Increasing Disputes Over Insurance Payouts...

Urgent Need for "Non-Covered Price Controls"

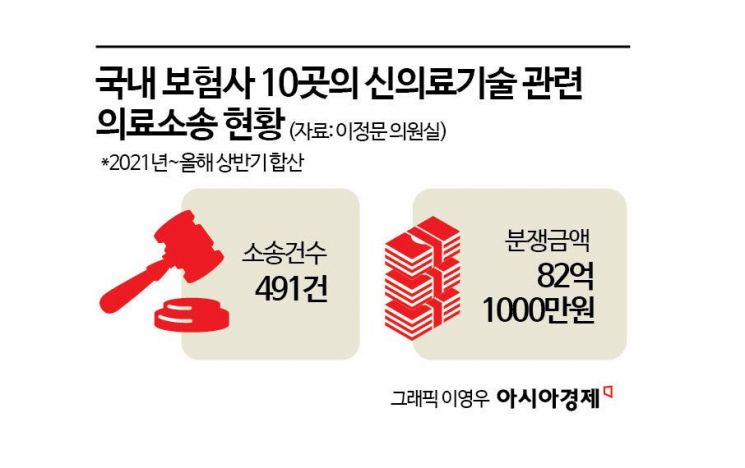

82 Billion Won in 491 New Medical Technology Lawsuits Over 4.5 Years

Patients Denied Insurance After Trusting Doctors' Assurances

"Concurrent Treatments Must Be Curbed and Non-Covered Prices Properly Regulated"

While the introduction of cutting-edge medical technologies such as new medical technologies and advanced regenerative medicine is accelerating, the lack of concrete guidelines regarding their scope of use and pricing is leading to a growing number of disputes among patients, insurance companies, and hospitals. Patients, relying solely on hospitals' assurances that non-covered treatments would be eligible for indemnity insurance, are being denied insurance payouts and left to shoulder enormous medical and legal expenses. Experts advise that the government must urgently move away from reactive, after-the-fact measures and instead develop fundamental solutions.

An image depicting patients protesting in front of an insurance company demanding insurance payments, while a doctor looks on indifferently. ChatGPT

An image depicting patients protesting in front of an insurance company demanding insurance payments, while a doctor looks on indifferently. ChatGPT

"Pay the insurance money" vs. "We can't pay"... Increasing disputes over insurance payouts related to new medical technologies

According to data on "Medical Lawsuits Related to New Medical Technologies" obtained by Asia Economy from Lee Jungmoon, a member of the Democratic Party of Korea, there were 491 lawsuits involving 10 domestic non-life insurance companies over the past four and a half years, from 2021 to the first half of this year, with the total disputed amount reaching 8.21 billion won. Complaints regarding non-payment of indemnity insurance related to new medical technologies submitted to the Financial Supervisory Service reached 3,490 cases in the first half of last year, a 31.6% surge compared to the same period the previous year.

Medical lawsuits and dispute complaints related to new medical technologies typically arise when Ministry of Health and Welfare notifications regarding these technologies are ambiguous, leading to conflicts between insurance policy interpretations and actual contracts, or when medical costs are set at unreasonable levels. Disputes also occur due to unusual concurrent treatments (mixed treatments). In some cases, lawsuits result from patients not fully understanding their insurance policies or from insurance companies interpreting the policies arbitrarily.

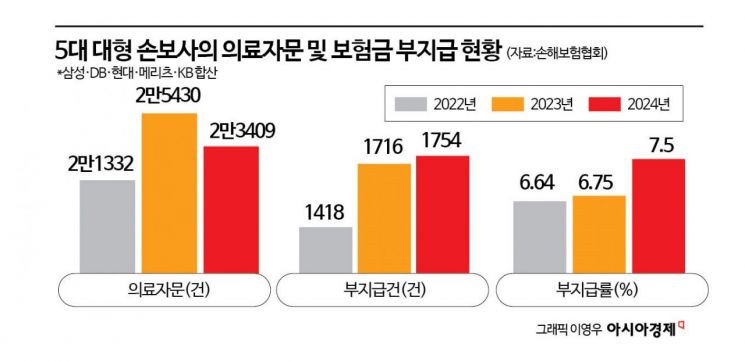

Disputes related to innovative medical technologies are also reflected in the number of medical consultations commissioned by insurance companies. As of the end of last year, the five major non-life insurance companies (Samsung, DB, Hyundai, KB, Meritz) commissioned 23,409 medical consultations, a 9.7% increase compared to 2022. Among these, the number of cases where insurance payouts were denied rose from 1,418 in 2022 to 1,754 last year, an increase of 23.7%. The denial rate, which is the proportion of denied payouts to total consultations, rose from 6.64% in 2022 to 7.5% last year. A representative from a major non-life insurer explained, "Because guidelines for innovative medical technologies are unclear and many non-covered treatments lack proven effectiveness, medical consultations are increasing. We seek opinions from higher-level medical institutions rather than the treating institution to ensure objectivity and prevent further disputes."

"The Ministry of Health and Welfare must take the lead and control non-covered treatment prices"

Experts advise that more concrete guidelines should be established regarding the application of cutting-edge medical technologies, and that efforts must be made to resolve information asymmetry between medical institutions and patients. Kim Sunjeong, a distinguished professor at Dongguk University’s Department of Law, stated, "With cutting-edge medical technologies, the frequency of use and the appropriateness of non-covered pricing become issues. Establishing detailed criteria for the application of medical technologies will help reduce unnecessary treatments. Along with clear criteria for inpatient and outpatient recognition, factors influencing non-covered pricing should be considered, and measures such as standard non-covered price disclosures and expanding price transparency among medical institutions should be implemented so that patients can compare prices and make rational choices."

There are also recommendations that, rather than responding only after controversies over specific medical technologies arise, proactive preventive measures such as price guidelines should be established to minimize harm. Lee Jooyeol, a professor at Namseoul University’s Department of Health Administration, said, "Since last year, all medical institutions have been required to report non-covered items and prices to the Health Insurance Review and Assessment Service through the non-covered reporting system. However, in Korea’s self-regulated medical market, there are limits to establishing standard prices. Even if the diagnosis-related group payment system is not fully implemented, each medical society should set standard surgical scopes, treatment procedures, and prices."

Professor Kim added, "Although the non-covered market is a competitive market based on private autonomy between medical institutions and patients, the structure is irrational because if a medical institution sets the quantity and price, the patient has no choice but to accept it. The fundamental solution is to establish a system that enables market participants to make rational decisions according to market principles."

Some argue that mixed treatments?combining covered and non-covered treatments?should be prohibited or strictly regulated. Kim Jaeheon, secretary-general of the Free Medical Care Movement Headquarters, pointed out, "Even if standard prices are established for some non-covered items, as long as the fee-for-service system and mixed treatments are allowed, it will be difficult to control non-covered treatments. Rather than focusing on fostering the medical industry, the Ministry of Health and Welfare should leave this to the Ministry of Trade, Industry, and Energy, and instead focus on reducing the public’s medical expenses and improving the safety of medical technologies."

Nam Eunkyung, head of the Social Policy Team at the Citizens' Coalition for Economic Justice, noted, "In major overseas countries with national health insurance systems, mixed treatments require approval from authorities and are subject to strict controls regarding price ranges. If Korea does not introduce such barriers, it will be fundamentally difficult to resolve the problems of non-covered treatments caused by doctors arbitrarily setting prices."

There are also opinions that public institutions related to the public’s medical expenses should be granted special authority to manage non-covered treatments. A senior official from the National Health Insurance Service labor union stated, "The Health Insurance Review and Assessment Service is failing to properly manage the use of new medical technologies and equipment, and sanctions and penalties for illegal acts by medical institutions are weak. Granting special judicial police authority to the National Health Insurance Service, which exists to reduce the public’s medical expenses, so it can investigate excessive and abusive non-covered treatments, is one possible solution."

There are also suggestions that a control tower for non-covered management is needed. Professor Lee said, "The introduction of an immediate market entry system or deregulation related to advanced regenerative medicine conflicts with non-covered and indemnity insurance reform policies. The fact that such contradictory policies can be announced simultaneously indicates poor communication not only between the Ministry of Health and Welfare and the Ministry of Food and Drug Safety, but also within the Ministry itself. It is necessary to establish a department for non-covered management within the Ministry of Health and Welfare to take charge of these issues." Ha Sangsoo, a lawyer at Dunamis Law Office, also stated, "The Ministry of Health and Welfare must take the lead in changing the decision-making system for non-covered treatments and pricing. The Ministry should establish a 'Non-Covered Policy Committee,' similar to the Review Committee at the Health Insurance Review and Assessment Service, to ultimately provide price guidelines."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)