'Gompyo Legend' Sevenbrau Faces Delisting

Amazing Brewing Seeks Court Receivership... Hanul & Jeju Remain in the Red

Relying on Convenience Store Distribution Over Product Innovation

Craft beer manufacturers that once dominated the refrigerated sections of convenience stores are now facing a survival crisis. Sevenbrau Brewery, which achieved massive success with its Gompyo Wheat Beer, is now at risk of being delisted. Amazing Brewing Company, headquartered in Seongsu-dong, Seoul, recently filed for court receivership. Hanul & Jeju, which changed its name from Jeju Beer, continues to post losses.

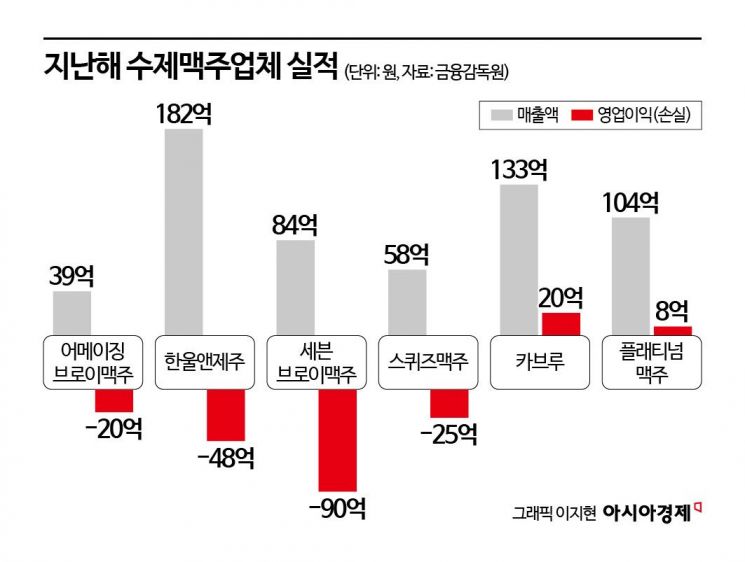

According to the Financial Supervisory Service on July 15, the Korea Exchange began a substantive review of listing eligibility for Sevenbrau Brewery, which entered court receivership on July 1. Sevenbrau faces effective expulsion just a year and a half after joining KONEX in January last year. The Exchange will convene a Listing Disclosure Committee by August 25, within 30 days of the notice, to decide whether to delist the company. Sevenbrau produces its own brands such as Gangseo Mild Ale and Seoul 1983, as well as non-alcoholic products like Neon Gangseo. Last year, the company recorded sales of 8.4 billion won and an operating loss of 9 billion won.

Amazing Brewing Company submitted its application for receivership to the Seoul Bankruptcy Court earlier this month. The court held a hearing for the company’s representative on July 10, and it is highly likely that receivership proceedings will commence within this month. Kim Taekyung, CEO of Amazing Brewing Company, stated, “I cannot comment on the receivership process.” Amazing produces Jin Lager and Evan Williams Highball, and succeeded in attracting investments totaling 11 billion won in 2021 and 2022. However, a failed diversification strategy led to mounting losses. Last year, the company reported sales of 3.9 billion won and an operating loss of 2 billion won. Accumulated deficits have reached 14 billion won.

Hanul & Jeju has also failed to find a turnaround opportunity. After joining KOSDAQ in 2021 under the special listing for companies with unrealized profits (the so-called Tesla requirements), the company has faced worsening performance and changes in its ownership structure. Sales fell from 28.4 billion won in 2021 to 18.2 billion won last year, and the company has posted losses for four consecutive years.The largest shareholder changed from MBH Holdings and two others, to Double HM, and most recently to Hanul Semiconductor, which participated in a paid-in capital increase.

The company invested a total of 15.5 billion won in acquiring the dining franchise Olgot and the venture investment firm KIB Ventures, but has yet to see clear results. As of the first quarter of this year, sales stood at 3.4 billion won, with an operating loss of 500 million won. Its main products currently include Jeju Wit Ale, Jeju Pellong Ale, Fruityje, and the non-alcoholic beer Jeju Nouveau.

Industry experts cite excessive investment in facilities and dependence on specific distribution channels as the main reasons for the recent downturn in the craft beer sector. In an effort to expand supply to convenience stores and compete with major beer brands, companies increased their production capacity, but failed to respond effectively to slowing demand and changing trends. According to the Korea Craft Beer Association, the domestic craft beer market grew from 9.3 billion won in 2013 to 152 billion won in 2021, but plummeted to 75.2 billion won in 2023. The market halved in just two years.

There is also criticism that a strategy focused solely on expanding distribution networks and marketing has reached its limits. Rather than enhancing product competitiveness and brand differentiation, companies relied on convenience store placements and short-term popularity, leading to significant demand outflow after the rise of new alcoholic beverages such as highballs.

Sevenbrau Brewery is a representative example. The company gained attention in 2020 by launching Gompyo Wheat Beer in partnership with Daehan Flour Mills. In 2021, it established a large-scale factory in Iksan, North Jeolla Province, investing 30 billion won, and posted an operating profit of 11.8 billion won that year. However, profitability plummeted after the brand licensing agreement ended in 2022. Operating profit dropped to 4.9 billion won in 2022, and the company posted a loss of 6.1 billion won in 2023. Last year, operating losses reached 9 billion won.

An industry insider commented, "The strategy of focusing on distribution expansion and short-term marketing, rather than brand value or product quality, has backfired. Unless companies overhaul their profit structures and focus on strengthening their products, survival will be difficult."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)