17% Plunge Despite Three Straight Quarters of Profit

Short-Term Trading by Major Foreign Investors Like JP Morgan Fuels Anxiety

Ongoing Foreign Sell-Off and Convertible Bond Overhang Add Pressure

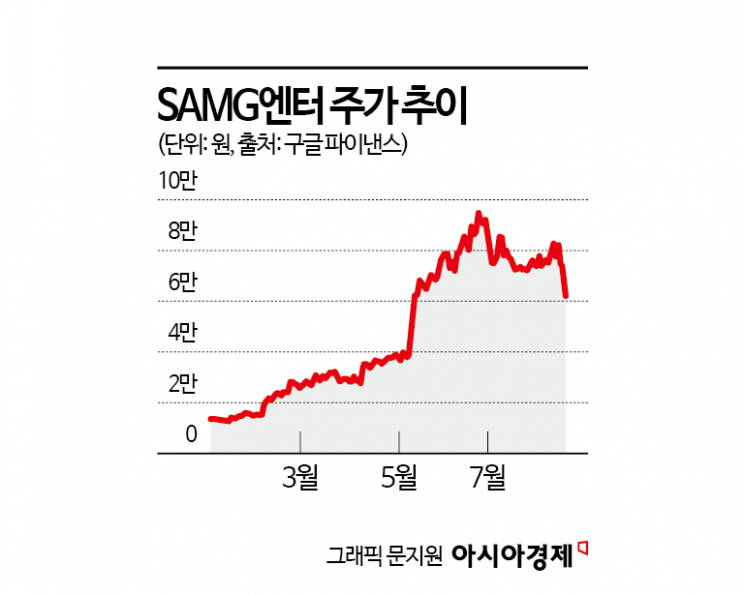

Global IP content company SAMG Entertainment has drawn attention as its stock price plummeted despite maintaining a profit for three consecutive quarters.

According to the Korea Exchange on August 19, SAMG Entertainment closed at 61,600 won the previous day, plunging 16.19%. At one point during the session, the stock dropped more than 19%, falling below the 60,000 won mark. Institutional investors and foreign investors led the decline by net selling 10.2 billion won and 4.4 billion won worth of shares, respectively. The year-to-date return, which had approached 500% as of last week, dropped to 365% due to this sharp decline.

A user on Naver's "Jongto-bang" (stock discussion board), Korea's leading investor community, lamented, "I never imagined the stock price would drop into the 50,000 won range during the session. The value of a Genesis car disappeared overnight." Another user questioned, "Is a slightly below-expectation performance really such a major negative factor?" and expressed concern, saying, "'Pasanping,' which I thought was someone else's problem, is becoming my reality."

Previously, after the market closed on August 14, SAMG Entertainment announced that its Q2 2025 sales reached 35.5 billion won (up 45.9% year-on-year), with an operating profit of 5.4 billion won (a turnaround into the black). This marks three consecutive quarters of profitability since the turnaround in Q4 2024. However, the market reaction was cold. As sales and operating profit fell by 0.7% and 14.8%, respectively, compared to the previous quarter, concerns about slowing growth emerged. The stock price dropped 11% in after-hours trading that day.

Foreign institutional investors have fueled shareholder anxiety by repeatedly acquiring and quickly disposing of SAMG Entertainment shares. On August 12, JP Morgan sold a total of 134,490 shares (1.52%), reducing its stake to 3.64%. This came just three weeks after it had raised its stake to 5.16% by acquiring 455,757 shares on July 21. During this period, there were as many as 15 on-market transactions. Morgan Stanley, which ended the first half of the year with a 5.38% stake, also bought and sold shares more than 60 times until August 6, lowering its stake to 4.55%. Morgan Stanley is the second-largest shareholder after founder Kim Soohoon (16.54%).

The persistent selling trend among foreign investors has also weighed on the stock. From July 23 to the previous day, they net sold SAMG Entertainment shares for 18 consecutive trading days, offloading 40.2 billion won worth (536,959 shares). Investor concerns have also been heightened by the start of the exercise period for convertible bonds (CB) worth 30 billion won issued on August 18, 2023. The total number of shares that can be converted is 1,254,023, which is equivalent to 14.1% of the total outstanding shares. The conversion price is 23,923 won.

However, some in the securities industry have argued that the "panic selling" has been excessive. Kim Aram, a researcher at Shinhan Investment Corp., stated, "The company is successfully expanding from its original focus on infants and toddlers to the 10-30s kidult market, and the collaboration with SM artist aespa, which is expected to be the biggest catalyst for the stock, has not even been announced yet." She added, "An 11% drop after the earnings announcement is an overreaction." Kim explained that, considering the "TiniPing Series" IP, which drove a step-up in performance among domestic consumers in their teens to 30s from Q4 2024 to Q2 2025, has not yet been consumed by the overseas 10-30s demographic, the 2026 price-earnings ratio (PER) of 26 times is not an excessive valuation.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)