TIGER Media Contents Drops 13.90% This Month

HYBE-Related Issues Weigh on Investor Sentiment

Valuation Pressures and Profit-Taking Hold Back Share Prices

Potential for a Renewed Rally After the Correction

Entertainment stocks, which had been performing strongly earlier this year, have recently faltered, causing the returns of entertainment stock ETFs to drop to the lowest levels this month. The decline in share prices appears to be driven by valuation pressures following gains in the first half of the year, profit-taking, and negative issues affecting leading stocks in the sector.

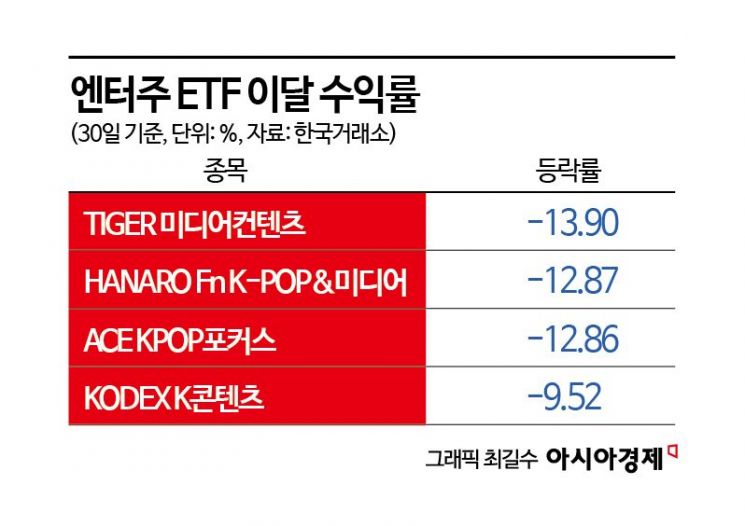

According to the Korea Exchange on July 31, TIGER Media Contents fell by 13.90% this month, posting the lowest return among all ETFs. HANARO Fn K-POP&Media declined by 12.87%, and ACE KPOP Focus dropped by 12.86%, placing entertainment stock ETFs at the bottom in terms of returns.

Although a boom was expected with the success of the Netflix animation "K-Pop Demon Hunters (Kedeheon)"?whose original soundtrack "Golden" ranked No. 1 on the US Billboard Global Chart and No. 2 on the main singles chart "Hot 100"?entertainment stocks have not reflected this positive momentum.

HYBE, the leading entertainment stock, has been on a downward trend since reaching a 52-week high at the beginning of this month. On July 2, its intraday price climbed to 323,000 won, marking a 52-week high, but has since dropped to around 250,000 won. This month, HYBE has fallen by 18.93%. During the same period, YG Entertainment declined by 15.65%, SM by 12.41%, and JYP Ent. by 6.86%.

Lee Hwanwook, a researcher at Yuanta Securities, analyzed, "After a three-quarter rally, entertainment stocks have seen a pronounced correction starting from early July. The reasons for the decline are clear: valuation pressures; the fading of tariff-free zone benefits as the sector becomes less sensitive to US tariff policy; profit-taking driven by increased investment appeal of other sectors following the launch of the new domestic administration; a lack of news regarding the lifting of China's Hallyu Ban (Hanhanryeong); delays in mega intellectual property (IP) comebacks; and ongoing legal risks."

In particular, the owner risk associated with HYBE Chairman Bang Si-hyuk has cast a shadow over the entire sector. While police are investigating allegations of unfair trading involving Bang, the National Tax Service has also launched a tax audit into HYBE.

HYBE is also expected to report second-quarter results that fall short of market expectations. Shinhan Investment & Securities projected HYBE's second-quarter operating profit at 67.2 billion won, below the consensus (the average forecast of securities firms). Ji Inhae, a researcher at Shinhan Investment & Securities, stated, "While increased IP activities are expected to push revenue above expectations, operating profit will likely fall short due to losses at Weverse Con, costs from Seventeen's 10th anniversary event, continued pre-investment in overseas labels, and ongoing investments in gaming and technology." She added, "Currently, HYBE's share price is facing a triple whammy: owner risk, being the only entertainment stock with a downgraded second-quarter outlook, and delayed full-group BTS results."

Although entertainment stocks are undergoing a correction, the outlook remains positive. Lee Hwanwook said, "After this short-term correction, a rally in share prices is possible. The earnings growth cycle in the core business remains intact, and the recent global success of Kedeheon is expected to create a trickle-down effect across the entertainment sector, leading to upward revisions in mid- to long-term earnings expectations."

Momentum is also expected to return from the fourth quarter. Lee Hwanwook predicted, "With the Asia-Pacific Economic Cooperation (APEC) summit at the end of October and the start of the fourth quarter, expectations for the lifting of the Hallyu Ban are likely to resurface, and mega IP comebacks such as BTS will also regain momentum. The current price correction will ultimately enhance valuation attractiveness."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)