Private and Government Consumption Rise... Strong Exports Driven by Semiconductors and Chemical Products

"Significance Lies in the Strong Contribution of the Private Sector, Led by Exports and Consumption"

Exports Expected to Decline, Domestic Demand to Rise in Second Half... 0.8% Quarterly Growth Needed for 1% Annual Target

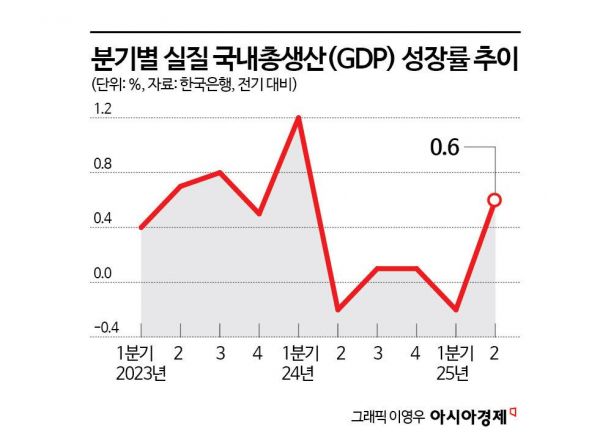

In the second quarter of this year (April to June), South Korea's economy grew by 0.6%, escaping the 'trap of low growth' around 0% for the first time in five quarters. This also exceeded the Bank of Korea's forecast in May (0.5% growth). The recovery was driven by a rebound in private consumption, which had been suppressed by domestic political uncertainty, and strong exports, particularly of semiconductors and chemical products. There was also a base effect from the negative growth in the first quarter.

In the second half of the year, exports are expected to be negatively affected as the impact of U.S. tariffs becomes more pronounced. However, domestic demand is projected to show a marked recovery compared to the first half, due to factors such as the recovery of consumer sentiment and the effects of the second supplementary budget.

Private and Government Consumption Up... Strong Exports Led by Semiconductors and Chemical Products

The Bank of Korea announced on the 24th that the real gross domestic product (GDP) growth rate (advance estimate) for the second quarter of this year increased by 0.6% compared to the previous quarter. To two decimal places, this is 0.61%. This slightly exceeds the figure presented by the Bank of Korea in its May economic outlook (0.5% increase) and marks the highest level in five quarters since the first quarter of last year (1.2%). Exports were better than expected, construction and facility investment were lower than anticipated, and consumption was in line with projections.

This growth rate is significant as it breaks the cycle of low growth that had continued since the second quarter of last year. After a 'surprise growth' of 1.2% in the first quarter of last year, the economy contracted by 0.2% in the second quarter, and grew by only 0.1% in both the third and fourth quarters, continuing the low growth trend. In the first quarter of this year, the economy returned to negative growth, extending the sluggishness.

The rise in the growth rate was due to improvements in both exports and domestic demand. Exports rebounded, led by semiconductors, and domestic demand contributed to growth, mainly through private and government consumption. Exports of semiconductors and petroleum and chemical products increased, resulting in a 4.2% rise. This is a significant improvement from the negative growth in the first quarter, marking the largest increase since the 14.6% jump in the third quarter of 2020. Imports, mainly of energy products such as crude oil and natural gas, rose by 3.8%. Imports, which had contracted by 1.1% in the first quarter of last year, also returned to an upward trend.

Although construction investment remained sluggish, consumption showed a moderate recovery. Private consumption increased by 0.5% compared to the previous quarter, with growth in both goods such as passenger cars and services such as entertainment and culture. This matches the private consumption growth rate (0.5%) recorded in the first quarter of last year, which saw surprise growth. Lee Dongwon, Director General of Economic Statistics Department 2 at the Bank of Korea, explained, "The improvement in private consumption was similar to the forecast. May was better than April, and June was better than May." He added, "Entertainment and culture benefited from a significant increase in performances and ticket sales, and demand at restaurants also improved."

Government consumption also increased by 1.2%, mainly due to health insurance benefits. This is the highest level since the fourth quarter of 2022 (2.3%). However, construction investment decreased by 1.5% compared to the previous quarter, as building and civil engineering construction declined, marking the fifth consecutive quarter of negative growth. Facility investment also fell by 1.5%. With declines in machinery such as semiconductor manufacturing equipment and transportation equipment such as ships, this is the lowest level since the third quarter of 2023 (-3.6%). Lee commented, "The slump in construction investment has only slightly eased. Looking at construction starts and orders, a rapid recovery is unlikely."

"Significance Lies in the Strong Contribution of the Private Sector, Led by Exports and Consumption"

By expenditure category, the contribution of domestic demand to second-quarter growth was clear. The contribution of domestic demand rebounded from -0.5 percentage points in the first quarter to 0.3 percentage points in the second quarter. The main contributors were private consumption (0.2 percentage points) and government consumption (0.2 percentage points). The contribution of net exports (exports minus imports) was 0.3 percentage points. By economic agent, the private sector contributed 0.5 percentage points to GDP growth, while the government contributed 0.1 percentage points.

By industry, both manufacturing and services showed clear improvement. Manufacturing increased by 2.7%, led by computers, electronics, and optical equipment. The service sector grew by 0.6%, with increases in wholesale and retail, accommodation and food services, and real estate, despite a decline in information and communications. In contrast, construction decreased by 4.4% as building and civil engineering construction fell. The agriculture, forestry, and fisheries sector declined by 1.4%, mainly due to fisheries, and the electricity, gas, and water supply sector decreased by 3.2%, mainly due to electricity.

In the first quarter, real gross domestic income (GDI) increased by 1.3% compared to the previous quarter, outpacing GDP growth. Real GDI is an indicator that reflects the real trade gains or losses due to changes in the terms of trade on real GDP, showing the actual purchasing power of final products produced domestically.

Lee stated, "Although construction investment remained sluggish, export performance led by semiconductors was better than expected, and as domestic political uncertainty was resolved, sentiment improved and private consumption recovered, resulting in 0.6% growth in the second quarter." He added, "There is still high uncertainty regarding the future growth path due to factors such as U.S. tariffs, but it is significant that in the second quarter, the private sector made a strong contribution to growth, mainly through exports and consumption."

Exports Expected to Fall, Domestic Demand to Rise in Second Half... 0.8% Growth Needed Per Quarter for 1% Annual Target

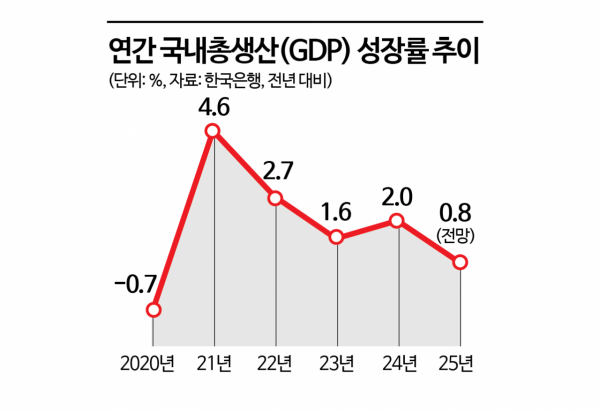

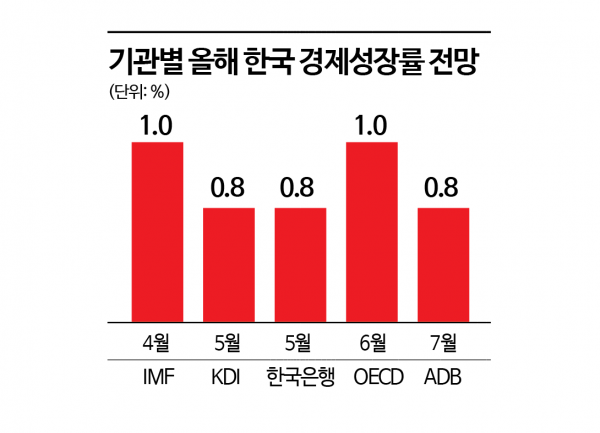

It remains uncertain whether this year's growth rate will exceed the May projection (0.8%) and reach 1%. This is because uncertainty related to U.S. tariffs continues. However, arithmetically, an average quarterly growth of 0.8% in the second half is required to achieve 1% annual growth. Kim Jeongsik, Professor Emeritus of Economics at Yonsei University, said, "Exports to the U.S. will be key in the second half. If tariff rates are higher than Japan's, exports may decline, making it difficult to expect a significant improvement in growth in the second half. The outcome of tariff negotiations with the U.S. will be a major variable."

Lee assessed that growth in the second half will look different from the first half. He said, "While exports drove growth in the second quarter of this year, from the third quarter, the impact of U.S. tariffs will become more pronounced and negatively affect exports. On the other hand, domestic demand could improve further due to factors such as the recovery of consumer sentiment and the effects of the second supplementary budget." The effect of the livelihood recovery consumption coupons is also expected to become apparent in the third quarter. Lee explained, "The exact impact of these (consumption coupons) will be known after the end of the year, but looking at the case of disaster relief funds during the COVID-19 pandemic, the initial phase had the greatest effect among the early, middle, and late stages of distribution."

The Bank of Korea, in its May outlook, projected this year's growth rate at 0.8%, reflecting the effect of the first supplementary budget. The second supplementary budget is expected to raise the growth rate by 0.1 percentage points, so if other factors remain unchanged, 0.9% growth can be expected. Lee stated, "Arithmetically, to achieve 0.9% growth this year, an average quarterly growth of 0.7% in the second half is needed. Since tariff negotiations are still ongoing, we need to monitor the situation further." Professor Kim also pointed out, "Since the supplementary budget has injected some funds into the economy, domestic demand could contribute to growth in the second half. However, additional policy measures to boost domestic demand are limited." He explained that it is difficult to lower interest rates due to household loans, and considering fiscal soundness, there are limits to further supplementary budgets.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)