Stock Prices Respond to Record Earnings

Kakao Surges 11% on Highest-Ever Quarterly Results

HYBE Rises Over 5% on Record Second-Quarter Revenue

Stock Price Divergence by Earnings Expected to Continue for Now

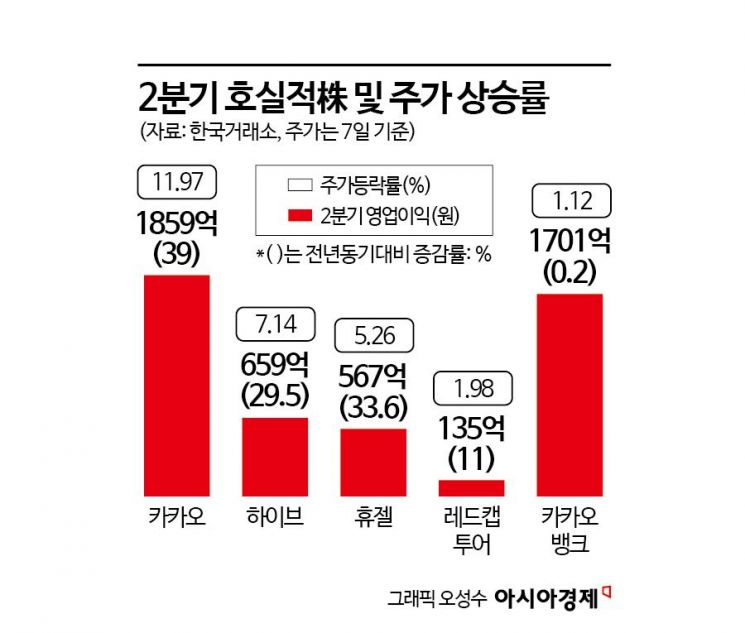

As companies continue to announce their second-quarter earnings this year, stocks of those reporting strong results have surged significantly, resulting in a clear divergence based on earnings performance.

According to the Korea Exchange on August 8, Kakao soared 11.97% the previous day to close at 63,600 won. The stock price was boosted by second-quarter earnings that exceeded expectations.

The previous day, Kakao announced that its consolidated revenue for the second quarter was 2.0283 trillion won, with operating profit reaching 185.9 billion won. These figures represent increases of 1% and 39%, respectively, compared to the same period last year. This marks Kakao's highest-ever second-quarter performance, surpassing market expectations. According to financial information provider FnGuide, the consensus forecast for Kakao’s second-quarter results was 1.9489 trillion won in revenue and 125.4 billion won in operating profit.

Kim So-hye, a researcher at Hanwha Investment & Securities, analyzed, "Even without any special events, Kakao's earnings fundamentals have improved. Overall, these strong results are attributable to company-wide cost optimization efforts initiated last year, combined with visible business achievements from its subsidiaries." Hanwha Investment & Securities raised its target price for Kakao from 78,000 won to 80,000 won. Kim explained, "We reflected expectations for a recovery in revenue through app restructuring and the introduction of artificial intelligence (AI) services, and raised our operating profit estimates for 2025 and 2026 by 18% and 6%, respectively, compared to previous forecasts." She added, "In the second half of the year, the core business fundamentals will improve, and business synergies among various subsidiaries will become more pronounced."

HYBE also posted record quarterly revenue, leading to a sharp rise in its stock price. The previous day, HYBE closed up 7.14% at 277,500 won. On August 6, HYBE announced that its consolidated second-quarter revenue was provisionally tallied at 705.7 billion won, up 10.2% from the same period last year. During the same period, operating profit rose 29.5% to 65.9 billion won, and net profit increased 53.5% to 15.5 billion won. Lee Hwanwook, a researcher at Yuanta Securities, commented, "HYBE's second-quarter results fell slightly short of consensus, but showed significant improvement compared to both the previous year and the previous quarter." He added, "Whereas artist intellectual property (IP) activities were subdued in the first quarter, this quarter saw maximized IP activity, resulting in balanced growth across key areas such as albums, concerts, and merchandise (MD)."

Hugel also delivered record half-year and quarterly results, with its stock price showing strength. The previous day, Hugel closed up 5.26% at 360,000 won. Hugel's consolidated second-quarter revenue rose 15.5% year-on-year to 110.3 billion won, with operating profit climbing 33.6% to 56.7 billion won. For the first half of the year, revenue surpassed 200 billion won and operating profit exceeded 95 billion won. Han Songhyeop, a researcher at Daishin Securities, stated, "Contrary to concerns that second-quarter results would fall short of consensus, Hugel demonstrated solid earnings fundamentals." He explained, "While selling and administrative expenses were contained at around 30 billion won per quarter, overseas toxin sales served as a growth engine and cost leverage was maximized."

In addition, companies such as APR, KakaoBank, and RedcapTour also achieved record second-quarter results, with their stock prices showing strong performance.

The trend of stock price divergence based on earnings is expected to continue for the time being. Kim Jiwon, a researcher at KB Securities, said, "Recently, the stock market has lacked a clear buying force and has shown limited volatility, while stock price differences by company have widened depending on earnings results." She added, "It is necessary to approach the market with a focus on earnings-related stocks."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)