"Amendment to the Commercial Act Marks Only the Beginning of Reform"

"Chaebols Fiercely Resist Change; Asset Managers Remain Silent"

"Stronger Oversight and Cumulative Voting Needed to Prevent Chaebol Abuses"

Participants are speaking at the "Supplementary Legislation on the Commercial Act from the Perspective of Overseas and Domestic Long-term Investors" meeting held by the Korea Corporate Governance Forum on the 30th in Yeongdeungpo-gu, Seoul.

Participants are speaking at the "Supplementary Legislation on the Commercial Act from the Perspective of Overseas and Domestic Long-term Investors" meeting held by the Korea Corporate Governance Forum on the 30th in Yeongdeungpo-gu, Seoul.

"With the amendment to the Commercial Act, a wind of change is finally blowing through the Korean capital market, but companies have contributed absolutely nothing. In particular, the chaebols are resisting to an unimaginable and extreme degree."

At the "Roundtable on Supplementary Legislation to the Commercial Act as Viewed by Overseas and Domestic Long-term Investors," hosted by the Korea Corporate Governance Forum on the 30th in Yeongdeungpo-gu, Seoul, participants unanimously criticized the business community and corporations.

The roundtable was attended by Oh Ki-hyung, Chairman of the Democratic Party's KOSPI5000 Special Committee, former lawmaker Lee Yongwoo, Lee Namwoo, President of the Korea Corporate Governance Forum, Choi Jooncheol, CEO of VIP Asset Management, and Kim Soohyun, Head of the Research Center at DS Investment & Securities. All participants freely shared their opinions without any pre-arranged questions.

"Passage of the Commercial Act Amendment, Only the Bottom of the First Inning"

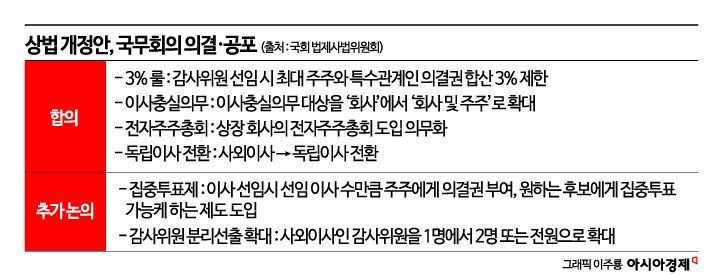

The core of the participants' criticism was the same. Although the passage of the Commercial Act amendment marks the first step toward change in the capital market, they emphasized that there is still a long way to go. They likened the current situation to just the bottom of the first or second inning in a baseball game.

Lee Namwoo, President of the Korea Corporate Governance Forum, said, "There are expectations that this government will show a different side, but foreign investors do not know this well. Over the past 20 to 30 years, they have been deceived time and again, to the extent that there is even the stigma of 'Too Much Korea, You Lose Your Career' (meaning if you hold too many Korean stocks, you will lose your job)."

He also acknowledged some positive aspects. He positively evaluated the change of the title from outside director to independent director and the shift of criminal breach of trust to the civil domain. However, he argued that the mandatory cancellation of treasury shares, which was omitted from the second amendment, is absolutely necessary.

Park Yukyung, Head of Emerging Markets Equities at APG, the Dutch pension asset management company, emphasized that market participants must raise their voices. She especially criticized asset management companies directly. Park said, "When discussions on the Commercial Act amendment began, we tried to meet domestic asset management companies to ask them to speak up, but almost all of them turned us away, and the Korea Financial Investment Association remained silent. Asset management companies are shareholders, not management, but they are afraid of losing pension business and so are overly conscious of the companies."

Kim Soohyun, Head of the Research Center at DS Investment & Securities, added, "I publish materials and hold seminars for companies on scenarios after the amendment to the Commercial Act, but many are looking for ways to bypass the cumulative voting system in the amendment, or are willing to take risks and face punishment just to curry favor with chaebol owners. Even group leaders who claim to be committed to shareholder returns are not interested in share price increases, and simply see holding company shares as tools for succession of management rights."

To Curb Chaebol Abuses, Cumulative Voting and Mandatory Treasury Share Cancellation Are Needed

The participants ultimately argued that there must be strong watchdogs in the market, and more entities must raise their voices. They stressed the need for mechanisms such as cumulative voting, which allows minority shareholders to pool their voting rights to appoint directors. Choi Jooncheol, Co-CEO of VIP Asset Management, said, "The reason companies oppose cumulative voting is that advanced countries do not have such systems, but in the United States, such a system is unnecessary. Shareholdings are already dispersed, and even if a major shareholder such as Elon Musk, CEO of Tesla, holds a large stake, all directors clearly work for the company and shareholders."

He also described the business community's fierce resistance to the cancellation of treasury shares. Choi said, "The very idea of using treasury shares bought with company money as personal assets or for defending management rights is far from the global standard. Treasury shares must be canceled as a matter of course, and it must now be accepted that this could even increase the chaebol's shareholding ratio."

Oh, the lawmaker, pledged that the government and the ruling party would not lose their resolve and would introduce legislation to normalize the capital market. He said, "There is criticism that progress is slower than expected, and questions about why certain things are not being done, but the overall process requires both domestic and international persuasion. Pressure comes in various forms from all directions, more than one can imagine. If there is social consensus, it can be handled independently."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)