Presidential Order for Maximum Measures Within Legal Limits

Higher Likelihood of HUG Guarantee and LH Bidding Restrictions

Cash Depletion and Capital Impairment at Overseas Subsidiaries... 'Time Bomb' Ahead of Strong Sanctions

Credit Rating

Recently, President Lee Jaemyung ordered the "maximum measures within the scope of the law" in response to fatal accidents at construction companies. As a result, the government is considering strong sanctions such as restricting guarantees from the Housing and Urban Guarantee Corporation (HUG), limiting participation in Korea Land and Housing Corporation (LH) projects, and permanently disqualifying companies from bidding. POSCO E&C, which is at the center of nationwide construction site shutdowns, is likely to be hit the hardest. The company is already facing simultaneous financial and operational pressures, raising concerns about its survival.

Presidential Directive Becomes Reality... Ministry of Land, Infrastructure and Transport Reviewing Strong Sanctions

According to the Ministry of Land, Infrastructure and Transport on August 14, the ministry has begun reviewing relevant laws concerning sanctions by its affiliated agencies, HUG and LH. Under current regulations, HUG cannot arbitrarily restrict guarantees without an administrative disposition. Similarly, LH faces limitations in restricting bidding qualifications.

However, if an administrative disposition such as license cancellation or business suspension is imposed, sanctions become easier to implement. Given that the president has even mentioned the possibility of license cancellation, the likelihood of strong sanctions becoming a reality is high. HUG's pre-sale guarantee is an essential requirement for recruiting residents at the start of construction. If this is blocked, pre-sales become impossible. In addition, if participation in LH projects is restricted, the company will be unable to bid for public land projects, which are a major source of business.

If another sanction under consideration-restricting all public bidding-is also applied, new orders will be blocked as well. Should these strong sanctions materialize, a surge in liabilities such as project financing (PF) agreement cancellations, debt assumption, and compensation for damages will be inevitable. On top of this, a flood of contract termination requests from subcontractors could exponentially increase litigation costs.

Comprehensive Financial Pressure... Cash Flow and Overseas Business in Critical Condition

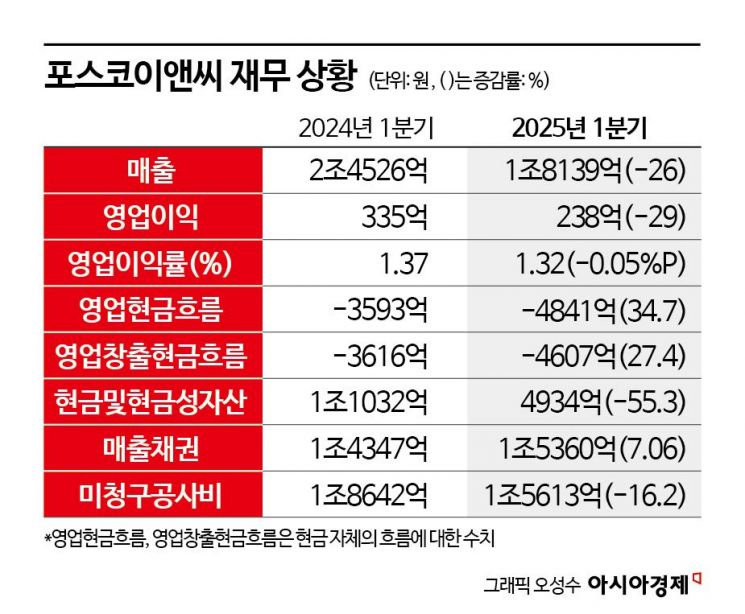

POSCO E&C's financial health is fragile and could be severely shaken by external sanctions. At the end of the first quarter this year, the company's cash flow from operating activities was negative 484.1 billion won. This loss is even greater than the negative 359.3 billion won recorded in the first quarter of last year. Cash flow generated solely from operations during the same period this year was negative 460.7 billion won, indicating a sharp decline in cash generation. This means that the costs incurred for construction exceeded the payments received.

Accounts receivable (money to be collected from clients) stood at 1.536 trillion won, while unbilled construction payments (payments not yet claimed after construction) amounted to 1.5613 trillion won, totaling over 3 trillion won. Outstanding payments due to subcontractors and others reached 144.2 billion won. The company holds only 493.4 billion won in cash and cash equivalents, a drop of more than 600 billion won compared to a year ago. When factoring in various litigation provisions (42.8 billion won) and contingent liabilities related to large-scale projects, the company's cash flow situation is in a state of emergency.

To make matters worse, risks are also emerging in overseas operations. POSCO E&C has 14 overseas plant and infrastructure subsidiaries. Their combined first-quarter losses amounted to approximately 4 billion won. Five of these subsidiaries are already in a state of capital impairment. While the immediate losses may not be large, subsidiaries with negative net assets pose potential risks. In fact, the company posted a consolidated operating loss of 91 billion won in the second quarter of this year, returning to the red after just two quarters. The company explained that this was due to additional cost recognition for the Malaysia power plant and the Poland incinerator projects.

Credit Rating Downgrade→Liquidity Crisis Concerns... Financial Exposure a 'Time Bomb'

If the crisis is prolonged, the company's entire financial structure could collapse, putting its very existence at risk. As of the first quarter this year, POSCO E&C had about 13 trillion won in completion guarantees. These are contracts in which the construction company promises to complete the project within a specified period. If the project is delayed, the contractor bears full responsibility. The company also has 2 trillion won in capital replenishment agreements, which require the construction company to inject its own funds if project costs fall short.

These agreements can immediately trigger events of default (EOD) or loan extension refusals by financial institutions if construction is delayed, significantly increasing the company's financial burden. So far, domestic financial institutions have not actively moved to recall loans or reduce credit limits. However, if normalization is delayed, credit rating agencies may begin downgrading the company's rating, pushing it into a liquidity crisis. In fact, two of the three major domestic credit rating agencies-Korea Investors Service and NICE Investors Service-have issued reports expressing concerns about POSCO E&C's creditworthiness. Trading of POSCO E&C corporate bonds in the over-the-counter market has virtually ceased.

Market watchers also note that, in a worst-case scenario, POSCO Holdings, the largest shareholder, could act as the "last line of defense" for POSCO E&C. However, such support would not fundamentally resolve the company's underlying crisis. An industry insider said, "If the president's strong sanction orders are implemented and the current situation drags on, POSCO E&C will face a critical crossroads that could determine the company's very survival."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)