Growth of Food Companies' Own Malls... Surge in New Subscribers and Sales

Strengthening Independent Distribution Networks and Differentiating Delivery Services

Self-Operated Malls as Testbeds for New Products

The food industry is strengthening its distribution strategies by leveraging their own online malls (self-operated malls). Companies are moving beyond simply using these channels to sell their products, instead focusing on building a loyal customer base and using their own malls as platforms for new product planning and marketing experiments. This is part of a broader strategy to secure independent platforms and reduce reliance on existing large-scale distribution networks.

According to the food industry on August 8, Ourhome is expanding its business-to-consumer (B2C) operations through its self-operated mall, 'Ourhome Mall.' As of the first half of this year, sales at Ourhome Mall increased by 66% compared to the previous year, and the number of new subscribers surged by 230%. Sales of the main ready-to-eat meal brand 'Onthego' grew by 618% year-on-year.

Growth of Food Companies' Own Malls... Increase in Subscribers and Sales

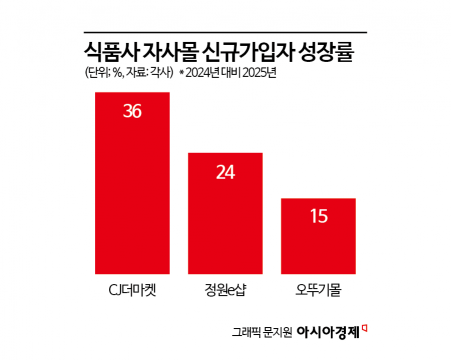

During the same period, Dongwon F&B's 'Dongwon Mall' saw its monthly active users (MAU) increase by 60%. In a live broadcast held at the end of last month, 2,000 sets of 'Dongwon Tuna BTS Jin Edition' sold out, and 1,334 new users signed up in just one day. Ottugi Mall also saw sales rise by 48% and new subscribers increase by 13.8% through its own promotions and strengthened customer relationship management (CRM). Daesang Group's 'Jungone Shop' recorded a 24% increase in membership compared to 2020, and sales grew by 34% as of 2024.

CJ CheilJedang operates a paid membership program called 'The Prime' on its own mall, 'CJ The Market.' For a monthly fee of 990 KRW (or 9,900 KRW annually), members receive a 10% rewards benefit and free shipping once a month. As of the end of March, CJ The Market had a cumulative membership of 4.09 million, and Prime members numbered 155,000, up 11% and 36% year-on-year, respectively. Recently, a merchandise event in collaboration with the character brand 'Bellygom' attracted 24,000 participants, with all prepared quantities selling out early.

Strengthening Independent Distribution Networks and Differentiating Delivery Services

The expansion of self-operated malls is attributed to the growth of the online food market. According to Statistics Korea, the domestic online food market reached 47 trillion KRW last year, a 15% increase from the previous year. This accounted for 18.3% of all online shopping transactions.

Additionally, there has been a strategic decision to reduce dependence on large distribution platforms such as Coupang. Due to high commissions and policies that restrict access to customer information, food companies are increasingly seeking to secure consumer data directly through their own malls. In response, food companies are increasing discounts on their own malls and offering exclusive product bundles and free shipping benefits.

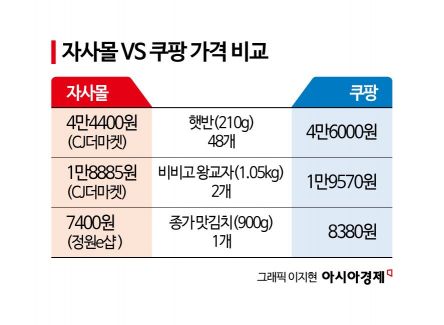

For example, on 'CJ The Market,' Hetbahn (48 packs of 210g) is priced at 44,000 KRW, and Bibigo Wang Gyoja (two packs of 1.05kg) is 18,885 KRW. Both items can currently be purchased together for a total of 53,452 KRW after an additional 15% discount, which is more than 10,000 KRW cheaper than the Coupang price (65,570 KRW). On Jungone Shop, Jongga Mat Kimchi (900g) is being sold for 7,400 KRW, about 1,000 KRW less than the Coupang price (8,380 KRW).

Delivery services have also been enhanced. Ourhome has established a 'Same Day Arrival·Next Day Arrival' service, offering same-day delivery in the Seoul and Gyeonggi regions and next-day delivery to most other regions nationwide. Delivery is available seven days a week, including public holidays. CJ CheilJedang also operates a 'Delivery Guarantee' service. In addition to its own brands, it sells products from external brands as well, increasing consumer convenience.

Self-Operated Malls as Testbeds for New Products

Self-operated malls also serve as testbeds for new products. In February, CJ CheilJedang launched 'Our Kids Organic Hetbahn (130g)' exclusively on 'CJ The Market,' and within four months, monthly sales exceeded 50,000 units. Daesang is offering a 'Kimchi Workshop' series exclusively on Jungone Shop, allowing real-time monitoring of consumer reactions.

Ottugi Mall runs exclusive promotions such as 'Family Day 818.' Ourhome is also launching new 'Onthego' products and broadcast-linked menus first on its own mall, simultaneously testing planning and consumer response. 'Dogani Yukgaejang,' a product created on the variety show 'Pyeonstorang,' sold out its first batch within two days after being released first on the self-operated mall.

Lock-in strategies utilizing customer data have also become more sophisticated. CJ The Market has introduced a generative AI-based natural language search service called 'Fai,' which can recommend customized products in response to queries such as "Recommend me high-protein, low-calorie foods." This approach is considered more intuitive and effective at encouraging repeat purchases compared to traditional keyword-based searches. Ourhome Mall is also operating a personalized 'customer-customized product recommendation service' that incorporates AI technology based on purchase history, preferred menus, and seasonal trends.

An industry insider stated, "Self-operated malls are evolving beyond simple shopping channels to become the core of marketing experiments encompassing product planning, launches, consumer feedback, and repeat purchases," adding, "They are becoming strategic platforms that enable both data acquisition and customer lock-in."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)