department stores, and K-beauty brands would stick to CJ Olive Young, but now the options are much more diverse. Well-known beauty brands such as Make Up For Ever, Kiehl's, and Aestura are now focusing on platforms for exclusive and early launches, which is a clear example of this trend."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)