July Imports Reach 875,000 Tons, Up 49% Year-on-Year

Thick Plate Imports Fall, But Hot-Rolled, Rebar, and Cold-Rolled Surge

Domestic Steelmakers Face Shutdowns and Declining Utilization Rates

Although the government imposed high provisional tariffs on certain imported steel products to counter low-priced imports, it has been confirmed that the influx of Chinese steel has not decreased. Analysts attribute this to a 'balloon effect,' as imports have shifted to items not subject to anti-dumping duties.

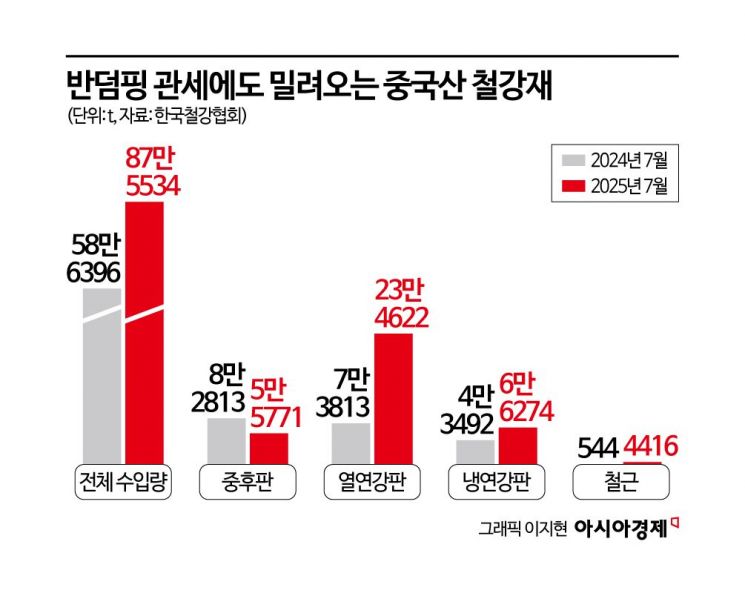

According to the Korea Iron and Steel Association on August 20, imports of Chinese steel products last month reached 875,534 tons, the highest monthly volume so far this year. This represents a 49% increase compared to 586,396 tons in the same month last year, and a 33% rise from 660,629 tons in the previous month. Since the government first imposed anti-dumping duties on Chinese steel in April, imports from April to July totaled 2,305,619 tons, up 9% from the same period last year.

By product, Chinese thick steel plates, which are subject to anti-dumping duties, saw a marked decline. Last month, imports of Chinese thick plates were 55,771 tons, down 33% from 82,813 tons in the same month last year. In May (62,072 tons) and June (79,730 tons), following the imposition of tariffs, imports also dropped by 63% and 25%, respectively, compared to the same months last year. The significant reduction in Chinese thick plate imports is attributed to the anti-dumping duties, which are as high as 38%.

In contrast, imports of hot-rolled steel sheets surged. Last month, imports of Chinese hot-rolled steel sheets reached 234,622 tons, the highest monthly volume so far this year. This is 3.2 times higher than the 73,813 tons imported in the same month last year, and nearly double the 119,111 tons imported in the previous month. Previously, the Trade Commission of the Ministry of Trade, Industry and Energy had recommended to the Ministry of Economy and Finance that anti-dumping duties of up to 33.57% be imposed on Chinese hot-rolled steel sheets. Industry insiders believe that as the move to impose tariffs in Korea gained momentum, Chinese suppliers began aggressively pushing shipments into the market.

Imports of items not subject to anti-dumping duties also expanded. In particular, imports of Chinese rebar last month reached 4,416 tons, more than seven times the 544 tons imported in the same month last year. Looking at the year-to-date figures (January to July), imports totaled 18,118 tons, up 33% from 13,637 tons in the same period last year. Imports of Chinese cold-rolled steel sheets also rose to 66,274 tons last month, a 53% increase from 43,492 tons in the same month last year.

An industry official stated, "While imports of items subject to tariffs have decreased, the overall import volume has increased due to a shift in demand to other products, resulting in a balloon effect. The main reason is that Chinese companies are accepting ultra-low prices to push out inventory." The industry expects that the supply pressure from Chinese steel products will continue for the time being, given the various ways to circumvent tariffs, such as routing shipments through third countries.

The influx of Chinese products is worsening the situation for domestic steelmakers. Companies are coping by partially suspending or completely shutting down production facilities, thereby lowering their operating rates. Hyundai Steel shut down its Incheon rebar plant for the first time ever in April, and subsequently suspended operations at its Pohang No. 2 plant in June. Hyundai Steel's crude steel production facility utilization rate in the first half of this year was 81%, down 5 percentage points from 86% in the same period last year. Dongkuk Steel also completely shut down its Incheon plant at the end of last month. As a result, the utilization rate of its product manufacturing facilities fell from 75% in the first half of last year to 68% this year.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)