Household Loan Growth Rate Falls to 1% in Q2

Deposit and Savings Rates Cut Due to Falling Market Interest Rates

Internet-Only Banks Turn to Non-Interest Income and Loans for Individual Business Owners

Internet-only banks, which have expanded their size through household lending, are now seeking new sources of revenue to secure profitability. This is because, after lowering deposit and savings interest rates in response to falling market rates, they have lost their appeal as investment destinations for customers. Additionally, the government's strengthened management of household loans has made it difficult for these banks to expand their household lending business. Internet-only banks are therefore looking to find new opportunities through non-interest income and corporate lending.

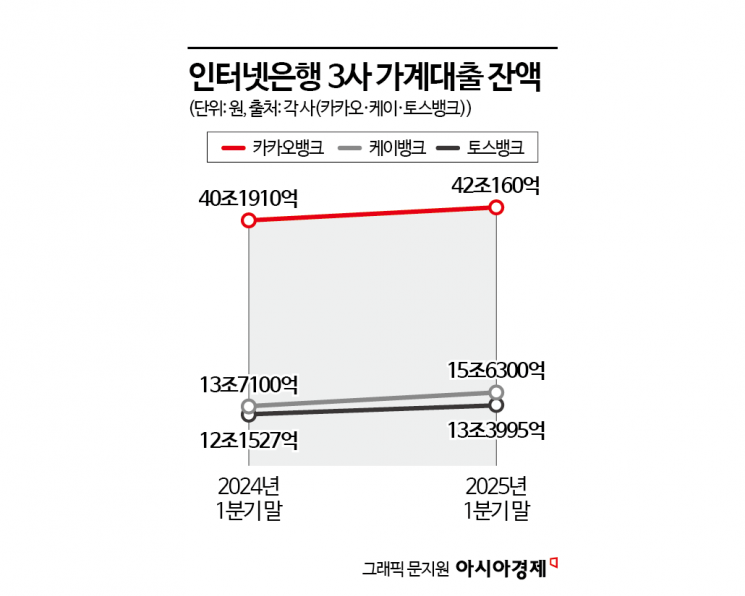

According to the financial sector on July 22, as of the first quarter of this year, the increase in household loans by the three major internet-only banks (Kakao Bank, K Bank, and Toss Bank) was about 5 trillion won, which is only one-third of the increase recorded during the same period last year. By bank, Kakao Bank's increase was about 2 trillion won, which is one-fifth of the approximately 11 trillion won recorded in the same period last year. Toss Bank also saw its first-quarter increase drop sharply to 1.2468 trillion won, which is one-fourth of the figure for the same period last year. As of the first quarter, the total outstanding household loans of the three internet-only banks stood at 71.0455 trillion won.

It appears unlikely that internet-only banks will see significant growth in household loans in the second half of the year as well. This is because, by their nature, household loans account for the majority of their total lending. For example, as of the end of 2024, Kakao Bank's total loans stood at 43.2022 trillion won, with household loans?including mortgage loans?amounting to 41.3076 trillion won, or 95.6% of the total. Similarly, at K Bank, household loans accounted for 15.1156 trillion won, or 92.9% of its total loans of 16.267 trillion won as of the end of 2024. Toss Bank, which has not yet launched a mortgage loan product, reported that, out of its total loans of 14.6271 trillion won in 2024, 13.1162 trillion won (89.67%) consisted of household loans, including credit loans and loans for jeonse and monthly rent deposits.

Kim Doha, a researcher at Hanwha Investment & Securities, analyzed, "Kakao Bank's household loan growth rate in the second quarter will remain at just 1%. In the short term, the key variables will be how well the bank manages additional operating income from a lower loan-to-deposit ratio, as well as the deterioration in the credit quality of vulnerable borrowers, especially after the June 27 household debt reinforcement measures were implemented."

As market interest rates fall and deposit and savings rates are cut in succession, customer attrition is also expected. On July 18, Kakao Bank lowered its deposit and savings rates by up to 2.00 percentage points. As a result, the interest rate for regular deposits (12-month maturity) was adjusted from 2.60% to 2.55% per annum, and the rate for free savings (12-month maturity) was lowered from 2.80% to 2.75% per annum. The interest rate for the "Savings Box" product, which collects spare change, was reduced by 2.00 percentage points from 6.00% to 4.00% per annum. The basic rate for monthly savings was cut by 1.00 percentage point, and the basic rate for 26-week savings was reduced by 0.50 percentage point. Previously, K Bank also lowered the rates for two of its deposit products, Plus Box and Code K Time Deposit. For K Bank's flagship parking account, Plus Box, the rate for deposits up to 50 million won was reduced from 1.90% to 1.70% per annum (based on one year), and for amounts over 50 million won, the rate was lowered from 2.40% to 2.30%, representing reductions of 0.20 and 0.10 percentage points, respectively.

Given these circumstances, internet-only banks are in urgent need of new revenue streams. However, expanding traditional corporate lending (business loans) is also difficult, as delinquency rates have risen sharply due to the economic downturn. As of the first quarter of this year, Kakao Bank's delinquency rate for individual business loans was 1.32%, more than double the 0.64% recorded in the same period last year. Toss Bank's rate increased from 0.85% in 2023 to 3.33% in 2024, nearly a fourfold rise.

Kakao Bank plans to launch non-face-to-face secured loans for individual business owners and strengthen its non-interest income. As part of its efforts to boost non-interest income, Kakao Bank intends to add "Auto Loan" (car purchase loan) to its loan comparison service. Until now, Kakao Bank's loan comparison service has only included credit loans and mortgage loans. In addition, since 2023, Kakao Bank has been offering a "Used Car Purchase Loan" service with a maximum limit of 40 million won. Kakao Bank recently raised the credit loan limit for individual business owners from 100 million won to 300 million won and announced plans to launch secured loans for individual business owners in the second half of the year, thereby expanding its business lending. Kakao Bank aims to increase the proportion of loans to individual business owners to 18% of its total loans by 2030.

K Bank also plans to expand its market for individual business owner loans. In its New Year's address this year, K Bank announced its intention to increase business lending to individual entrepreneurs. K Bank has successively expanded its product lineup, introducing "Sajangnim Guarantee Loan," "Sajangnim Credit Loan," and most recently, "Sajangnim Real Estate Secured Loan." The "Sajangnim Real Estate Secured Loan" surpassed a cumulative transaction volume of 300 billion won within one year of its launch.

Na Minwook, a researcher at DB Financial Investment, predicted, "The impact of stronger-than-expected household loan regulations will be inevitable."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)