NTS Launches Tax Investigation into 49 Foreign Tax Evaders for Illegal Gifts, Business Income Evasion, and Unreported Rental Income

Suspected Tax Evasion Totals Between 200 Billion and 300 Billion Won

NTS: "Reviewing Institutional Improvements for Foreigners' Housing Ownership"

The National Tax Service (NTS) has launched a tax investigation into foreign tax evaders who acquired high-priced apartments in the Seoul metropolitan area, including the three Gangnam districts (Gangnam, Seocho, and Songpa), while evading taxes. These individuals are suspected of using various illegal methods to avoid paying taxes, such as acquiring luxury apartments using corporate funds embezzled through overseas paper companies, or purchasing high-priced apartments with funds received through illicit gifts.

On the 7th, the NTS announced that it would conduct tax investigations into a total of 49 foreign tax evaders who avoided paying legitimate taxes by using various illegal methods during the process of acquiring and holding apartments in Korea. More than two-thirds of the suspected tax evaders were citizens of the United States and China.

Min Juwon, Director of the National Tax Service Investigation Bureau, is holding a briefing on the tax investigation of foreign tax evaders who acquired high-priced apartments at the Government Sejong Complex on the 7th.

Min Juwon, Director of the National Tax Service Investigation Bureau, is holding a briefing on the tax investigation of foreign tax evaders who acquired high-priced apartments at the Government Sejong Complex on the 7th.

The number of foreigners acquiring apartments in Korea, especially high-priced apartments in the three Gangnam districts and other metropolitan areas, has continued to increase over the past three years. According to real estate registration data, foreigners purchased a total of 26,244 apartments in Korea from 2022 to April 2025, with a total transaction value of 7.973 trillion won. Foreigners mainly acquired apartments in the metropolitan area, with high-priced apartments in the three Gangnam districts and the Mayongseong area (Mapo, Yongsan, Seongdong) accounting for 39.7% of the total.

Min Juwon, Director of the NTS Investigation Bureau, stated, "Foreigners who can raise funds in their home countries are not subject to Korea's various loan regulations, which could negatively affect real estate policies. Therefore, the NTS has conducted a thorough analysis of the entire process by which foreigners acquire and hold high-priced apartments in Korea, including those in the three Gangnam districts, and is conducting tax investigations into suspected tax evasion."

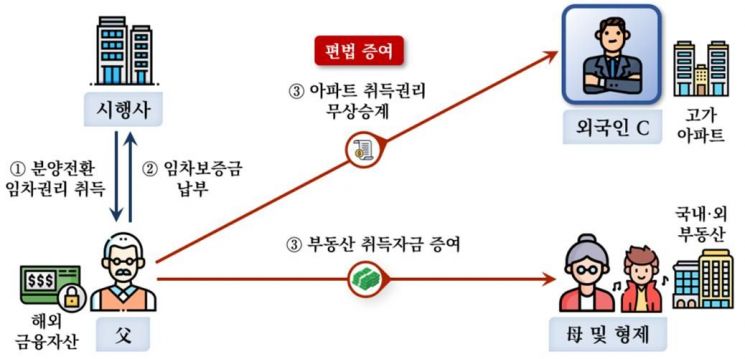

The subjects of this investigation consist of 16 individuals who acquired apartments using illicit gifts, 20 who used undeclared income, and 13 suspected of evading rental income taxes, totaling 49 individuals. The suspected amount of tax evasion ranges from 200 billion to 300 billion won. The first group includes those who used hard-to-trace overseas accounts to receive funds as illicit gifts for acquiring high-priced apartments. According to the NTS, foreigner C, who had no income, acquired the right to convert an apartment for sale from his father, a resident in Korea, free of charge and then converted it under his own name, acquiring a high-priced apartment worth several billion won. Although C's father had paid a security deposit worth several billion won to acquire the conversion right, C acquired this deposit free of charge but did not report it for gift tax. In addition, C's father is suspected of gifting overseas real estate worth several billion won to his spouse free of charge, and of supporting C's sibling with funds for acquiring overseas real estate through overseas financial accounts. The NTS plans to collect additional gift taxes through investigations into gift tax evasion resulting from the free succession of lease contracts and the sources of funds used by the family to acquire real estate both domestically and abroad.

A case where a foreigner without income succeeded in acquiring the right to an apartment from his father free of charge, then converted it to a sale and acquired a high-priced apartment.

A case where a foreigner without income succeeded in acquiring the right to an apartment from his father free of charge, then converted it to a sale and acquired a high-priced apartment.

There were also cases where foreigners used their status to siphon off business income. This involved individuals who raised funds for apartment purchases using undeclared income from domestic businesses or corporations operated by themselves or related parties. According to the NTS, foreign owner E disguised the purchase of goods from paper company G, established in a tax haven, by domestic electronic parts trading company F, and made false payments for the goods to siphon off corporate funds and evade corporate tax. E then brought the funds retained in the tax haven back into Korea and rapidly acquired ultra-high-priced apartments and land worth several billion won. The current market value of the apartment is in the tens of billions of won. The NTS plans to verify suspicions of gift tax evasion and other tax violations by checking the source of funds for luxury apartments and received foreign currency, and will conduct a thorough investigation into transactions between domestic company F and paper company G in the tax haven to determine the scale of funds transferred abroad and impose corporate taxes accordingly.

Foreigners who acquired high-priced apartments and received rental income without registering as housing rental businesses or reporting related rental income are also subject to this tax investigation. These individuals leased high-priced apartments in areas such as Hannam-dong and Gangnam to expatriates of foreign corporations who have little incentive to report their rental status, earning rental income ranging from tens of millions to hundreds of millions of won. However, by exploiting the fact that tenants often do not properly file move-in notifications and that income and account information for foreigners is often unclear, they failed to properly report their rental income.

Among those under investigation, there were also cases where individuals disguised themselves as single-home owners by entering into fake transfer contracts to avoid higher capital gains and acquisition taxes (local taxes) imposed on multiple-home owners, or where non-resident foreigners posed as residents to receive tax reductions on housing rental income that are only available to Korean residents, resulting in tax reductions worth several hundred million won.

Along with this tax investigation, the NTS is also reviewing institutional improvements to prevent tax evasion by foreigners. Currently, non-resident foreigners are taxed on rental income from homes valued over 1.2 billion won in the same way as residents, and if recognized as residents, they are eligible for tax exemptions and high-rate long-term holding deductions for single-home owners.

Director Min stated, "We are reviewing tax system reforms such as excluding non-resident foreigners from receiving special rental income tax benefits for single-home owners, or requiring all household members of foreigners to register so that the status of foreign home ownership can be managed by household. We plan to actively propose improvements to relevant authorities after reviewing any institutional deficiencies or unreasonable aspects."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)