Subsidiary Awaiting Business Approval

Need to Accelerate Capital Expansion

to Speed Up Resolution of Non-Performing Loans

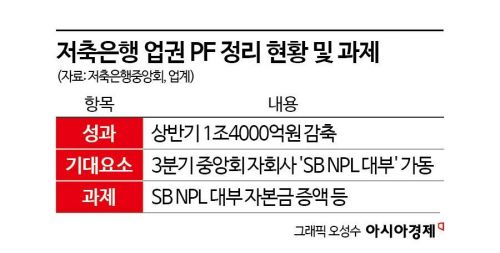

Although the savings bank industry succeeded in resolving 1.4 trillion won worth of real estate project financing (PF) in the first half of the year, key soundness indicators continue to deteriorate. The Korea Federation of Savings Banks has launched 'SB Fixed and Below Standard Loans (NPL) Loan Company,' a subsidiary specializing in the handling of non-performing loans. However, there are growing calls to accelerate capital expansion in order to facilitate a smoother resolution of distressed PF assets.

According to the savings bank industry on July 15, the Federation established SB NPL Loan Company with the legal minimum capital of 500 million won and is currently awaiting approval from the Financial Supervisory Service to commence operations. Under the Lending Business Act, the Financial Services Commission must grant business approval, but this authority has been delegated to the Financial Supervisory Service. It is reported that the operational structure has largely been completed. Once regulatory approval is granted, the company plans to promptly begin field operations such as purchasing developer bonds. Additional personnel will be recruited in line with the increase in bond purchases.

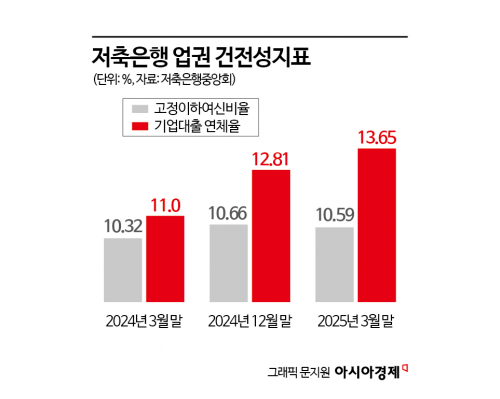

According to the Financial Supervisory Service and the Federation, despite resolving 1.4 trillion won in PF non-performing loans in the first half of the year, the savings bank industry is deeply concerned as soundness indicators such as the ratio of fixed and below standard loans and corporate loan delinquency rates have worsened. As of the end of March, the fixed and below standard loan ratio for 79 savings banks stood at 10.59%, up 0.27 percentage points from a year earlier, while the corporate loan delinquency rate reached 13.65%, up 2.65 percentage points.

Fixed and below standard loans refer to loans with a delinquency period of three months or more, classified as 'fixed' or below, which is the third of five credit quality categories for savings bank loan assets. A higher proportion of fixed and below standard loans to total loans indicates weaker asset quality. Lending is largely divided into corporate and household loans, with real estate PF counted as corporate loans. A high corporate loan delinquency rate signals instability in the real estate PF market.

Furthermore, the financial sector believes that while the short-term business environment for SB NPL Loan Company is not unfavorable, securing long-term growth momentum will be challenging. The key to management success will be how quickly the company can expand its capital and whether it can build a track record in real estate PF transactions with the capital secured.

On July 10, Korea Ratings published its '2025 Financial Sector Annual Evaluation Results and Second Half Outlook' report, predicting that asset growth at NPL companies will continue through the end of the year regardless of whether they are affiliated with financial holding companies. It especially forecasted that non-holding company NPL firms would increase their market share in bond purchases. However, it also analyzed that momentum could gradually weaken due to overlap with the government’s long-term delinquent bond debt adjustment program (bad bank) operated by Korea Asset Management Corporation (KAMCO).

Wi Jiweon and Jung Hyukjin, heads of research at Korea Ratings, said, "Given the declining funding costs, performance improvements such as increased interest income at NPL companies may continue for the time being." However, they added, "Considering the establishment of a bad bank through KAMCO and the government's expansionary fiscal policy, the volume of non-performing loan purchases by NPL companies is likely to gradually decrease after the fourth quarter."

Accordingly, the Federation plans to rapidly increase the capital of SB NPL Loan Company through both existing reserve deposits and active capital raising efforts. The goal is to raise capital to 100 billion won. Although no specific timeline has been set for reaching the 100 billion won target, the Federation intends to accelerate the process by closely analyzing sales demand, developer conditions, and expected transaction prices. Previously, in November last year, the Financial Services Commission also encouraged increasing capital during PF operations. At that time, the self-capital ratio required for PF investment projects was just 3% of the total project cost, but the standard was raised to 'at least 20%'.

An industry official stated, "The Federation plans to start with bond purchases of around 10 billion won at SB NPL Loan Company and gradually increase the amount," adding, "We will do our best to achieve the 100 billion won capital target as quickly as possible."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)