Share value plummets 80% in 10 years...

-8% in a single day after President's remarks

Poor performance and overseas business in endless decline

Comprehensive crisis sparks sale rumors...

Attention on PIF's stance as second-largest shareholder

The value of the stake held by Saudi Arabia's Public Investment Fund (PIF), led by Crown Prince Mohammed bin Salman, in POSCO E&C has plunged by more than 1 trillion won over the past 10 years. Amid a prolonged slump in the construction industry and continued deterioration in performance, small shareholders' anxiety has surged following President Lee Jaemyung's recent directive to consider revoking the company's construction license.

Market observers are calling this "a representative case of investment failure, where even the PIF could not avoid losses." PIF is the world's fifth-largest sovereign wealth fund, with assets under management (AUM) totaling $925 billion (approximately 1,276 trillion won).

Share value plummets 80% in 10 years... -8% in a single day after President's remarks

According to POSCO E&C on August 8, PIF invested 1.2391 trillion won in the company in 2015, securing a 38% stake at roughly 82,000 won per share. This makes PIF the second-largest shareholder after POSCO Holdings (52.8%). Of the five board members, two are from PIF. At the time of the acquisition, POSCO E&C explained that the investment aligned with Saudi Arabia's strategy to prepare for the post-oil era. The company achieved an exceptional feat for a construction firm by attracting such a large amount of foreign capital, prompting credit rating agency Standard & Poor's (S&P) to upgrade POSCO E&C's credit rating amid high expectations.

However, what was once described as a "win-win" share deal has, 10 years later, resulted in nearly 1 trillion won in valuation losses for PIF and the loss of POSCO E&C's "overseas powerhouse" status, leading to a contraction of its business. Based on the Korea Over-the-Counter (K-OTC) market, where unlisted shares are traded, POSCO E&C's stock price is now around 14,550 won. The current value of PIF's 15,886,544 shares is about 231.1 billion won. Compared to the initial investment 10 years ago, this represents a decrease of approximately 81.3% (1.008 trillion won).

In particular, on August 6, when President Lee made remarks about "considering license revocation and bidding restrictions," the stock price plunged 8.7% in a single day, causing investor sentiment to freeze. POSCO E&C, which was valued at over 3 trillion won at the time of PIF's investment, now has a market capitalization of about 610 billion won. Some minority shareholders have reacted angrily, with comments such as, "It would be better to liquidate the company and distribute the assets to shareholders."

Poor performance and overseas business in 'endless decline'

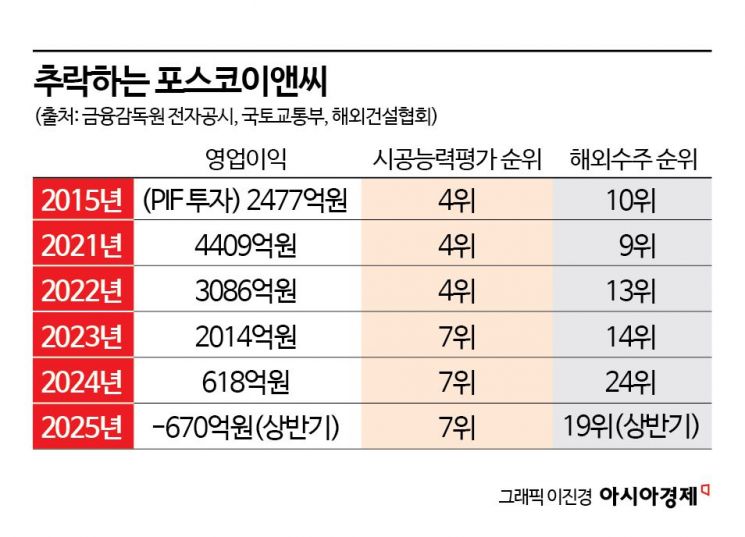

The most direct cause of the share value collapse is poor performance. POSCO E&C's operating profit has steadily declined over the past five years: 440.9 billion won in 2021, 308.6 billion won in 2022, 201.4 billion won in 2023, and just 61.8 billion won last year. In the first half of this year, the company recorded an operating loss of 67 billion won, turning into the red. The plant and infrastructure divisions have continued to post losses, and the architecture division remains stuck at a low operating margin of 2.13%, failing to recover profitability. Its construction capability ranking, a key competitiveness indicator, has also dropped from 4th place in 2015 (when PIF invested) to 7th place now.

The partnership with PIF was initially seen as a springboard for "overseas expansion." The results have not been positive. The company's overseas order ranking has fallen from 10th place in 2015 to 19th in the first half of this year. Since 2022, it has not ranked in the top 10 even once. In the 2023 bidding for Saudi Arabia's NEOM City project, POSCO E&C failed to achieve any notable results. In the same year, the company also abolished its overseas business division, drastically downsizing its overseas-related departments.

Although this was explained at the time as an efficiency measure through organizational restructuring, many in the industry viewed it as "effectively a withdrawal from overseas business." Instead, POSCO E&C turned its focus to the stable domestic market. In the urban redevelopment sector, the company ranked second in orders for two consecutive years.

Comprehensive crisis sparks sale rumors... Attention on PIF's stance as second-largest shareholder

As uncertainty over POSCO E&C's future business sustainability grows rapidly, rumors of a potential sale are spreading. Jeong Wonjoo, Vice Chairman of Jungheung Construction Group, which has been mentioned as a possible acquirer, stated, "There are no such plans."

Any M&A would require consultation with PIF, the key partner and second-largest shareholder. Given the nature of sovereign wealth funds, it is highly unlikely that PIF will make any official statement regarding its stake. A POSCO E&C representative said, "PIF invested with a long-term vision, and our relationship with PIF remains unchanged," cautioning against overinterpretation.

An investment banking (IB) industry insider commented, "PIF's losses are the result of POSCO E&C's management failures," adding, "Over the past 10 years, POSCO E&C has experienced multiple cases of embezzlement and breach of trust within the organization, as well as repeated failures in overseas business." He further noted, "By adopting an excessively conservative strategy, the company has shrunk itself, leading to the current situation."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)