Comprehensive Analysis of Sales and Delinquency Data

"Aiming for Zero Incidence of Abnormal Transactions"

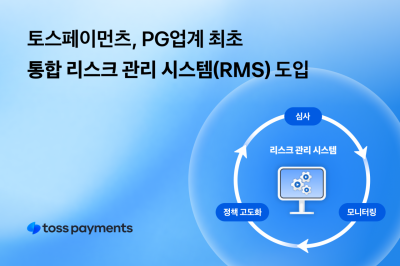

Toss Payments, the electronic payment gateway (PG) subsidiary of Viva Republica (Toss), announced on July 23 that it has become the first in the industry to fully implement an integrated Risk Management System (RMS).

Toss Payments is transitioning all merchant screening and monitoring operations to an automation-based system. With the introduction of the RMS, Toss Payments has established an automated screening environment that overcomes the limitations of manual merchant reviews and enables real-time identification, analysis, and response to various risk factors.

In particular, the company explained that it can now respond to changes in merchant status and complex risk factors based on consistent criteria, significantly improving the accuracy and efficiency of its screening process. The screening period is also expected to be shortened.

The Toss Payments RMS is a modular system that integrates every stage, from pre-detection and automated decision-making to post-action, within a single engine.

By comprehensively analyzing a variety of data, including sales and delinquency information, the system evaluates the credit and liquidity of new merchants and automatically grades risk levels by industry sector. Settlement cycles and collateral conditions for new merchants are also set automatically according to standardized policy criteria.

The RMS also provides real-time monitoring of key indicators such as sales, refund rates, and complaint rates for existing merchants. When abnormal signs are detected, the system sends automatic alerts to enable proactive responses.

Data is automatically accumulated, allowing continuous advancement of screening and monitoring policies. High-risk cases that require expert judgment are separately classified for in-depth analysis. The system is also structured to flexibly respond to exceptional situations (edge cases).

A Toss Payments representative stated, "Our goal with the introduction of the RMS is to reduce the incidence of abnormal transactions to virtually 0%. Based on our fast and precise data-driven risk response capabilities, we will provide an even safer payment environment for both merchants and consumers."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)