Sharp Slowdown in Price Gains in Strong Districts Like Seongdong and Mapo

President Lee Jaemyung: "This is just a preview"... Market Direction Hinges on Additional Measures

Slowdown in Price Gains in the Metropolitan Area... Jeonse Market Also Eases

Flyers for sale and jeonse listings are posted at a real estate agency in Gangnam, Seoul. Photo by Kang Jinhyung

Flyers for sale and jeonse listings are posted at a real estate agency in Gangnam, Seoul. Photo by Kang Jinhyung

Apartment transactions in Seoul have decreased, and consumer sentiment has also weakened. This is the change observed over the month following the announcement of the June 27 real estate measures. Analysts say that a wait-and-see attitude has become more pronounced as the possibility of additional government measures is being considered.

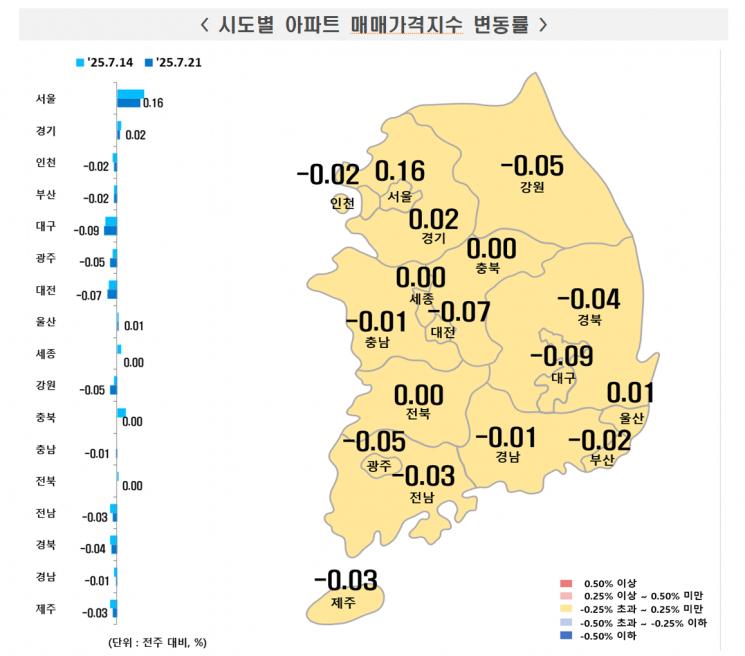

According to the "Weekly Apartment Price Trends for the Third Week of July (as of the 21st)" released by the Korea Real Estate Board on July 24, the rate of increase in Seoul apartment sale prices was 0.16%, a slight decrease from the previous week’s 0.19%. The overall increase rate for the Seoul metropolitan area was only 0.06%, while in the provinces, the decline widened to -0.03%.

Sharp Slowdown in Price Gains in Strong Districts Like Seongdong and Mapo

In Seoul, the upward trend slowed, particularly in the Gangnam area and major districts along the Han River. Seongdong-gu, which recorded an all-time high increase of 0.99% just before the June 27 measures, saw its weekly growth rate shrink to 0.37% this week. Mapo-gu also experienced a slowdown for four consecutive weeks, posting a 0.11% increase this week.

Among the three Gangnam districts, Gangnam-gu’s increase narrowed from 0.15% to 0.14%, and Seocho-gu’s from 0.32% to 0.28%. Yongsan-gu (0.26%→0.24%), Gangdong-gu (0.22%→0.11%), and Yangcheon-gu (0.29%→0.27%) showed similar trends. Songpa-gu saw its rate of increase expand from 0.36% last week to 0.43% this week, but this is still only about half of the 0.88% recorded just before the policy announcement.

Ham Youngjin, head of the Real Estate Research Lab at Woori Bank, said, "While some areas like Songpa and parts of Gangseo have seen larger increases, overall, transactions have dropped significantly and the Bank of Korea’s consumer sentiment index has also fallen, indicating a subdued market. The shift to a wait-and-see attitude among buyers is largely due to the realization of regulatory measures following the June 27 announcement."

According to the Consumer Survey released by the Bank of Korea the previous day, the July Housing Price Outlook Consumer Sentiment Index (CSI) was 109, a sharp drop of 11 points from the previous month. This is the largest decline since July 2022 (-16 points). This means the proportion of consumers expecting home prices to rise over the next year has decreased significantly.

President Lee Jaemyung: "This is just a preview"... Market Direction Hinges on Additional Measures

The government’s signaling of further regulations is also weighing on the market. On July 3, President Lee Jaemyung stated that the June 27 real estate loan regulations were merely a preview, adding, "There are still many supply expansion and demand suppression measures left." This implies that additional measures could be introduced depending on market conditions. Regarding this, Ham said, "Because no one knows what policies might come next, genuine homebuyers are hesitant to act."

Park Wongap, senior expert at KB Kookmin Bank, also analyzed the current market as being in a wait-and-see mode. Park noted, "Unlike in the past, we are not seeing an immediate drop in home prices right after the announcement of new measures." He explained, "The market no longer reacts dramatically to a single round of regulations as it did before. The increase in purchases for actual residence rather than for reconstruction expectations is also a factor limiting the possibility of a sharp decline." Park added, "The first stage is waiting, followed by a wave of urgent listings and price drops, but currently we are in an intermediate phase. The market has strong momentum, and unless the intensity of government regulations exceeds a certain threshold, a rapid short-term decline is unlikely."

However, if follow-up measures such as strengthening the Debt Service Ratio (DSR) or imposing additional restrictions on jeonse loans are implemented, a second shock could occur. Park said, "Policy effects accumulate over time, so the direction will not change abruptly in the short term. Popular areas could see an adjustment period of about three to six months." He continued, "Mid- to low-priced homes will also find it difficult to benefit immediately, as demand recovery will be delayed due to requirements such as residency and loan regulations."

He cited the example of the "December 16 Measures" announced in December 2019 to emphasize caution. Park said, "At that time, after the policy announcement, only transaction volumes dropped while prices held firm, and then the following summer, Seoul home prices soared. The same pattern could repeat if there are no additional measures this time."

Ham also said, "The slowdown in price increases and the lull in transactions are likely to continue for the time being. Until the policy direction becomes clear, it will be difficult for buyers to make bold moves."

Slowdown in Price Gains in the Metropolitan Area... Jeonse Market Also Eases

Apartment Sale Price Index Change Rate by City and Province for the 3rd Week of July. Provided by Korea Real Estate Board

Apartment Sale Price Index Change Rate by City and Province for the 3rd Week of July. Provided by Korea Real Estate Board

Districts that had seen sharp price increases, such as Bundang-gu in Seongnam (0.40%→0.35%) and Gwacheon-si (0.39%→0.38%), also saw their growth rates slow. In Ilsanseo-gu, Goyang (-0.08%→-0.13%), prices fell mainly in Daehwa and Tanhyeon-dong, while in Pyeongtaek-si (-0.24%→-0.13%), declines were concentrated in Jang-an-dong and Godeok-myeon due to new supply. Sejong City showed mixed trends by district and complex, shifting from an overall increase last week (0.03%) to flat (0.00%) this week.

Nationwide, apartment prices rose by 0.06%, a smaller increase than last week’s 0.07%. The Seoul metropolitan area continued to rise (0.07%→0.06%), while the provinces continued to decline (-0.02%→-0.03%). Provincial home prices have been on a downward trend since the last week of May 2023 (-0.01%). Among them, only Ulsan managed to hold steady, rising by 0.01%, while Jeonbuk and Chungbuk remained flat.

The jeonse market also saw a slowdown in price gains, especially in the metropolitan area. Seoul apartment jeonse prices rose by 0.06%, but the rate of increase was smaller than last week’s 0.07%. Seocho-gu (-0.18%→-0.16%) saw declines mainly in Jamwon and Seocho-dong due to new supply, while Songpa-gu (0.27%→0.23%) saw increases mainly in Jamsil and Garak-dong, Gangdong-gu (0.22%→0.22%) in Myeongil and Amsa-dong, and Gangseo-gu (0.13%→0.13%) in large complexes in Hwagok and Gayang-dong. In the southwestern area, Yeongdeungpo-gu (0.02%→0.1%), Geumcheon-gu (0.03%→0.05%), and Dongjak-gu (0.07%→0.08%) saw their rates of increase expand.

In Gyeonggi Province, the rate of increase slowed in Bundang-gu, Seongnam (0.11%→0.03%) and Gwacheon-si (0.38%→0.33%). Pyeongtaek-si (-0.17%) saw declines mainly in Seojeong and Jisan-dong, while Ilsandong-gu, Goyang (-0.14%) fell mainly in older complexes in Madu and Baekseok-dong. Incheon continued its decline at -0.04%, the same as last week (-0.04%).

In the provinces, jeonse prices remained flat for the second consecutive week. Sejong City rose by 0.11%, a smaller increase than last week’s 0.18%, while Daejeon (-0.03%→-0.06%) and North Gyeongsang (-0.03%→-0.04%) continued their declines.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)