Korea's Household Debt Ratio Is Too High, Hindering National Development

Increase in Banks' Real Estate Loans Is the Main Cause of High Household Debt Ratio

Korea Institute of Finance: "Financial Institutions Should Reduce Real Estate Loans and Increase Corporate Lending"

As President Lee Jaemyung and financial authorities have strongly called for an expansion of productive finance within the domestic financial sector, there is a growing argument that financial institutions must move away from their longstanding real estate-focused business practices. Instead, they should increase corporate lending to enhance their role in supporting the real economy.

Korea's Household Debt Ratio Is Too High, Hindering National Development

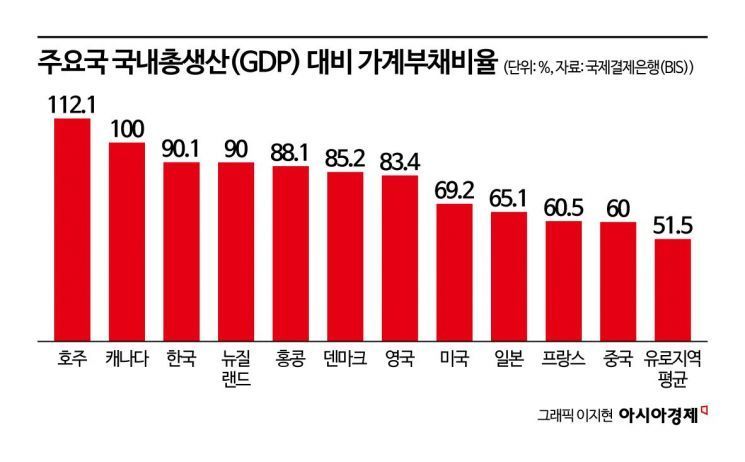

According to the report "Tasks for Transitioning from Real Estate-Centered Conventional Finance to Business Feasibility-Centered Finance" published by the Korea Institute of Finance on the 29th, Korea's household debt has recently been increasing, mainly driven by mortgage loans. This trend is expected to heighten potential risks for both financial institutions and households in the future. Korea's household debt-to-GDP ratio stands at 90%, ranking among the highest in major countries worldwide. The government views the rising household debt ratio as a factor that restricts national consumption and economic growth.

The institute pointed out that the growing burden of debt repayment due to increased household debt in Korea leads to reduced household consumption. This, in turn, is likely to decrease aggregate demand, which could result in lower employment and investment. This creates a vicious cycle, as it acts as a factor in reducing household income, further increasing the burden of debt repayment and causing additional contraction in consumption. From the perspective of corporations, an excessive focus on real estate-related finance may prevent them from concentrating on their core businesses, forcing them to focus on securing real estate instead, which could negatively impact their competitiveness.

"Financial Institutions Should Actively Foster Loan Experts and Expand Immunity Privileges"

The institute argued that Korea's lending policy needs to shift from real estate-centered finance to business feasibility-centered finance in the future. To curb the current concentration on real estate finance, it proposed policy measures such as raising the minimum risk weights for real estate-backed loans and strengthening regulatory limits relative to capital.

To expand business feasibility-centered finance, the institute emphasized the need to establish a key performance indicator (KPI) system that can enhance financial companies' ability to evaluate business feasibility and to create incentives for developing a system that fosters experts in this field. Currently, loan officers at domestic financial institutions lack expertise compared to their overseas counterparts and tend to rely primarily on real estate collateral when making lending decisions. The institute stressed the need to change this system.

In the United States and the United Kingdom, KPIs for loan officers are not limited to simple profit or sales targets and delinquency performance; they also include factors related to relationships with client companies, timeliness of post-loan management, and contributions to the bank's corporate value. The institute suggested that Korea could benefit from adopting similar practices. It also analyzed that expanding government immunity privileges could help reduce the liability faced by domestic financial institution employees when providing loans based on credit rather than collateral.

The report also proposed ways to expand business feasibility-centered finance through policy finance. For example, in the case of companies using long-term guarantees, banks could directly issue guarantee certificates on behalf of guarantee agencies to provide greater flexibility in lending. Other suggestions included expanding the on-lending loan system, where public institutions (such as Korea Development Bank) provide banks with long-term, low-interest funds, and banks support companies at their own risk. Additionally, the institute emphasized the need for policy efforts to strengthen creditors' rights to respond efficiently to debt recovery if companies borrowing based on business feasibility become insolvent.

Kim Seokki, Senior Research Fellow at the Banking Research Division of the Korea Institute of Finance, stated, "While the positive impact of Korea's high household debt and private credit on the real economy is gradually diminishing, the negative impact on financial stability is increasing. Therefore, discussions are needed to shift the current lending practices, which are concentrated on real estate-related finance, toward business feasibility-centered finance."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)