Pulmuone and Lotte Wellfood Struggle with Domestic Reliance

Samyang and Orion Secure High Profit Margins in Global Markets

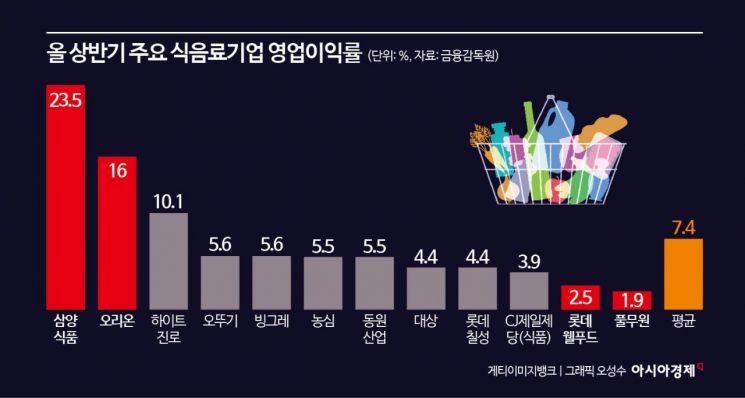

This year, a clear polarization in profitability has emerged among major domestic food and beverage companies in the first half. While Pulmuone and Lotte Wellfood remained at a low operating margin of 1-2%, Samyang Foods and Orion posted double-digit high profit margins, driven by their overseas performance.

According to an analysis of the first-half operating margins of 12 listed domestic food and beverage companies on August 19, the average was calculated at 7.6%. Pulmuone (1.9%) and Lotte Wellfood (2.5%) remained at the bottom, while Samyang Foods (23.5%) and Orion (16.0%) took the lead. Hite Jinro (10.1%), Ottogi (5.6%), Binggrae (5.6%), and Nongshim (5.5%) followed.

Pulmuone Earns 2 Won for Every 100 Won in Sales

Pulmuone recorded sales of 1.6326 trillion won and an operating profit of 30.8 billion won in the first half, resulting in an operating margin of just 1.9%. The gross profit margin was 24.3%, meaning that for every 100 won in sales, 24 won remained as gross profit. However, after deducting logistics costs (7 won), selling and administrative expenses (14 won), and R&D expenses (1 won), the actual profit left is about 2 won per 100 won in sales. The company could not avoid chronic cost burdens due to a low-margin structure focused on fresh foods like tofu, seasoned vegetables, and fresh noodles, combined with a nationwide refrigerated logistics network and high disposal rates.

Selling and administrative expenses amounted to 231.9 billion won, which is 14.2% of sales. In particular, labor costs increased by 5.8% year-on-year to 146.6 billion won, outpacing the sales growth rate of 4.5%. In addition, due to the nature of fresh foods, logistics costs to maintain refrigerated and cold-chain distribution reached 7% of sales (118.3 billion won), further increasing the fixed cost burden.

Lotte Wellfood posted sales of 2.0394 trillion won and an operating profit of 50.7 billion won. The operating margin remained at 2.5%. Rising raw material prices and labor costs weighed on profitability. The gross profit margin for the first half was low at 27.4%, while selling and administrative expenses accounted for 24.9%. In the first half of the year, the company carried out restructuring, including offering voluntary retirement to employees aged 45 and older and suspending production at the Cheongju plant, which increased related costs. Labor costs rose by 13% compared to the previous year.

Lotte Wellfood's main products include confectionery such as Xylitol, Pepero, Ghana, Moncher, and Kkokkalcorn, as well as ice cream products like World Cone, Seolleim, Screw Bar, and Dwaeji Bar. However, the company was unable to withstand the rise in raw material prices. In particular, the price of cacao, the main ingredient in chocolate, increased, leading to an average 9.5% increase in Pepero prices, but this was not enough to improve profitability. The rise in the won-dollar exchange rate also drove up the cost of imported raw materials, further worsening profitability.

In contrast, Samyang Foods and Orion shone with their performance in overseas markets. Samyang Foods achieved a gross profit margin of 46.2% thanks to a high-margin structure centered on exports of the "Buldak Series" instant noodles. Orion also recorded a gross profit margin of 36.6%, leveraging the brand power of snacks such as Choco Pie and Kkobuk Chip. For every 100 won in sales, Samyang retains 46 won and Orion 37 won as gross profit.

Overseas Sales Drive Profitability Gap

The difference in profitability among companies was also influenced by the proportion of overseas sales. In the first half, Samyang Foods earned 80% (864.1 billion won) of its sales overseas, while Orion earned 68% (1.0736 trillion won) from overseas markets. This indicates that both companies have established a stable profit structure abroad. In particular, Samyang Foods expanded exports beyond the US, China, and Southeast Asia to Europe, absorbing demand for "K-ramyeon." Orion continued its growth by generating stable profits in its subsidiaries in China and Vietnam, and expanding into emerging markets such as Russia and India.

On the other hand, Pulmuone's overseas sales accounted for only 19.4% (316.1 billion won). While sales of tofu and home meal replacement (HMR) products were strong in the US, losses continued in China and Vietnam. The Japanese subsidiary Asahico saw strong performance from its new "Tofu Bar" product, but has yet to reach the break-even point. Effectively, domestic profits are being used to offset overseas losses. By business segment, domestic food manufacturing and distribution accounted for 788.9 billion won (48.3%), followed by food service distribution at 475.1 billion won (29.1%), and health care manufacturing and distribution at 51.4 billion won (3.1%). The domestic sales ratio reached 80.6%.

Lotte Wellfood also maintains a high domestic dependence (77%), with overseas sales accounting for only 23%. By region, sales were highest in India (9%), followed by Kazakhstan (6.3%), Europe and Russia (4.1%), and Pakistan (1.8%). Although the company is attempting diversification, it has not significantly reduced its domestic dependence.

The domestic market has entered a low-growth phase, limiting the potential for price increases. Under the government's price control policy, companies are hesitant to raise prices on essential goods. In contrast, the global reputation of K-food is rising, allowing companies to maintain pricing power and expand high-margin premium product lines overseas. Furthermore, companies focused on fresh foods and reliant on the domestic market face constraints in overseas expansion due to the fixed cost structure of refrigerated and cold-chain logistics networks. In contrast, companies with global brands have been able to localize production bases, partially offsetting cost burdens and protecting profitability. Shim Eunju, a researcher at Hana Securities, stated, "The domestic sales growth of major food and beverage companies remained around 1%," and added, "In the second half of the year, overall performance will depend on overseas results."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)