Beware of Money Laundering Through Person-to-Person Foreign Currency Transactions

Secondhand Trading Platforms Increasingly Used for Voice Phishing Scams

Accounts May Be Frozen or Restricted if Involved in Criminal Fund Transfers

Financial Supervisory Service Recommends Using Official Channels for Foreign Currency Sales

# After returning from an overseas trip, Mr. A sold leftover US dollars on an online secondhand trading platform. The buyer turned out to be a money mule for a voice phishing crime. The buyer sent Korean won to Mr. A using an account under his wife's name, but the money was actually transferred by a victim of voice phishing. As a result, Mr. A's account was designated as a "fraudulent use account" under the Act on the Refund of Damage from Telecommunications-based Financial Fraud, leading to the suspension of his account and blocking of electronic financial transactions.

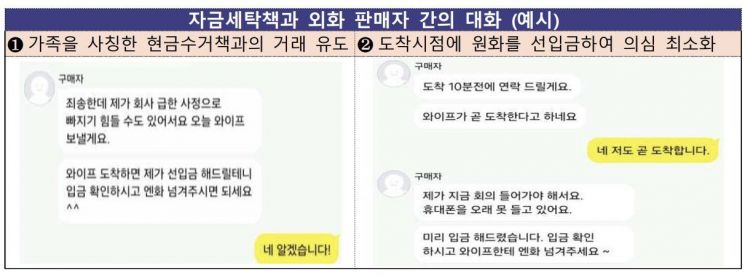

There have been cases where people who trade leftover foreign currency from overseas trips on online secondhand platforms become involved in laundering criminal funds from voice phishing, prompting financial authorities to issue a warning.

On July 24, the Financial Supervisory Service issued a consumer alert, noting that attempts to launder criminal funds using person-to-person foreign currency transactions are increasing during the busy summer travel season.

If you become involved in laundering criminal funds from voice phishing in this way, your account may be designated as a fraudulent use account, resulting in disadvantages such as a payment suspension or transaction restrictions for two to three months, or forced return of the proceeds from foreign currency sales.

The Financial Supervisory Service advised that when selling foreign currency, you should use a foreign exchange bank or a formally registered currency exchange business. If someone offers a high exchange rate or a premium on a secondhand trading platform, you should suspect voice phishing crime. They also recommended using the platform’s own secure transaction service or meeting the buyer in person for the transaction.

The Financial Supervisory Service emphasized that precious metals, expensive secondhand luxury goods, and gift certificates traded on secondhand trading applications are often used as means of money laundering, so users should be cautious.

The Financial Supervisory Service stated, "We plan to continue our efforts to eradicate voice phishing damage related to foreign currency transactions by strengthening consumer guidance in cooperation with platform operators and by monitoring suspicious foreign currency transaction posts and suspected fraudulent members in real time."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)