Expansion of Exports Led by the UK, Spain, and India

Effect of Eco-friendly Vehicle Demand and Processing Center Strategies

Industry: "Temporary Rebound Cannot Be Ruled Out"

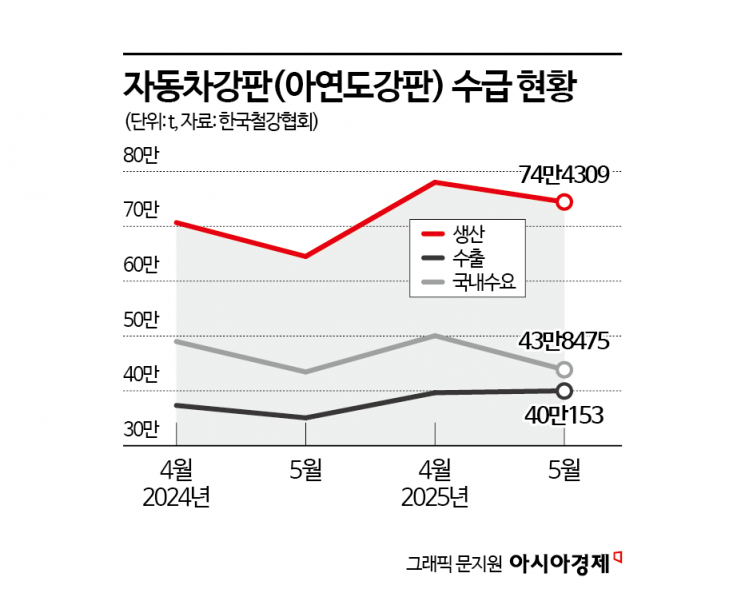

According to the steel industry on July 24, domestic production of automotive steel sheets in April and May of this year reached 780,108 tons and 744,309 tons, respectively, representing increases of 10.4% and 15.5% compared to the same period last year (706,646 tons and 644,903 tons). Exports in April (396,593 tons) and May (400,153 tons) totaled 796,746 tons, up 10.0% from the same period last year (724,301 tons). Domestic sales over the two months amounted to 938,973 tons, a 1.6% increase from the same period last year (924,340 tons).

Initially, the steel industry had anticipated that demand for automotive steel sheets would decrease due to the impact of U.S. tariffs. At the beginning of this year, global finished vehicle sales appeared to be slowing, and the United States imposed a 25% tariff on automobiles, raising concerns about negative effects on exports and production. However, the figures for April and May contradicted these expectations.

The primary reason is a shift in the export landscape. While exports to the United States shrank by about 7% year-on-year following the imposition of tariffs, exports of automotive steel sheets to European countries such as the United Kingdom, Belgium, and Spain, as well as emerging Asian markets such as India, Thailand, and Indonesia, increased during this period. Among these, the United Kingdom recorded the highest growth rate, with exports surging by 278.53% compared to the same period last year. Exports to Spain and Indonesia also soared by 173.48% and 47.96%, respectively. Analysts attribute this to Europe diversifying its steel import sources after the war in Ukraine, as well as increased demand for high-quality coated steel due to the expansion of electric vehicle production. In Asia, the recovery in automobile demand has contributed to an increase in imports.

Kim Kyungyu, a researcher at the Korea Institute for Industrial Economics and Trade, stated, "Although demand in the European market stagnated after COVID-19, replacement demand has accumulated, and recently there has been a gradual recovery. In Southeast Asia, local production by finished vehicle manufacturers such as Hyundai Motor is expanding, leading to a steady increase in steel demand."

However, the steel industry largely views this trend as a temporary phenomenon driven by short-term demand recovery. An industry official said, "Even though demand for steel sheets has increased, it is difficult to conclude that this is a sign of an expansion in automobile production. It is highly likely that temporary factors, such as pre-shipping volumes before the imposition of high tariffs, have played a role."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.