Lee Administration's Tax Reform Plan Points to Corporate Tax Hike

Business Sector Reviews Risks... "Concerns Over Weakened Investment Sentiment"

Burden Grows With Amendments to Commercial Act and Yellow Envelope Act

The business community is expressing growing dissatisfaction as the Lee Jaemyung administration pushes for a corporate tax rate hike. There are criticisms that it is unreasonable to interpret the recent decline in tax revenue as a result of tax cuts, given that the main background is worsening business performance due to the economic downturn. Concerns are also being raised that raising the tax rate again could undermine policy consistency and predictability, which may dampen corporate investment sentiment.

According to the business sector on the 22nd, companies have begun risk assessments in anticipation that the first tax law amendment to be announced by the Lee Jaemyung administration will include a plan to raise the corporate tax rate. A senior executive in the business community stated, "The corporate tax cut was a message to increase investment incentives for companies, but reversing it could cause confusion about the credibility of the policy," and added, "For companies operating large-scale manufacturing plants, this can only be perceived as a medium- to long-term investment risk."

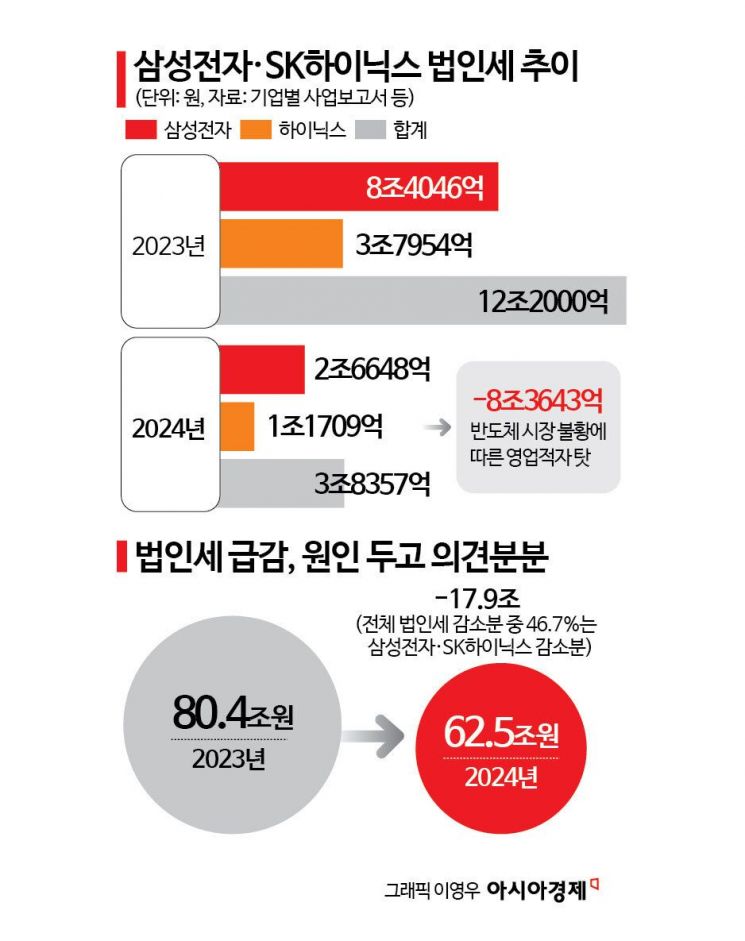

The top corporate tax rate was lowered by 1 percentage point from 25% to 24% through the 2022 tax law revision. After that, corporate tax revenue fell from 103.6 trillion won in 2022 to 80.4 trillion won in 2023, and to 62.5 trillion won last year, a decrease of over 40 trillion won in two years.

The business community believes that the main cause of the decline in tax revenue is poor corporate performance rather than the tax rate cut. In particular, Samsung Electronics and SK Hynix saw a sharp drop in operating profits due to the downturn in the semiconductor market, which led to a significant reduction in the corporate taxes they paid.

Of the total decrease in corporate tax revenue of 17.9 trillion won from 2023 to 2024, the reduction in corporate taxes paid by these two companies accounted for about 8.36 trillion won, or 46.7% of the total decrease. Samsung Electronics' corporate tax payments fell from 8.4 trillion won to 2.66 trillion won, and SK Hynix's from 3.79 trillion won to 1.17 trillion won. According to the "2023 Corporate Tax Rate Cut Effect Analysis Report" published by the Korea Institute of Public Finance, the total tax reduction effect from a 1 percentage point cut in the corporate tax rate was only about 3.3 trillion won. This supports the interpretation that the main cause of the decrease in tax revenue was the worsening performance of major companies.

Deputy Prime Minister and Minister of Economy and Finance Koo Yoonchul is answering reporters' questions about negotiations with the United States after the Ministerial Meeting on External Economic Relations held at the Government Complex Seoul in Jongno, Seoul on the 22nd. Photo by Cho Yongjun

Deputy Prime Minister and Minister of Economy and Finance Koo Yoonchul is answering reporters' questions about negotiations with the United States after the Ministerial Meeting on External Economic Relations held at the Government Complex Seoul in Jongno, Seoul on the 22nd. Photo by Cho Yongjun

The government is raising the need to increase the tax rate, arguing that corporate investment did not increase despite the lower corporate tax rate. However, the business community believes a cautious approach is necessary. They explain that investment decisions are not determined by the tax rate alone, but must also consider profitability, market conditions, and the predictability of policy, among other complex factors.

An industry representative said, "The timing of the corporate tax rate cut coincided with a global decline in demand for key industries such as semiconductors, and companies at the time had no choice but to focus on defending their performance and securing liquidity," and pointed out, "It is unreasonable to deny the effectiveness of the tax cut itself just because investment did not immediately increase after the rate was lowered."

The period immediately after the corporate tax rate cut, from 2023 to 2024, was when industry operating profits plummeted. Major companies such as Samsung Electronics also saw a significant reduction in their corporate taxes. This is why worsening business performance is seen as the main background restricting investment. Raising the tax rate when profitability has not yet recovered could make it even more difficult for companies to make medium- and long-term investments.

Within the business sector, there are calls emphasizing the importance of policy consistency and predictability. An industry official said, "When adjusting the tax system, not only the direct effects but also the policy signals and business sentiment must be considered," and added, "Frequent changes in tax policy can increase uncertainty and have a negative impact on private sector investment sentiment."

Businesses are also feeling increasingly powerless as they watch for additional legal amendments beyond corporate tax changes. The amendment promulgated at the Cabinet meeting on the 15th included the so-called "3% rule," which limits the voting rights of the largest shareholder and related parties to a combined 3%. Concerns continue that supplementary measures, such as the introduction of a "business judgment rule" to respond to threats to management rights, are missing, but the Democratic Party has already announced plans for a second and third round of additional amendments. Amendments containing the "cumulative voting system" and "expanded separate election of audit committee members," which the business community has been concerned about, are scheduled to be dealt with at this month's extraordinary session of the National Assembly, while amendments including "treasury stock cancellation" are targeted for passage at the regular session in September.

The legislative revision of Articles 2 and 3 of the Trade Union and Labor Relations Adjustment Act, known as the "Yellow Envelope Act," also appears to be gaining momentum. After the ruling party pledged to expedite the bill, Minister of Employment and Labor Kim Younghoon, a former leader of the Korean Confederation of Trade Unions, also announced that he would support the amendment through party-government consultations immediately upon his appointment. In addition, the Korean Confederation of Trade Unions is demanding further amendments to the labor union law, including provisions for "presumed employee status" and for including principal contractors using in-house subcontractors as "employers."

There are concerns that if union-related risks increase, companies will have to bear management losses such as a decline in external credibility. A steel industry representative said, "If the definition of 'employer' is expanded, the principal company will have to negotiate directly with subcontractor unions, which will increase the likelihood of strikes and cause losses such as production disruptions, delivery delays, and a decline in external credibility," and added, "There are also concerns about labor-labor conflicts, as principal company employees may be dissatisfied that subcontractor employees have the same bargaining rights."

A business community representative pointed out, "Tax law, commercial law, and the Yellow Envelope Act are regulations concentrated on companies above a certain size, which actually penalize growing companies," and added, "While we agree with the policy goal of resolving polarization, the system that imposes greater burdens as companies grow is increasingly undermining the efficiency of the Korean economy."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)